SEC Approves Spot Ether ETFs In Major Crypto Victory

What until just a few days ago was viewed as an extremely low-probability event, has just come true, when the highly politicized Securities and Exchange Commission, headed by Liz Warren’s soon to be terminated lackey Gary Gensler, has – against its desires – been forced again to approve no less than eight crypto ETFs, this time for spot Ethereum, following what was reportedly urgent political intervention from the White House.

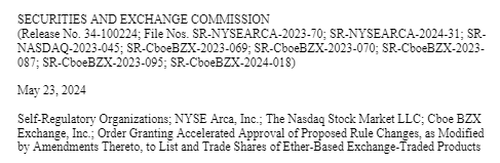

Following relentless pushback which prompted Bloomberg’s ETF expert Eric Balchunas to give a spot ETH ETF only 25% odds of approval, in the first-of-its-kind blessing, the SEC signed off on a proposal by venues run by Cboe, Nasdaq and the New York Stock Exchange to list products tied to the world’s second-biggest cryptocurrency. The move removes a key hurdle for spot Ether ETF trading in the US.

Issuers now need a separate sign-off from the regulator, and no deadline has been set for that decision. In other words, as Bloomberg’s James Seyffart explains, today’s approval does not mean ethereum ETFs will begin trading tomorrow: this is just 19b-4 approval. Now the SEC will need to approve the S-1 documents which is going to take time: “We’re expecting it to take a couple weeks but could take longer. Should know more within a week or so”

TO BE CLEAR: This does not mean they will begin trading tomorrow. This is just 19b-4 approval. Also needs to be an approval on the S-1 documents which is going to take time. We’re expecting it to take a couple weeks but could take longer. Should know more within a week or so!

— James Seyffart (@JSeyff) May 23, 2024

Ahead of the approval, SEC boss Gary Gensler had been cryptic on his views over whether Ether is a security, stoking concerns that the agency was hardening its stance. Others, such as this website, duly noted that in the grand scheme of things it is not what Gary Gensler or “Senator Karen” want, but rather only the wishes of Larry Fink…

Fink’s endgame is ETH: he has repeatedly said the goal is tokenization

“I see value in having an Ethereum ETF. These are just stepping stones towards tokenization and I really do believe this is where we’re going to be going.”https://t.co/MfGAqHZLWc

— zerohedge (@zerohedge) March 10, 2024

… and JPMorgan matter…

JPMorgan now just as bullish on ethereum as Larry Fink. Good luck @GaryGensler pic.twitter.com/tdQFKUvsKI

— zerohedge (@zerohedge) May 10, 2024

… And while crypto enthusiasts said they were worried about Gensler trying to subject Ether — and various other projects based on the Ethereum blockchain — to the agency’s arbitrary, capricious, and onerous investor-protection rules, claiming that Ether is in fact a security despite claiming previously that it is not, the recent sharp policy stance reversal driven by an abrupt change in the political climate, revealed that the only thing that decides whether something is a security or not, is a phone call from the White House which is trailing Donald Trump in the polls by double digits.

Which is why, as recently as last week, companies were banking the SEC would reject the Cboe plan — and potentially others — by Thursday’s deadline. Additional SEC approval is still needed for the issuers, but the signoff is a huge victory for the industry, and especially those who held on to Ether since January, which continued to sink mercilessly even as bitcoin soared.

Backers hope a listing will bring a new flood of money to the asset class by appealing to retail and institutional investors, who are interested in crypto but more comfortable investing in ETFs than tokens.

Overall, investors, many who retreated after FTX exchange’s collapse, have already been piling back into crypto. Ether, the native token of the Ethereum blockchain, is up more than 60% this year alone thanks to the frenzy. And, as both Goldman and Bernstein have noted, the upside for Ether is likely far greater than that of bitcoin in the long run.

Full report available to pro subscribers

Some of Ether’s recent rally is also due to optimism that the US crackdown on the industry – led by such congressional knucle-draggers as Elizabeth Warren – is finally waning. The Republican-led House on Wednesday advanced sweeping cryptocurrency legislation despite opposition from the White House and Gensler. Although the Senate isn’t expected to approve the measure, it also garnered notable Democratic support in the House.

On the jurisdictional question, Lee Reiners, policy director of the Duke Financial Economics Center at Duke University, said that exchange bids to list the products were based on Ether being a commodity and not a security. An SEC decision to green light the plan bolsters the view that the SEC still considers Ether not to be a security, he said. Investment companies seeking to list the products have already been making concessions to win SEC approval.

Fidelity Investments said it will keep Ether it buys as part of the ETF out of programs that pay rewards for blockchain maintenance, known as staking. The latter has been a hot-button issue for Ether because it raises questions about whether the token should be treated as a security. Last year, the SEC in a lawsuit accused Coinbase Global Inc. of breaking its rules by offering staking services.

And so, we now wait for the various ETH ETF issuers to make adjustments for today’s latest clarifications and to get S1 approval imminently which will finally greenlight trading; indeed, VanEck which was the first to apply for a spot Ether ETF wasted no time in filing an amendment to their S-1 filing.

VanEck making amendment to their ETH ETF S-1 already https://t.co/9faENB70nF pic.twitter.com/xQNLxJ7kO3

— NLNico (@btcNLNico) May 23, 2024

And speaking of Van Eck, here is what the head of the company’s digital asset research team, Matthew Sigel published seconds after the ETF approval:

We are so thrilled to confirm that the SEC has approved, pursuant to Section 19(b) of the Securities Exchange Act of 1934, our exchange partner CBOE’s proposed rule change to list and trade a @vaneck_us

spot #Ethereum ETF on the CBOE!

