Inflation Isn’t A Bug In The System, It’s A Feature

Authored by J. Kennerly Davis via RealClearPolicy,

May brings more bad economic news for hard-pressed American households. “Transitory” inflation remains firmly entrenched at rates equal to or higher than those reported at the start of 2024.

The Labor Department reports this week that the Consumer Price Index, or CPI, it’s official measure of the rate of change in the retail price of a basket of everyday goods and services, rose 0.3% in the month of April, the same as for the month of January. For twelve months, CPI increased 3.4% through April compared to 3.1% for twelve months through January. And wholesale prices, a good indicator of future retail prices, increased much more than expected in April, rising at the fastest annual rate since April 2023.

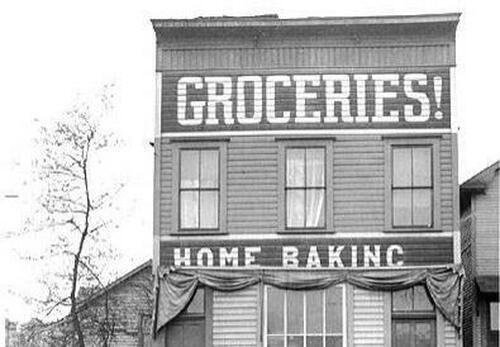

The cumulative effect of persistent inflation is devastating. Since President Biden took office in 2021 the CPI is up, and Americans’ purchasing power is down, by 19%. For basic necessities, the situation is even worse. Groceries are up 21%. Gasoline prices are up 47%. The cost of shelter 20%, and electricity almost 30%.

American workers cannot keep up. Since President Biden took office, average hourly earnings after inflation have fallen over 2.5%. A typical American family must pay $12,000 more per year simply to maintain the standard of living that it enjoyed when President Biden took office.

As bad as the official CPI numbers are, actual inflation is much worse. That is because the government calculates CPI using a methodology intentionally designed to understate actual inflation. It does so to conceal the destructive results that inevitably flow from its irresponsible policies.

Inflation is always and everywhere the result of government policies that increase the supply of money circulating in the economy faster than the productive sectors of the economy can expand their capacity to produce goods and services for purchase.

From day one, the Biden administration has flooded the economy with borrowed money in the form of transfer payments, subsidies, and grants designed to purchase the political support of favored constituencies such as those in the green tech sector. At the same time, Biden-controlled federal agencies have unleashed a tidal wave of crushing regulation designed to reduce the productive capacity of disfavored constituencies such as the oil and gas industry. The inflation that afflicts us was inevitable.

President Biden has asserted that fighting inflation is the “top economic priority” of his administration. Such a statement would be laughable if the subject matter was not so serious. This president has no intention of altering the policies that define and drive the progressive agenda. There is no war on inflation or, indeed, any serious attempt to bring it under control and stabilize prices. Inflation is baked into the progressive model of government that depends on the continuing disbursement of borrowed money to political supporters.

Under President Biden, the national debt has increased a whopping $13 Trillion and now stands at over $34.6 Trillion. Concerned commentators point out that it will require much sacrifice, potentially disruptive sacrifice, to pay off or even materially to pay down the national debt. They lament that elected officials seem to lack the will and have no plan to deal with the national debt.

In fact, the progressive political class does have a plan to deal with the national debt. Their plan is to perpetuate inflation and thereby to engineer a slow-motion stealth default on the debt that will enable them to continue to enjoy without disruption the political benefits that flow to them from their irresponsible debt-funded vote buying.

During the periodic “fiscal cliff” showdowns in Congress, it is often said that the United States cannot default on its debt. An outright default would certainly shred the government’s credibility in financial markets and dangerously undermine its ability to access those markets to raise funds in the future.

There is also a legal reason that the United States cannot default on its debt. Section 4 of the Fourteenth Amendment to the Constitution, enacted to repudiate Confederate debt and put beyond question the integrity of the obligations of the United States, provides in part that “The validity of the public debt of the United States…shall not be questioned.”

Compliance with the Constitution requires that the obligations incurred by the government be repaid in full, dollar for dollar. But, over time, inflation steadily reduces the value of the dollars used by the government to repay the obligations it has incurred. The purchasing power, or value, of a dollar has decreased by 19% just since President Biden took office and is today worth only 81% of what it was worth in January 2021.

This dollar-cheapening inflation, created by irresponsible spend-to-elect policies, enables the government to pay off its debts for cents on the dollar, and effectively default on the obligations it has incurred as a result of those policies. Clearly, inflation is not a bug in the government’s financial system. It is an essential feature.

The Federal Reserve actively supports the spend-elect-inflate model of governance by pursuing policies designed to achieve and maintain a rate of inflation equal to 2% per year. Over a generation, that rate of inflation will reduce the value of a dollar by approximately 50%. That will certainly help the government avoid having to fully repay its debts, but it will be devastating to American households.

By using inflated dollars to pay its debt, the government is failing to honor its financial obligations. It is defaulting on those obligations and cheating the institutions and individuals who purchased its securities. And it is violating the Constitution. Inflation is not only destructive economically; it is also unlawful.

J. Kennerly Davis is a former finance executive at a Fortune 500 electric and gas company, and a former Deputy Attorney General for the Commonwealth of Virginia.

Tyler Durden

Sun, 05/19/2024 – 09:55