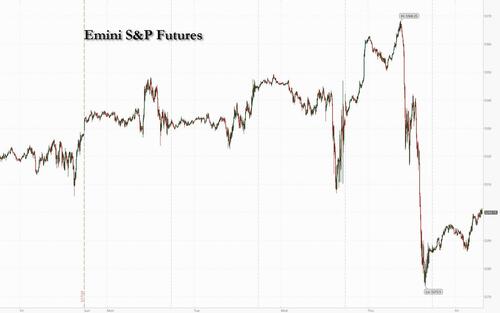

Futures Rebound After Thursday Rout As Rate Cut Expectations Fade

After Thursday’s rout, which saw the overbought S&P first hit an all time high before traders suddenly dumped everything (following hotter than expected PMI and Initial claims reports has further delayed expectations for the Fed’s first rate hike ostensibly to December) to buy Nvidia, whose market cap soared by over $200 billion to a record $2.55 trillion, on Friday US equity futures and treasuries have staged a modest rebound. As of 7:30am, S&P 500 and Nasdaq 100 futures rose 0.3%, led by premarket gains at Micron, Microchip Technology and Advanced Micro Devices all of which continue to benefit from bullish sentiment around artificial intelligence following Nvidia’s blockbuster earnings. Europe’s Stoxx 600 index slipped 0.4%, playing catch-up with Wednesday’s Wall Street drop, which was the biggest this month. 10Y yields dropped 1bp to 4.47% after surging the previous session by as much as 8bps ahead of a half-day trading session for the US bond market; the Bloomberg Dollar Spot Index was headed for its first drop in five days, but still on track to post its best weekly gain since April 12. Oil continued its decline despite the signal from macro data that the economy is actually growing quite strong, in what appears to be accelerating CTA liquidations. Today’s macro events includes the April prelim Durable Goods report, the Kansas City Fed and the May final UMich report.

In premarket trading, Apple shares ticked 0.7% higher after the technology firm’s price target is raised to a Street-high view of $275 from $250 at Wedbush, a move that reflects “iPhone demand turning the corner into an AI driven iPhone 16 supercycle.” Tesla was flat after a report that Elon Musk’s SpaceX has initiated discussions about selling existing shares at a price that could value the company at roughly $200 billion. Here are some other notable premarket movers:

Bilibili (BILI US) shares fluctuate between gains and losses as analysts debate the outlook for the Chinese online entertainment firm’s goal toward reaching breakeven, with Barclays upgrading the stock to equal weight from underweight.

Domo (DOMO US) shares slide 11% after the enterprise software firm’s second-quarter revenue forecast came in below estimates.

DuPont (DD US) shares climb 1.8% after an upgrade to overweight at Wells Fargo.

Exact Sciences (EXAS US) slip 2.0% after rival Guardant Health’s Shield blood test to screen for colorectal cancer received the support of an FDA advisory panel Thursday.

Intuit (INTU US) shares are down 6.2% after the tax-preparation software company gave a forecast for adjusted fourth-quarter earnings that is weaker than expected. However, it raised its full-year revenue forecast. The company also said the CEO of its Credit Karma business will retire by the end of the year.

Summit Theraputics (SMMT US) shares tumble 20% after trial data on Hong Kong-listed biopharmaceutical company Akeso’s lung cancer drug was seen as disappointing. Summit acquired exclusive rights for development and commercialization of the drug in the US, Canada, EU and Japan from Akeso for $500 million in late 2022.

Workday (WDAY US) shares fall 12% after the software company cut its full-year subscription revenue forecast. The company also reported 1Q results, which analysts said were mixed. Peer Salesforce (CRM US) also decline 1.4%

The market mood turned more sombre after stronger-than-expected US business activity data forced traders to push back rate-cut expectations by a month. The change put Bloomberg’s dollar index on track for its biggest weekly gain since early April, while rate-sensitive Treasury two-year yields traded just off the three-week highs above 4.95% hit on Thursday. Separately, the latest FOMC minutes showed policymakers are in no rush to cut rates, with some even seeing a need for more restrictive policy.

