The Land Of The Setting Sun: The Currency Crisis Of Japan Has Just Started

By Tuomas Malinen of The MT Malinen substack

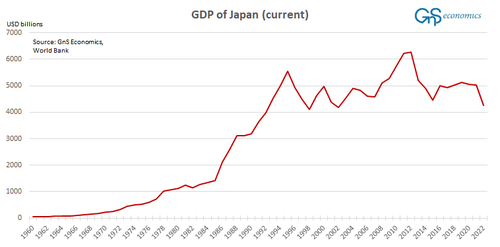

On Tuesday, we shortly commented the flash crash and the (assisted) recovery of the Japanese Yen between Friday and Monday, 26-29 April, on the GnS Economic’s Deprcon Outlook. In this entry, I will detail the reasons behind the crash, which go way back in history starting from the post-WWII growth model of the Japanese economy, leading to the the financial crash of early 1990s. They imply that the currency crisis of Japan is far from over.

Boom and bust

The Japanese economy was devastated in the Second World War, which created a need for a major reconstruction effort. Japanese also switched their model of governance to democracy, which laid the foundation for a stable society supportive of investments. The economic boom after WWII was fueled by financial regulation that kept the nominal interest rate below inflation and successful economic reforms that supported, e.g., neutral recruiting of labor and education. The mandarins at the Ministry of Finance issued ceiling on interest rates of both lending and deposit rates, which led to a notable investment boom. Export sector grew fast with the composition of the exports changing from toys and textiles to bicycles and motorcycles and further to steel, automobiles and electronics over the decades.

Japanese government began to deregulate the financial sector in the early 1980’s, following a global trend. Also, in the mid-1980’s, the Bank of Japan (BoJ) tried to aggressively limit the appreciation of yen (because it decreased country’s trade surplus), by cutting interest rates. These led to a rapid growth in the supplies of money and credit. A financial boom ensued.

The credit expansion led to notable gains in the real estate and stock markets, where bubbles grew to massive sizes. By the late 1980’s, the price index for residential real estate in the six largest Japanese cities had 58-folded from 1955. During the 1980’s alone, the price of real estate increased by a factor of six. At the peak, the value of Japanese real estate was double of that in the US. According to the chatter at the time, the market value of land under the Imperial Palace in Tokyo was greater than the market value of all real estate in California. The Nikkei stock market index rose 40000 percent from early 1949 till late 1989, with massive increase during the 1980’s. In the late 1980’s, the market value of Japanese equities was twice the market value of US equities.

The real estate and stock market booms were highly connected. A substantial portion of firms listed in the Tokyo Stock Exchange were real estate companies, which held considerable positions in property of major cities. Construction activity surged due to the combination of booming real estate prices and financial deregulation. Banks held large volumes of real estate and stocks, whose increasing value led to appreciation of banking stocks. Borrowers were usually required to pledge real estate as collateral, which meant that increase in the value of the real estate increased the value of the collateral enabling banks to increase their loan portfolio and grow in size. Also industrial firms bought real estate as the profit it produced was many times higher than that of, e.g., producing steel and automobiles. There was a ‘perpetual motion machine’ of ever-increasing prices and financial wealth, until suddenly there was not.

In the mid-1989, the BoJ started to rise interest rates, with the obvious effort to prick the asset bubbles. It succeeded. The stock market peaked at the last trading day in 1989, and fell over 38 percent in 1990. It bottomed out in Spring 2003 after falling close to 80 percent from the peak (Nikkei actually broke its previous record, set on December 29, 1989, on February 22 this year). The fall in real estate prices was slower, but extensive. For example, commercial real estate fell close to one-tenth of its peak value. Because the collateral of the banking sector was tightly connected to real estate, its value collapsed. Many industrial firms suffered crippling losses from their investments in the real estate.

The collapse of stock markets and real estate wiped out a large chunk of capital of banks, which in collaboration with the declining value of bank collateral, hurdled the banking sector into insolvency. Credit creation collapsed and the economy tumbled. A financial crisis set in.

The bailout

After the crash of the real estate sector, majority of the large Japanese banks remained bankrupt for most of the 1990’s. It was a tradition in Japan to socialize the losses of the banking sector, and regulatory authorities were reluctant to close banks considered bankrupt.

While the BoJ was somewhat slow to respond to the crisis, it started to lower its target interest rate in 1991, which eventually reached zero in early 1999. When the crisis intensified, the BoJ started to act as lender of last resort, the main task of a central bank in a crisis, but it also bailed out several financial institutions. This was mostly done by providing funds to different bodies, including the Housing Loan Administration assuming bad loans from the off-balance sheet, or jusen, companies banks had created to provide mortgages and the New Financial Stablization Fund, which provided capital both to banks and private financial institutions. This was very exceptional as central banks do usually provide only liquidity, not capital, to banks not to mention to private financial companies.

Facing a public anger over bank bailouts in the early stages of the crisis, the government allowed, and in some cases even encouraged, banks to extend loans to ailing businesses. Government, e.g., allowed for accounting gimmicks which, with the lacking transparency, enabled banks to downplay their loan losses and overstate their capital.

These measures saved the financial sector, but at a heavy cost. Because the banking sector was not restructured, bank lending collapsed and was diverted towards ailing unprofitable companies. The reason for this was simple: banks tried to avoid further losses from bankruptcies.

