WTI Rallies After Crude Inventory Build, Another Large SPR Addition

Oil prices edges lower again this morning (for the third straight day) after API reported crude and gasoline builds overnight in the US, and on the other side of the Atlantic, Genscape data showed expanded inventories in Europe’s oil trading hub.

Additionally, Bloomberg reports that signs of physical market weakness have been signaled by multiple market gauges.

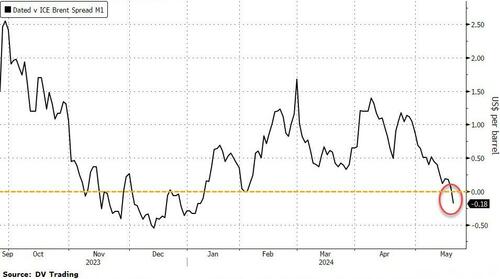

Brent’s prompt spread remains close to flipping into a bearish contango structure for the first time since January – an indication of plentiful supply relative to demand.

Meanwhile the Brent DFL – a measure of Dated Brent relative to futures – also recently turned negative.

Will the official data provide any support for crude prices?

API

Crude +2.49mm (-3.1mm exp)

Cushing +1.77mm

Gasoline +2.09mm

Distillates -320k

DOE

Crude +1.825mm (-3.1mm exp)

Cushing +1.325mm

Gasoline -945k

Distillates +379k

The official data confirmed a crude inventory build (vs an expected draw) and stocks at the Cushing Hub also rose. Gasoline and Distillates inventories were mixed…

Source: Bloomberg

While the Biden administration drained its gasoline reserve, it added to the SPR once again last week (+993k barrels – the most since Dec 2023)…

Source: Bloomberg

US Crude production continued to chug along near record highs at 13.1mm b/d…

Source: Bloomberg

WTI was trading around $77.60 ahead of the official data and rallied up to $78 shortly after…

OPEC and its allies, led by Russia, will hold a crucial meeting to review production policy next weekend. A coalition of nations in the broader OPEC+ grouping are cutting 2.2 million barrels per day, which has supported oil prices this year.

The group is likely to extend those production cuts as prices soften, according to analysts.

Tyler Durden

Wed, 05/22/2024 – 10:36