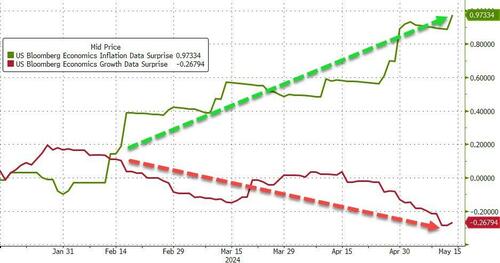

Retail Wrecking Crew Hammers Hedgies Again; Stocks/Powell Shrug Off Stagflation Signals

Hot PPI initially spooked markets (yields and dollar up, stocks down) but that faded fast (on lower revisions) – but the stag-flation trend continues this week…

Source: Bloomberg

Powell did briefly spook stocks around 1030ET with the following comment:

“it’s a possibility – but I dont think it will be the case – that the next action we take will be a rate hike… most likely we will stay the course….”

Between that comment (basically jawboning away any rate hikes) and the CPI-related components within PPI actually looking positive (well actually not positive and thus implying CPI may come softer), we actually saw rate-cut expectations rise today. 2024 now pricing in almost two cuts and 2025 now pricing in just over three cuts…

Source: Bloomberg

Goldman’s John Flood noted that trading volumes finally tracking higher +31% vs the 20dma, with ETF’s capturing 25% of the overall tape.

Floor skews +106bps better to buy with HFs +100bps better to buy (squeezes in consumer discretionary + ETF buying driving this) while LOs -300bps better for sale (selling tech + industrials), but overall flows here feel muted.

Another big day for the ‘meme stocks’…

Source: Bloomberg

…with AMC and SunPower (among others) joining GameStop

Source: Bloomberg

All of which means that ‘indicative’ hedge funds were clubbed like a baby seal for the second straight day – down a stunning 15% at the lows of the day…

And that meant several crowded longs (ABDE, V, SHOP) were hit as the squeeze in shorts forced de-grossing overall…

Source: Bloomberg

Small Caps were the winners today (and Dow was the laggard) but all the majors ended higher on the day. The Nasdaq closed at a record high…

The basket of MAG7 stocks broke out to new record highs today…

Source: Bloomberg

Treasury yields kneejerked higher on the PPI print then swiftly reversed to all end lower on the day by 3-4bps…

Source: Bloomberg

The dollar drifted back to the week’s lows – after a brief spike higher on PPI…

Source: Bloomberg

The dollar’s loss was gold’s gain…

Source: Bloomberg

Bitcoin erased yesterday’s gains which erased Friday’s losses…

Source: Bloomberg

The roller-coaster in crude prices continues – today was back down again, with WTI finding support at $78…

Source: Bloomberg

Copper closed at a record high today…

Source: Bloomberg

Finally, spot the odd one out – Nasdaq at record highs while US macro data at its weakest in two years…

Source: Bloomberg

Financial Conditions are as easy as they’ve been in years…and Fed Funds are at 23 year highs…

Source: Bloomberg

…will you be the greater fool?

Tyler Durden

Tue, 05/14/2024 – 16:00