Welcome To LaLa Land As Market Jettisons Tail Risks

By Simon White, Bloomberg Markets Live reporter and analyst

The economy is signaling a more volatile, potentially recessionary period. Markets, however, aren’t paying attention. Not only are the twin tail risks of a downturn or resurgent inflation being ignored, but a near-impossible “immaculate acceleration” of boomy growth and benign price appreciation is becoming the base case.

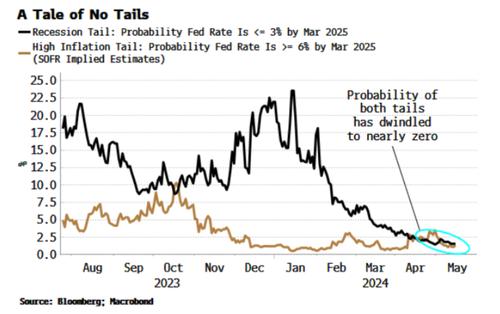

It’s not the first time that markets and the economy have been at odds, but this is one of the most egregious. Just as the economic mood music becomes more somber and underlying signs of persistent price pressures continue to fester, the market has virtually eliminated the tail risks of a recession or an inflationary shock.

We can estimate what the probability of those are by inferring from SOFR options the odds the Federal Reserve’s rate drops below 3% or rises above 6%. (Even though the time to expiry is falling as we move to the right in the chart below, the message is the same when using SOFR contracts with later expiries, i.e. tail-risk pricing is evaporating.)

The non-recessionary growth of immaculate disinflation has given way to expectations of an immaculate acceleration: accelerating growth and slowing inflation.

Immaculate acceleration is the quintessential two impossible things before breakfast. Yet that is exactly what the market is intending to digest: nominal rate volatility is rapidly picking up – as would be expected if a positive growth shock is foreseen – while real rate volatility is declining, indicative of inflation that is anticipated to keep falling. This is “cake and eat it”-ism writ large.

In the absence of outright panic, it doesn’t take the market long to find the diametrically opposite pole of greed and complacency. You don’t have to believe either a recession or unruly inflation are particularly likely to agree that the scant probability they are ascribed is negligently low.

That leaves the stock market in a more precarious position. It has been content to rally through this cycle with the belief the Fed would aggressively cut rates if a recession looked likely, i.e. the tail risk was underwritten. That’s ultimately still the case, but stocks are now happy to power ahead even though this tail is no longer priced by the rates market. That’s a degree of nonchalance equities have hitherto not yet displayed.

The two impossible things can be glimpsed again by looking at growth expectations. Economists’ forecast for 2024 real annual GDP was 0.6% as recently as August and is now 2.4%, while the Atlanta Fed’s GDPNow estimate for the current quarter is almost 4%. Yet the market is still projecting a steady drop in headline CPI back to 2.5% within the next year.

The market seems to be willfully ignoring many clear signals emanating from the economy. Recession risk has been in abeyance for more than six months, but that is changing. While near-term risk of a downturn is still low, we are at the point where it would not take much to flip the risks of one occurring in the next few months to being very high.

Not only have we had weak ISM services and manufacturing data, the unemployment level by US state is deteriorating. This can be a very early indication of a recession as it is a sign of a pervasive weakening of labor markets across the country — precisely one of the harbingers of a national downturn. That typically augurs much higher market volatility, as cash flows are stressed as companies hold on to workers until the last minute, despite slowing demand.

Yet volatility is muted and asleep at the wheel, seemingly paying no heed to the unemployment ripples spreading out state by state.

Indeed, hedging demand for higher equity volatility, inferred by the call-put ratio in VIX options is going down after two years at an elevated level. Have even volatility hedgers finally relented and embraced the immaculate acceleration nirvana?

Bond volatility is also ignoring the inflation backdrop. Bond vol is a price on uncertainty, and there is no more of an uncertain consideration for bond holders – even more so than the Fed – than inflation.

It may have come down, but inflation volatility is high and rising again in the US and Europe. Yet bond vol is near two-year lows. A repricing to where inflation volatility is would see a decline in global sovereign-bond liquidity (see chart below), and thus lead to much higher bond volatility.

Commodities are beginning to behave in a less emollient fashion. Copper, cocoa and natural gas are up 30-50% over the last few months and more and more commodity-future curves are going in to backwardation. Volatility has picked up in several commodities, but overall it is still muted.

One silver lining is that the widespread level of complacency in markets along with subdued implied-volatility means portfolio hedging costs are cheap.

That is the prudent way to go when we bear in mind the twin tail risks of inflation and recession have all but been erased from the market’s outlook.

Also overlooked is the possibility we enter a recession with elevated inflation. Needless to say, very few portfolios are likely prepared for this double tail-risk, or either one on its own. Moreover, little consideration is given to the boosting impact on inflation from the rate cuts that are priced in by the market.

Immaculate acceleration is like trying to thread a needle while shaking from an adrenaline rush. In other words, it’s unlikely to go according to plan.

Tyler Durden

Thu, 05/16/2024 – 08:10