TLDR: We expect the improved political backdrop will lead to further victories for digital asset investors & developers, via new laws & in the courts, that draw investment to #Bitcoin, Ethereum and other open-source blockchain software.

We applaud this decision, as we believe the evidence clearly shows that #ETH is a decentralized commodity, not a security. ETH’s status as a commodity has now been recognized in a variety of circumstances, including the CFTC’s regulation of ETH futures, public statements by Commission officials, rulings by federal courts, and now, hopefully, this ETF.

The high degree of correlation between ETH spot prices and CME Ethereum futures prices, similar to the correlation seen with Bitcoin, proved that the spot ETH market is tightly linked to the regulated futures market. This tight linkage supports the listing of spot ETH ETFs, as it allows for the market surveillance the SEC requires. Additionally, the presence of liquid, regulated ETH futures trading on the CME and the approval of ETFs tracking those futures demonstrated to all neutral observers that Ethereum meets the same criteria as Bitcoin for an ETF holding the spot asset. The SEC approved the listing of spot Bitcoin ETFs based on these exact criteria, and we have long believed that Ethereum warrants the same treatment.

Any claim that Ethereum’s move to proof-of-stake has turned it into a security, or that staking itself is a securities transaction is misguided and harmful to innovation. Proof-of-stake is simply an alternative consensus mechanism to proof-of-work mining – it does not fundamentally alter Ethereum’s decentralized nature or transform ETH into a security issued by a central entity. Since the DAO hack in 2016, Ethereum has become highly decentralized, with no centralized issuer or promoter controlling a material supply or percentage of validators. The Ethereum Foundation’s ETH holdings have steadily declined to just 0.30% of the circulating supply, and Vitalik Buterin holds around 0.23%. This widespread distribution of ETH contradicts the idea of it being a security issued by a common enterprise.

We have also heard arguments that Ethereum’s transition to proof-of-stake (PoS) was a securities transaction. This misunderstands the decentralized nature of Ethereum’s governance. Ethereum’s transition to PoS was driven by social consensus, involving broad community discussions, transparent development processes, and voting mechanisms within a decentralized network. This contrasts sharply with traditional financial systems, where decisions are made by centralized entities or a small group of registered stakeholders. Changes in Ethereum are proposed through Ethereum Improvement Proposals (EIPs), debated publicly, and adopted only with widespread community support, ensuring no central authority controls the network. This decentralized, community-driven process highlights that Ethereum remains a decentralized commodity, not a security, as its evolution reflects the collective agreement of its diverse global participants.

As the UK Prime Minister on this topic just recently said: “We are pro-open source. Open-source drives innovation. It creates start-ups. It creates communities. There must be a very high bar for any restrictions on open source.”

Many traditional finance market participants may not fully understand that ETH is not just a speculative asset but has extensive real-world utility underpinning a vibrant decentralized application ecosystem. Ethereum supports over 270 million unique user addresses and processes an average of 1.2 million transactions daily. On-chain value settlements exceeded $2.8 trillion over the last year, compared to global remittances of $860B, PayPal volumes of $1.5 trillion, and Visa network volume of $15 trillion. Ethereum boasts a robust developer community, with more than 2,300 monthly active developers contributing to 113,000 distinct Githib repositories. Thanks to the network effects from this decentralized community, Ethereum has become the foundational layer for a vast ecosystem of over 3,000 applications, including financial services, games and collectibles. Its smart contract functionality enables automated lending/borrowing, decentralized exchanges, NFT marketplaces, play-to-earn games, and tokenization of real-world assets. Major companies like Reddit, Ubisoft, Nike, and Visa have launched Ethereum-based projects. Regulating Ethereum NFTs differently from physical collectibles like baseball cards or Rolex watches is often absurd – both represent unique digital/physical scarcity and ownership. A Bored Ape Yacht Club NFT and a rare 1952 Topps Mickey Mantle rookie card can serve similar purposes as status symbols and stores of value. But governance structures like those enabled by Ethereum underpin much of the innovation happening in open-source databases, including real-world asset tokenization. Stifling this utility through misguided regulation would hamper technological progress and drive those talented entrepreneurs overseas.

The situation has been made even more confusing by the inconsistent stances taken by different U.S. regulators. While the SEC has recently declined to clarify ETH’s status, the Commodity Futures Trading Commission (CFTC) allowed Ether futures products to trade as commodities. The Chairman of the CFTC has stated repeatedly under oath that ETH is a commodity. Even the SEC’s own guidance has stated that a digital asset may transition away from being a security as it becomes sufficiently decentralized over time, though critical details are lacking. Adding to the contradictions, just last week the U.S. Attorney’s Office for the Southern District of New York unveiled an indictment that referred to Ethereum as a “decentralized” blockchain. Needless to say, this regulatory discord has fostered harmful uncertainty and, contrary to the SEC’s mandate of capital formation, has inflicted a lot of pain in the market.

That’s why today feels particularly sweet to VanEck, the first traditional ETF issuer to file for both Bitcoin & Ethereum ETFs. It is so encouraging to observe the growing bipartisan support for digital assets in DC, reflecting widespread voter input, & culminating in today’s ETF news and this week’s congressional repeal of SAB 121, an accounting rule hostile to crypto that was enacted through unorthodox means.

We expect this improved political backdrop will lead to further victories via new laws and in the courts that draw investment to Bitcoin, Ethereum and other open-source blockchain software.

Stay tuned for further updates.

PS – we expect to go FIRST.

After tumbling just after the close because someone was stupid enough to assume that since there was no approval by 4:00:00pm it means the SEC won’t bless the ETF, Ethere was last trading just above $3,800…

… and rapidly approaching its YTD high just above $4,000, from where it will proceed to move much higher in the coming months.

Tyler Durden

Thu, 05/23/2024 – 17:58