To that point, this morning Goldman pushed back its forecast of the Fed’s first rate cut back one meeting, from July to September: “Earlier this week, we noted that comments from Fed officials suggested that a July cut would likely require not just better inflation numbers but also meaningful signs of softness in the activity or labor market data. After the stronger May PMIs and lower jobless claims, this does not look like the most likely outcome” wrote Goldman economist Jan Hatzius.

“What we have is this repricing of rate cuts,” said Kenneth Broux, a strategist at Societe Generale. “Two-year yields are again within touching distance of 5%, so the debate on whether US yields have peaked is still alive.” For now, profits at larger US companies appear resilient to the higher-for-longer rates backdrop, offering encouragement to equity bulls. For broader positive momentum to reverse, “we’ll need to see if there’s a repricing of Fed cuts to hikes but the bar for that is still very high,” Broux said.

The Fed minutes and robust data have put MSCI’s global benchmark on track for its first weekly decline in five, and some strategists, including BofA’s Michael Hartnett are warning the rally is at risk of overheating. Barclays strategists said stock gains are starting to “look tired.”

European stocks followed their US and Asian counterparts lower after traders pushed back expectations of Fed interest rate cuts. The Stoxx 600 fell 0.5% with almost all subindexes in the red, with only retail and auto stocks rising. The tech sector leads declines, breaking a two-day advance fueled by sentiment around Nvidia. In company news, drugmakers GSK and Boehringer win the first US Zantac cancer case to go to trial. Here are some of the biggest European movers Friday:

GSK rises after winning the first US Zantac cancer case to go to trial. It’s another positive step, according to Jefferies analysts

Drugmakers GSK and Boehringer Ingelheim persuaded a Chicago jury to reject a woman’s claim that the blockbuster heartburn drug Zantac caused her cancer

Pepco Group surges as much as 13%, after reporting gross margin improvement in 1H ended March 31 and guided for 20% increase of underlying Ebidta in FY

DNB Bank rises as much as 2.4% after a Barclays double-upgrade as analysts grow more constructive on Norway versus other Nordic countries in a rate-cut environment

Gerresheimer rises as much as 0.4% after being upgraded to buy by analysts at Hauck & Aufhaeuser following its deal to buy the holding company of Bormioli Pharma

Renault gains as much as 3.2% as UBS upgrades to hold from sell, saying cash return expectations are now building due to factors including the cancellation of Ampere’s IPO

Julius Baer gains as much as 3.4% after higher-than-expected assets under management outweighed concerns over weak net new money

Acciona Energia falls as much as 8.5% after cutting its Ebitda guidance for 2024. Analysts say it’s “perplexing” the company failed to fully quantify its new outlook

Zealand Pharma drops as much as 7.1% after reporting topline results from a trial investigating dapiglutide as an obesity treatment, which analysts called underwhelming

Celon Pharma drops as much as 7.4% after announcing a venture with US life science fund Tang Capital for the development of depression drugs

Hargreaves Lansdown falls as much as 5%, with Liberum analysts highlighting the opportunity to take profits after the investment platform rebuffed a £4.7 billion offer

In FX, the Bloomberg Dollar Spot Index was headed for its first drop in five days, but still on track to post its best weekly gain since April 12. The Norwegian krone topped the G-10 FX leaderboard while cable was steady at 1.2696 after falling earlier as UK retail sales missed forecasts; GBPUSD is poised for its best monthly gain since November on view the Bank of England will take longer to cut interest rates. USD/JPY rose 0.1% to 157.01, up a third day; Japan’s inflation cooled for a second month while staying above the Bank of Japan’s price target as the yen’s recent depreciation fuels concerns that cost-push inflationary pressures may be here to stay

“Fed cuts are likely at least four months away barring a sudden growth shock, while other central banks are starting to cut, albeit only gradually,” Wells Fargo strategists led by Michael Schumacher wrote in a research note. “And if there is a further repricing in global rate expectations, that would likely only serve to weigh on global growth expectations, tilting the balance in favor of US dollar strength”

