Bond Yields Soar As Rate-Cut Hopes Plunge; Stocks, Oil, & Gold All Sold

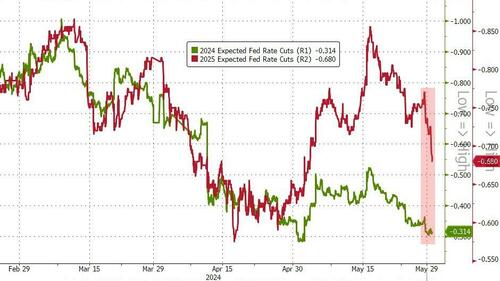

A quiet macro day in the US – mixed bag of regional Fed survey data (Richmond Manufacturing good, Richmond Biz Conditions bad, Dallas Services bad) and plunging mortgage apps) – followed a hotter than expected inflation print in Germany, which sparked a further hawkish shift lower in rate-cut expectations with 2024 falling back to a 50-50 coin toss for 2 cuts or 1; and 2025 tumbling to less than 3 more cuts…

Source: Bloomberg

Treasury yields surged higher, led by the long-end (2Y +2bps, 30Y +7bps)…

Source: Bloomberg

…steepening the curve even more…

Source: Bloomberg

2Y Yields ramped within 0.25bps of 5.00%, erasing all the gains from payrolls and CPI…

Source: Bloomberg

And higher yields are starting to hit stocks. Today was relatively unusual for recent times with no big BTFD bounce back after almost non-stop selling from the cash close last night. Small Caps lagged on the day with S&P and Nasdaq the best looking horses in the glue factory. The cash open offered a little blip higher but that was sold into…

The Dow broke below its 50- and 100-DMA and Small Caps broke below their 50DMA…

‘Most Shorted’ stocks were monkeyhammered lower… again…

Source: Bloomberg

But, of course, MAG7 stocks levitated…

Source: Bloomberg

…as NVDA hit another new record high…

Since NVDA’s earnings, everything but AI has been sold…

Source: Bloomberg

The dollar followed rates higher, back near one-month highs…

Source: Bloomberg

…which hit gold…

Source: Bloomberg

…sent oil lower with WTI back below $80…

Source: Bloomberg

…and bitcoin also fell back below $68,000 (despite the Blackrock flows news)…

Source: Bloomberg

Ethereum slipped back below $3800….

Source: Bloomberg

Finally, while financial conditions remain drastically loose (especially relative to Fed rates), we note that they are starting to tighten…

Source: Bloomberg

We’ve seen this before a few times this year – so let’s not hold our breath, but The Fed surely wants the market ‘tighter’ than it is before it starts actually ‘easing’.

Tyler Durden

Wed, 05/29/2024 – 16:00

Recent Comments