The Power Grid Expansion, Part 2: A Longer-Term View

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

This article follows Part One, which discusses the massive investment dollars that will be spent expanding and modernizing the power grid to facilitate demand from AI data centers and EV users. With the macro investment theory laid out, we explore which industries and companies may benefit from the power grid expansion. Part Two focuses on the traditional energy suppliers that will fuel the power grid. We do not present the industries and companies in any particular order.

As you read, please consider that picking the “right” power grid stocks is difficult. In the short run, money flows into and from stocks and sectors align with the popular narratives of the day, regardless of whether they prove correct. Narratives and the sentiment they spur can grossly distort a stock or industry’s valuations and create overbought or oversold conditions. However, over the long term, profits supersede narratives.

This article presents a longer-term view.

Before starting, we address a reader’s question regarding the electricity Bitcoin miners require.

Bitcoin Mining

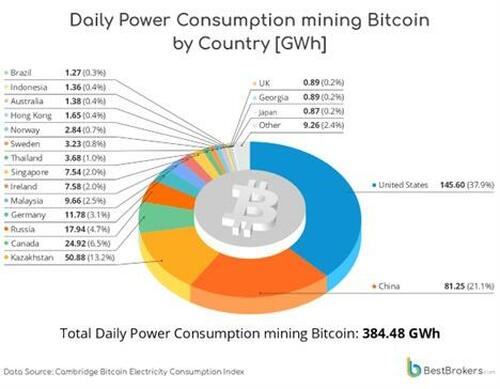

After reading Part One, a reader asked if Bitcoin mining contributes to the need to expand the power grid. The answer is mixed. Bitcoin mining requires a lot of electricity. However, as a percentage of total power usage, it’s not nearly as much as AI data centers and EVs will consume.

To put perspective on the amount of electricity that bitcoin miners use, we share some excerpts from a recent report by Paul Hoffman at Best Brokers.

Currently there are 450 Bitcoins mined daily and this costs the mining facilities a whopping 384,481,670 kWh of electrical power. This comes at 140,336 GWh yearly and is more than the annual electricity consumption of most countries, save for the 26 most power-consuming ones.

When this power expenditure was resulting in 340.82 BTC mined up until 20 April 2024 before the halving, it was still economically feasible to mine Bitcoin in the U.S. by using grid power entirely. This is no longer the case and the fact the U.S. mining facilities are still operational points to the notion that they are relying mostly on their own renewable energy sources and/or have special deals with suppliers.

From his report, the first pie chart below shows that the US accounts for over a third of the global power consumption used to mine for Bitcoin. While we are the most significant power user for mining, it is a relatively minor percentage of our total power consumption. To wit, Bitcoin miners use 1.34% of domestic electricity. While a small percentage, it is still a tremendous amount of electricity, as the second graphic shows. However, it is not single-handed enough to warrant the mass expansion of the grid.

Natural Gas- “The Fuel That Keeps The Lights On“

Per the EIA, natural gas accounted for 43.1% of domestic utility-scale electricity generation in 2023. No wonder they call it “the fuel that keeps the lights on.”

Natural gas is abundant in the US. As a result, its price is near 30-year lows, as shown below. In addition to being cheap, burning natural gas is cleaner than burning coal or petroleum products. It’s a win-win energy source for utility companies.

The increase in natural gas reserves over the last fifteen years is primarily the result of shale oil fracking. About three-quarters of the nation’s natural gas comes from shale wells.

According to Wells Fargo analyst Roger Read, the demand for natural gas could increase by 10 billion cubic feet daily by 2030. If correct, that is a nearly 30% increase from what is currently used for electricity generation in the US.

The graphic below, courtesy of the Williams Company, illustrates the roles of the upstream and midstream participants who get natural gas downstream to our homes, schools, and businesses.

Upstream Producers

The largest US natural gas producers, aka upstream, are listed below. Of these, EQT, SWN, AR, and CNX predominantly drill for natural gas. The remaining companies have significant interests in other types of fuels as well as natural gas.

EQT, SWN, AR, and CNX share prices correlate highly with natural gas prices. Conversely, the other stocks are not nearly as connected to natural gas prices. Given the high correlation, EQT, SWN, AR, and CNX will benefit the most if natural gas prices rise. However, natural gas is plentiful in the US. Accordingly, prices could stagnate near current levels if the supply keeps pace with growing demand.

Unless they are estimating the supply of natural gas, we do not think this sector will benefit overly from the increased use of natural gas to fuel our growing power grid.

Midstream

Natural gas distributors, referred to as midstream, will benefit proportionately from the increased demand. These companies transport natural gas via pipelines from the wells (upstream) to the end users (downstream).