In rates, Treasuries edge higher, with US 10-year yields falling 1bp to 4.47%. Gilts gain, led by the short end after UK retail sales fell at the fastest pace this year. UK two-year yields fall 4bps. SIFMA recommend early close for cash bond market Friday at 2pm New York, ahead of Memorial Day weekend. US yields richer by up to 1bp across front-end of the curve with 2s10s spread wider by almost 1bp as long-end yields remain close to Thursday’s closing levels. In UK 2-year gilts richer by around 2bp, outperforming across front-end of the curve

In commodities, oil prices decline, with WTI falling 0.9% to trade near $76.20. Spot gold rises 0.5%.

In crypto, Bitcoin is modestly softer and holds just above $67k, while Ethereum trades around $3.7k after the SEC approved plans from NYSE, CBOE and Nasdaq for the listing of spot Ethereum ETFs.

Looking at today’s calendar, US economic data includes April durable goods orders (8:30am), May University of Michigan sentiment (10am) and Kansas City Fed services activity (11am). Fed officials’ scheduled speeches include Waller at 9:20am, giving a keynote address at a Central Bank of Iceland event in Reykjavík on R*.

Market Snapshot

S&P 500 futures up 0.2% to 5,295.50

STOXX Europe 600 down 0.5% to 519.01

MXAP down 0.8% to 179.35

MXAPJ down 0.9% to 561.72

Nikkei down 1.2% to 38,646.11

Topix down 0.4% to 2,742.54

Hang Seng Index down 1.4% to 18,608.94

Shanghai Composite down 0.9% to 3,088.87

Sensex up 0.1% to 75,526.60

Australia S&P/ASX 200 down 1.1% to 7,727.59

Kospi down 1.3% to 2,687.60

German 10Y yield little changed at 2.58%

Euro little changed at $1.0820

Brent Futures down 0.3% to $81.13/bbl

Gold spot up 0.4% to $2,338.61

US Dollar Index little changed at 105.02

Top Overnight News

European stocks followed New York and Asia lower after traders pushed back expectations of interest rate cuts by the Federal Reserve to later in 2024 following strong US economic data.

Chinese President Xi Jinping urged deeper reforms for some of the country’s key sectors as investors look for hints on major policy shifts to be revealed at the upcoming party conclave.

UK retail sales fell at the fastest pace this year as consumers delayed spending due to rainy weather, underlying the hurdles facing the Conservative government’s bid for reelection.

Overseas issuers sold yen bonds at the fastest pace in five years this month, chasing cheap funds before an expected interest rate hike by the Bank of Japan pushes up borrowing costs.

Tesla (TSLA) to cut Model Y output at Shanghai plant by at least 20% during March-June 2024, via Reuters citing sources

US Treasury Secretary Yellen said many Americans are still struggling with inflation, while she expressed concern over ‘substantial’ increases in living costs, according to FT.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks followed suit to the selling on Wall St where the initial NVIDIA-related euphoria was soured after strong US PMI data lifted the dollar and yields. ASX 200 declined with underperformance seen in the consumer and rate-sensitive sectors. Nikkei 225 gapped down at the open beneath the 39,000 level amid the headwinds from the US, while participants digested mixed inflation data which slowed in pace from the prior month. Hang Seng and Shanghai Comp were lower with the former weighed on by losses in the property sector and with tech stocks pressured by mixed earnings, while the downside was limited in the mainland amid a lack of catalysts.

Top Asian News

RBNZ Deputy Governor Hawkesby said while near-term inflation risks are to the upside, he is confident medium-term inflation is returning to the target. Hawkesby said no single data point will cause a rate hike and he is watching domestic inflation pressures and expectations, while he added that cutting interest rates is not part of the near-term discussion and there is a lot of uncertainty about tradable inflation going forward.

RBNZ Assistant Governor Silk said RBNZ is concerned about near-term inflation risks and adjusts its models after underestimating domestic inflation.