After the implosion of the asset bubbles, the domestic non-traded goods sector held the largest share of unprofitable companies. While bank lending to exporting (trading goods) sector diminished in the 1990’s, bank lending to the non-traded good sector actually increased. Thus, Japanese banks kept extending lines of credit to unprofitable firms to avoid losses that would have occurred if the firms would have gone bust. This zombified the Japanese economy.

So, while government policies were effective in restoring some trust to financial sector, they let the “zombie” banks to linger. They were kept standing without recapitalization or clearing their books. Subsidies from the government and ‘zombie-lending’ from banks kept unprofitable firms operating, but also blocked creation of new firms, because when banks use their diminished lending capacity to support ailing companies, the funding for risky new enterprises dries up. The old unprofitable firms also tie private capital, which could otherwise be used to support the creation of new businesses. This leads to a vicious loop of depressed innovation, falling production and diminishing profits. As a result, the Japanese economy stagnated. Moreover, these policies led to misallocation of credit on a massive scale, fall in the investment rate, and a prolonged slump in productivity.

The drag

When the private sector becomes infested with so called zombie companies, which are able to stand only with the help of easy credit, it becomes a serious drag to the economy. This is clearly visible in the growth of the Total Factor Productivity of Japan.

The figure above presents the three-year moving average of the growth of the TFP. We can see a rather clear collapse in the growth rate of the TFP of Japan from around 1992 lasting till 2012. In 2018, the TFP growth fell negative again, and spiked in 2023. The U.S. series provides a reference point.

You can think of the TFP as a your productivity at work. If your productivity increases, you (usually) earn more income, which makes you able increase your livings standards and, e.g. to pay back your loans. However, if your productivity stagnates, or even starts to fall, you earn less income, which starts to eat into your living standards, unless you support it (artificially) through borrowing. Moreover, if a considerable share of this borrowing does not go into productive investments, which would increase your productivity and thus income stream in the future, you just go deeper into debt with your ability pay it back hindered. This is exactly what happened to Japan. Because her productivity fell for a very long time, the only way to keep the living standards and the economy afloat was through massive government borrowing and monetary stimulus (low interest rates). Due to this, the ability of the Japanese government to pay back its debt has diminished as the economy has now grown, while the debt pile has grown to a monstrous size.

The problem Japan currently faces can thus be depicted as follows:

After the crisis of early 1990’s, the leaders of Japan decided not to let the economy to crash, because of e.g. cultural issues. In Japan, bankruptcies are considered highly shameful often leading to suicides. While the bailout of the Japanese economy was understandable culturally, the fact is that the restructuring of the Japanese economy after the financial crisis was an utter failure. Another country which experienced a financial crash at the same time, but recovered quite remarkably, is Finland.

Currency crisis

Currency and debt crises tend to be deeply intertwined. This is because the foreign exchange value of a currency reflects the trust of international investors and businesses on the keeper of the currency, i.e. the government of a country.

Essentially, a currency crisis or a crash is an “attack” on the exchange value of the currency in the markets. If the foreign exchange (FX) rate is fixed or pegged, this attack will test central banks (the monetary authority) commitment to the peg. The current view is that the timing of the attacks is not predictable (forecastable). If the FX-rate is fixed or pegged, market participants expect the policy of monetary authorities will be inconsistent with the peg and they will try to force authorities to abandon the peg, thus validating their expectations.

What matters for speculators are the internal economic conditions with respect to external conditions set for the currency (like stable FX-rate) . If these are incompatible in some meaningful way, like when the government has an unsustainable debt burden, monetary authorities face a trade-off between external and domestic goals for the exchange rate. In these circumstances, random shocks in the foreign exchange markets, called sunspots, can trigger an attack on the external value of the currency. This means that, when internal economic conditions are deteriorating, due to e.g. an unsustainable sovereign debt load, random events or shocks, can break the trust of investors leading them to sell the currency in the exchange markets causing the (external) value of the currency to drop suddenly or even to crash.

If a country holds a large external debt pile, a crashing currency will naturally increase its (foreign-currency) value threatening to create a wave of defaults. This applies to private entities, as well as to local and central governments. A currency crash is often expected to lead to interest rate rises by the monetary authority to defend the FX-rate of the currency. However, if the government holds a large amount of debt, higher interest rates can easily succumb the government under interest payments, which will eventually lead to a sovereign default. Rising interest rates would thus lead to further deterioration of trust by investors in the currency of a highly indebted government. This is why the Bank of Japan is trapped. If it would start to raise rates, the debt service burden of the Japanese government would rapidly become unsurmountable.

Conclusions

The bailout of the Japanese economy in early 1990s, which caused the slump in productivity leading to the very high indebtedness of the Japanese government, is the main culprit behind the ‘flash crash’ of the Japanese Yen. On April 26, it seems, a ‘sunspot’ triggered the selling. The response of the monetary authority, i.e., the BoJ, was to start to defend the yen at USDJPY pair of 160. Its intervention (buying of yen) pushed the pair to under 153 on May 3, where it has started to creep back up.

As the underlying problems of the Japanese economy have not gone anywhere, the attack on the yen in the markets is likely to continue and escalate, again, at some point. The question is, what is the breaking point in the USDJPY pair after which investors start to flee? Moreover, we should remember that monetary authorities have their limits, while markets don’t. Thus, it is very likely that the currency crisis of Japan has but just started. See my other post for analysis on its implications.

Tyler Durden

Sat, 05/11/2024 – 19:50