Think of these companies as toll-takers on the energy highway. The more natural gas moves through their pipelines, the more revenue they make. Unlike producers, midstream stock prices are less correlated with natural gas prices and more so by the volume of energy transported.

Many midstream companies pay high dividends, which can fluctuate with profits. Some are organized as limited partnerships with unique tax reporting obligations.

Kinder Morgan (KMI) owns the nation’s largest natural gas network, accounting for approximately 40% of the natural gas consumed. Other large companies include Cheniere Energy (LNG), The Williams Companies (WMB), Energy Transfer LP (ET), Enterprise Products Partners LP (EPD), and Enbridge (ENB). Other than KMI, these companies also derive revenue from different energy sources.

Kinder Morgan (KMI), ONEOK (OKE), and Targa Resources (TRGP) are principally natural gas and liquid gas transporters.

Since midstream company profits depend more on the volume of gas being transported versus upstream producers who rely more on natural gas prices, we prefer midstream. The graph below compares the correlations of the four upstream and three midstream natural gas stocks versus the price of natural gas over the last two years.

Nuclear Energy

Nuclear energy is back in vogue. After being out of favor following Chernobyl and, more recently, Fukushima, countries are rediscovering its benefits. As the graph below from Our World in Data shows, nuclear energy is not only one of the safest energy sources but the cleanest.

The graph below, courtesy of Statista, shows that nuclear power production has stagnated for over 20 years.

There are three main ways to invest in nuclear energy: uranium miners, constructing and maintaining nuclear power plants, and the utilities engaged in generating nuclear power.

According to the World Nuclear Association (WNA), 60 reactors are under construction, and another 110 are planned, 13 of which are in the US. For context, there are about 440 nuclear reactors in the world. Notably, some of the growth will replace old plants being retired. If the world truly embraces nuclear power, the number of new reactors will likely grow substantially.

While natural gas is now being liquified and shipped internationally, most natural gas is and will be distributed within the US. On the contrary, uranium miners and nuclear construction companies can benefit more from expanding power grids globally.

Uranium Producers

The graph below from Cameco shows that the price of uranium has tripled in the last few years but is still below its record highs.

Uranium production peaked in the US about forty years ago. Per the EIA, Canada and Kazakhstan now account for over half of our imports.

The four biggest uranium producers trading on US exchanges are BHP (BHP), Cameco (CCJ), NexGen Energy (NXE), and Uranium Energy (UEC). CCJ, UEC, and NXE primarily produce uranium. BHP, on the other hand, produces a wide variety of commodities.

Since 2021, when uranium prices started to increase aggressively, shares of the three pure uranium producers have grossly outperformed BHP. Given these significant returns, investors should exercise caution in the short run despite optimistic long-term predictions for more nuclear facilities.

Nuclear Reactor Construction and Maintenance

Coming online later this year, Unit four of the Nuclear Plant Vogtle in Georgia expects to generate more than 1,100 megawatts of energy. This follows unit three, which went online in 2023. Construction of both units started in 2009. The total cost of the two units will exceed $34 billion. In the construction process, the lead contractor, Westinghouse, went bankrupt.

We share this because building a new reactor is time-consuming and very expensive, and as Westinghouse investors found out, it can be risky. Further, the permitting and approval process can take years. But if done correctly, it can be very profitable.

Brookfield Renewable Partners (BEP) and Cameco (CCJ) now own Westinghouse.

In addition to Brookfield, other companies can profit from constructing new plants. One such company is GE Vernova (GEV), which owns GE Hitachi Nuclear Energy (GEH). Per their website:

GEH combines GE’s design expertise and history of delivering reactors, fuels, and services globally with Hitachi’s proven experience in advanced modular construction to offer customers around the world the technological leadership required to effectively enhance reactor performance, power output, and safety.

Quanta Services (PWR) is another beneficiary of the growth in the number of nuclear plants. They are certified by the NRC to repair nuclear plant substations and switchyards.

We think GEV and PWR potentially offer investors promising long-term returns, as they are involved in nuclear facilities and a wide range of traditional power generation operations.

Nuclear Power Generation

Many utilities source electricity from nuclear plants. Some of the largest include Duke, Dominion, NRG, Southern Company, and Constellation. While their expenditures to build and service nuclear facilities are extensive, the benefits of this clean and safe energy will pay future dividends. Investors must carefully weigh the initial capital expenditure of building a nuclear facility versus its long-term benefits.

The graph below from the Nuclear Energy Institute (NEI) shows the US has 93 nuclear reactors of which the large majority are in the eastern half of the nation.

Summary

Part Three will cover alternative energy sources and summaries of other industries and companies that may benefit from the expansion and modernization of the power grid.

Tyler Durden

Wed, 05/29/2024 – 09:50

Recent Comments