European bourses, Stoxx 600 (-0.5%), are entirely in the red, though off worst levels, with Europe playing catch-up to the risk-off sentiment which reverberated from the Wall Street afternoon session. European sectors hold a strong negative bias; Banks and Tech reside as the laggards whilst Retail, Autos & Parts, and Media are among the better performers, albeit still mostly in the red. US Equity Futures (ES +0.2%, NQ Unch, YM +0.2%, RTY +0.3%) are marginally firmer attempting to pare back some of yesterday’s hefty losses.

Top European News

ECB’s Schnabel says some elements of inflation are proving persistent; would caution against moving too fast on rates

UK Ofgem Energy Price Cap (GBP): 1,568 (exp. 1,574; prev. 1,690), -7% (exp. -7%) for dual-fuel households.

Barclays expects the BoE to begin lowering rates in August with rate cuts to follow in November and December.

FX

DXY is marginally softer vs. some peers but ultimately still around yesterday’s PMI-inspired best levels which saw DXY tick above the 105 mark; trough thus far at 104.92.

EUR is a touch firmer vs. the USD after finding support above the 1.08 mark. Price action this week has largely been at the whim of the USD with yesterday’s EZ PMI data overshadowed by the equivalent US release. overshadowed by the equivalent US release.

GBP is steady vs. the USD after yesterday’s PMI-induced downside, and brushes off initial pressure following the softer-than-expected Retail Sales figures. Cable currently trades on either side of 1.27.

JPY is marginally softer vs. the USD following mixed Japanese inflation metrics overnight which warrant a cautious stance from the BoJ and an unchanged rate at the June meeting. For now, the pair is contained within yesterday’s 156.50-157.19 range.

Antipodeans are both contained vs. the USD in quiet trade. AUD/USD has been unable to launch much of a recovery from recent losses. NZD/USD is steady vs. the USD having performed much better than its antipodean counterpart this week on account of a hawkish RBNZ.

PBoC set USD/CNY mid-point at 7.1102 vs exp. 7.2539 (prev. 7.1098).

Fixed Income

USTs are marginally firmer with prices unable to launch much in the way of a meaningful recovery after yesterday’s PMI-induced losses and awaiting impetus from US Durable Goods. Today’s range is well contained within yesterday’s 108.17+ to 109.06 parameters.

Bunds are attempting to claw back some of the lost ground seen yesterday in the wake of encouraging EZ PMI metrics, which were then followed up by an uptick in EZ wages and a particularly hot US PMI release.

Gilts are attempting to atone for yesterday’s downside which followed the broader dynamics within global fixed income markets. Gains are smaller than their German counterpart despite disappointing UK retail sales metrics which saw a M/M contraction of -2.3% vs. exp. -0.4%.

Commodities

Crude is modestly softer in what has been a catalyst-thin session thus far; Brent sits in a USD 81.05-81.55/bbl.

Spot gold and silver attempt to recover from yesterday’s steep losses in the absence of fresh catalysts this morning; XAU sits in a USD 2,325.47-2,340.69/oz intraday range.

Mixed/contained trade across base metals as prices consolidate from this week’s choppiness which saw 3M LME copper print record highs on Monday before tumbling over USD 700/t throughout the week.

OPEC+ to meet virtually on June 2nd, according to statement (prev. June 1st)

Geopolitics

China on Friday sent multiple bombers to conduct mock missile strikes in the Taiwanese drills, with dozens of missiles used in the drills, according to Chinese state media.

Israel’s PM and ministers decided to expand the mandate of the negotiating team during the war cabinet meeting on Wednesday night, according to Axios’ Ravid citing an Israeli senior official, although the official noted that it is not certain that it will be possible to achieve a breakthrough in the talks on abductees.

American and British aircraft launched two raids on Hodeidah Airport in Yemen. It was later reported that a Yemeni official said about ten Houthi leaders and experts were killed and wounded in the marches and missiles as the coalition targeted an operations room in Hodeidah, according to Sky News Arabia.

