CPI Does Not Signal Re-Emergence Of Disinflationary Trend

Authored by Simon White, Bloomberg macro strategist,

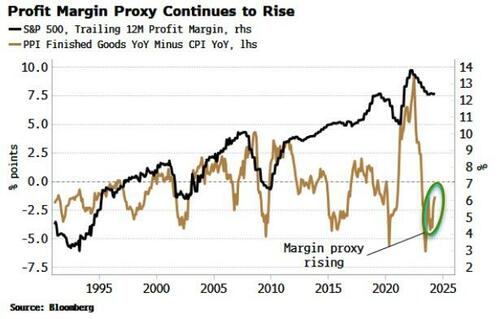

Today’s CPI data shows the gap between CPI and PPI continues to rise, a proxy for profit margins.

After a rise and fall through the pandemic, they are persistently rising again.

Profits are positioned to be one of the main vectors of persistent consumer inflation in this cycle.

Yields are in an interim trend lower as recessionary risks resurface, but the primary uptrend is intact.

There will be another bond selling opportunity later in the summer.

This rise in the profit-margin proxy matches the message from the primary services component of the PPI data…

Nothing moves in a straight line, and it is far too early to declare that the disinflationary trend has resumed.

Tyler Durden

Wed, 05/15/2024 – 12:05

Recent Comments