Russian President Putin is reportedly ready to halt the war in Ukraine with a negotiated ceasefire which recognises current battlefield lines, according to Reuters sources; but is prepared to fight on if Ukraine and the West do not respond

Ukrainian President Zelensky is set to attend the G7 leaders meeting in a fresh push for aid, according to Bloomberg. It was separately reported that House Speaker Johnson said they would soon host Israeli PM Netanyahu for a joint session of Congress.

Japan imposed sanctions against Russian-related entities and an individual. It was separately reported that South Korea imposed sanctions on seven North Korean individuals and two Russian vessels.

China’s Defence Ministry said military drill exercises around Taiwan continued and they will test the ability to jointly seize power, strike jointly, and occupy and control key areas.

US, Australia, Britain, Canada, Japan, Czech Republic, Lithuania and German offices in Taipei issued a joint statement supporting Taiwan’s participation at the WHO meeting.

Azerbaijan takes control of four villages on the border with Armenia, according to Tass

US Event Calendar

08:30: April Durable Goods Orders, est. -0.8%, prior 2.6%, revised 0.9%

April Durables Less Transportation, est. 0.1%, prior 0.2%, revised 0%

April Cap Goods Orders Nondef Ex Air, est. 0.1%, prior 0.1%, revised -0.2%

April Cap Goods Ship Nondef Ex Air, est. 0.1%, prior 0%, revised -0.1%

10:00: May U. of Mich. Sentiment, est. 67.7, prior 67.4

May U. of Mich. Current Conditions, est. 68.8, prior 68.8

May U. of Mich. Expectations, est. 67.0, prior 66.5

May U. of Mich. 1 Yr Inflation, est. 3.4%, prior 3.5%

May U. of Mich. 5-10 Yr Inflation, est. 3.1%, prior 3.1%

11:00: May Kansas City Fed Services Activ, prior 9

Central Bank Speakers

09:20: Fed’s Waller Gives Keynote Address on R*

DB’s Jim Reid concludes the overnight wrap

It was a fascinating day yesterday as a barnstorming reaction to Nvidia’s results (+9.32%) clattered headfirst into stronger data and rising yields (UST 10yr +5.5bps), with the negative impact of the latter winning out with the S&P 500 (-0.74%) and the NASDAQ (-0.39%) seeing their worst day of May so far.

After Nvidia’s results the night before it felt like nothing could derail the market and at the open the S&P had initially hit an all-time intraday high (+0.66% on the day at the peak) and the VIX index of volatility hit its lowest intraday level since the pandemic, falling as low as 11.52pts.

The momentum had started to shift as US weekly initial jobless claims fell back to 215k (vs. 220k expected). That’s a second weekly decline, and suggests that the spike to 232k a couple of weeks ago was just a blip. And shortly afterwards, that theme was cemented by the flash composite US PMI for May, which rose to its strongest in over two years, at 54.4 (vs. 51.2 expected). That was led by a strong rebound in services activity (from 51.3 to 54.8), while manufacturing also ticked up (from 50.0 to 50.9). So the data yesterday suggests there’s little urgency for the Fed to cut rates anytime soon, and the odds of a cut by the September meeting were slashed to 56% by the close, down from 72% the previous day.

With investors pricing out rate cuts, that led to a sovereign bond selloff on both sides of the Atlantic. For US Treasuries, this pushed the 10yr yield up +5.5bps to 4.48%, whilst the 2yr yield was up +6.6bps to 4.94%. In addition that move left the 2s10s yield curve at -46.3bps by the close, which is the most inverted it’s been so far this year. So as it stands, there’s little sign that the longest 2s10s inversion on record is coming to an end. This morning in Asia, yields on 2 and 10yr Treasuries are back down -1.5bps and -1bps respectively.

Meanwhile in Europe, yields on 10yr bunds (+6.1bps), OATs (+5.8bps) and BTPs (+6.3bps) all moved higher yesterday, which was cemented by their own PMI numbers earlier in the day. Indeed, the Euro Area composite PMI was up from 51.7 to 52.3 on the flash reading, which is its strongest level in a year.

Staying on Europe, there was also some interesting wage data from the ECB yesterday, which showed that negotiated pay accelerated from +4.5% to +4.7% year-on-year in Q1. Together with the PMI data, that supported a decent move lower in rate cut expectations, with the amount of rate cuts priced by the December meeting down -4.7bps to just 59bps, which is the fewest so far this year. However, the general consensus remains that they’re still likely to cut rates in June (which is 91% priced), and the ECB’s Villeroy said that they “should not over-interpret”, and that “we are very probably, barring a surprise, going to have a first rate cut in our next Governing Council meeting”. A little earlier in the year, the ECB had been telling us how crucial this wage data is, and then when it was released they downplayed it citing the role of one-off payments. Read their blog here. Our European economists note that realised wage data has been sticky of late, providing potential ammunition for the hawks, though the forward looking indicators of wages are pointing to a clear slowing.

But of course, it wasn’t all bad news yesterday, as Nvidia’s results from the previous day did lead to fresh gains for tech stocks. In fact, Nvidia saw their own share price rise by another +9.32% to $1037.99, having been up by +12% intra-day. So just a cool $218bn of additional market cap on the day – a similar size to the entire market cap of Shell (2nd largest in FTSE). Bear in mind that exactly a year earlier Nvidia closed at $306.88, so its share price has more than tripled in that time. We did a late CoTD yesterday updating our analysis comparing the Mag-7 profits to that of the entire listed universe of G20 countries. Nvidia is actually catching up fast making around a quarter of the profit of the entire listed UK or French markets. If the Mag-7 were a country index it would now be the third most profitable in the world behind US and China with just 7 stocks compared to the hundreds or thousands of stocks in other country indices. See our report here.

Nvidia’s rally helped push the Magnificent 7 (+0.40%) up to another all-time high, even as the other 6 stocks were down on the day. Indeed, outside of the positivity around Nvidia, it was a pretty weak day for equities, with a negative turn later in the session leading the S&P 500 (-0.74%) to the largest fall since the end of April. A remarkable 89% of the companies in the S&P 500 were down on the day, with semiconductors being the only one of the 24 industry groups to post a gain. And the small-cap Russell 2000 (-1.60%) lost ground for a third consecutive day. Over in Europe, equities were also supported by the strength among tech stocks, with the STOXX Technology index up +1.51% and the STOXX 600 up +0.07%, but closing before the more negative sentiment fully took over.

In Asia, the Hang Seng (-1.19%) is the biggest underperformer driven by a decline in technology stocks while the Nikkei (-1.16%) is also notably lower as Japan’s consumer inflation softened (more on this below). Elsewhere, the KOSPI (-1.04%) is also trading in negative territory dragged down by index heavyweight Samsung Electronics while mainland Chinese stocks are also falling with the CSI (-0.43%) and Shanghai Composite (-0.16%) both edging lower. In overnight trading, S&P 500 (+0.13%) and Nasdaq futures (+0.07%) are back up a touch.

Coming back to Japan, core inflation slowed for a second straight month in April after it rose +2.2% y/y as expected and after increasing +2.6% in March, indicating that the Bank of Japan (BoJ) will be patient in raising interest rates. At the same time, “core-core” inflation rate — which strips out both fresh food and energy prices witnessed the sharpest fall to 2.4% y/y in April from 2.9% the month before, albeit in line with expectations. Meanwhile, headline inflation also slowed to +2.5% y/y in April (v/s +2.4% expected), down from March’s +2.7% figure.

To the day ahead now, and data releases include UK retail sales for April, and in the US there’s the preliminary April reading for durable goods orders, along with the final May reading for the University of Michigan’s consumer sentiment index. Meanwhile from central banks, we’ll hear from the ECB’s Schnabel, Vasle, Muller, Nagel, De Cos and Centeno, along with the Fed’s Waller.

Tyler Durden

Fri, 05/24/2024 – 07:56

Recent Comments