“The Jobs Market Is Weakening, Inflation Has Picked Up And Growth Unexpectedly Slowed”

By Rabobank

The Bank of England left the Bank Rate unchanged at 5.25% yesterday, but the clear signal from the record of votes, and Governor Bailey, is that cuts aren’t far away. This time around the vote split 7-2 in favour of holding (previously 8-1), with arch-dove Dhingra being joined by former hawk Ramsden in plumping for a cut.

The BOE’s Monetary Policy Report lowered inflation forecasts, but the policy Summary warned on uncertainties around the persistence of high services inflation and the spotty ONS labour market data. Governor Bailey commented that a cut in June is “neither ruled out nor a fait accompli”, while our own BOE watcher Stefan Koopman favors an August cut, owing to sticky services inflation and uncertainties around the impact of the recent 9.8% minimum wage decision.

So, the Bank of England is now in a similar place to the ECB, and a similar place to where the Fed was earlier in the year: cuts are coming, we just need to see some more data to be assured on the timing. In spending so much time talking about cutting rates before actually cutting them, central bankers are doing their best Abe Lincoln impersonation: “give me six hours to chop down a tree, and I will spend the first four sharpening the axe.”

A dovish Bank of England follows Sweden’s Rijksbank delivering a 25bps cut earlier in the week (the first in 16 years) and a 25bps cut from the Brazilian central bank yesterday (though four Board members wanted to cut by 50). The RBA doved-it-up on Tuesday by keeping the cash rate unchanged at 4.35% and maintaining their neutral bias – despite a big upside surprise in inflation in Q1 and half-percentage point upward revisions to their inflation forecasts for the remainder of this year. We think the RBA’s ‘hold and hope’ strategy will ultimately get waylaid by economic reality and that they will end up hiking twice more this year, albeit reluctantly.

Banxico might have been the closest thing to a hawkish central bank this week. They opted to pause the cutting cycle that was initiated in March, while revising inflation forecasts substantially higher and warning of persistence in inflationary shocks. USDMXN dropped below 16.80 following the meeting despite small gains in the DXY index. Nevertheless, Rabobank’s Christian Lawrence and Molly Schwartz are expecting Banxico’s policy rate to continue falling later in the year, ultimately hitting 10% by Christmas.

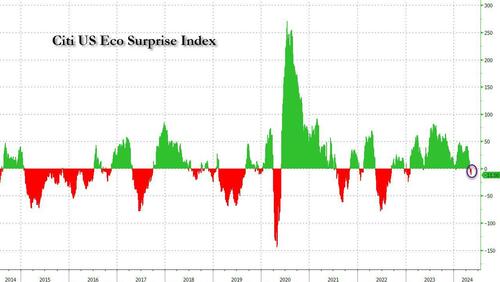

Over in the United States we saw a continuation of the theme established by a soft non-farm payrolls report last Friday that the US jobs market may be beginning to crack. Initial jobless claims this week printed at 231,000, well up on the expected 212,000 and last week’s upwardly-revised 209,000. This follows a recent run of soft data, including the lacklustre payrolls report, below expectations JOLTS job openings, and ISM reports showing employment contracting for both the manufacturing and services sectors.

While the labor market is starting to look creaky, the prices paid components of those ISM reports pumped higher. This chimes nicely with a strong run of PCE and CPI data, which we might see continued next week when we get the April PPI and CPI reports for the United States. Could another upside surprise be on the cards there? [ZH: a downside surprise is far more likely]

So, the jobs market looks to be weakening, inflation has picked up and growth unexpectedly slowed to just 1.6% annualized in Q1 figures reported the week before last. Nevertheless, Jay Powell isn’t bothered. He recently told reporters that he couldn’t see the ‘stag’ or the ‘flation’ in the economy at the moment.

The BOE and the ECB might be channelling one former President in softening us up for rate cuts, but in light of the recent run of data it stretches credulity to suggest that Powell is channelling another: “Father, I cannot tell a lie…”

While the economic picture appears to be softening in North America, in Europe things seemed to turn for the better this week. PMIs indicated a faster rate of expansion for Spain, France and Germany, and Italian industry also remains in expansion (albeit at a slightly reduced rate). German factory orders remained dreadful, but both imports and exports showed unexpected strength. French wage growth accelerated and German industrial production was less bad than feared. All of this follows on from stronger than expected Q1 growth figures for the Eurozone last week.

Europe might be looking better, but it isn’t time to break out the bunting just yet. Growth is still weak, and it would be a brave call to suggest that inflation has been routed – even if it may be in retreat at the moment. There’s also plenty of potential for further shocks. Just this morning we saw news that Joe Biden plans to impose tariffs on Chinese EVs and other strategic sectors as early as next week. Such moves raise the risk of China dumping those products into other markets (like Europe), which might prompt action from the Europeans to protect already fragile German industry.

There’s also the issue of the Israel-Hamas (/Hezbollah/Iran) war bubbling away in the background. Brent crude has stabilised around $83-84/bbl after the recent tit-for-tat between Israel and Iran momentarily petered-out, but tensions remain high and the war is moving into a new phase that introduces new potential catalysts for regional potshots.

Israel this week cut off the crossing from Rafah into Egypt as a precursor to a ground offensive. Hamas tried to accept a ceasefire deal that Israel hadn’t offered. Joe Biden wound-back long running bipartisan support of Israel by threatening to halt shipments of offensive weapons if Israel pushes into Rafah. That latter development was almost certainly electorally-driven, with the campus youth vote, and the large Muslim population in Michigan of crucial importance to Biden’s chances of re-election. Netanyahu remains undeterred, declaring that “if we must, we shall fight with our fingernails.”

So, all in all, it was another week where there were plenty of problems that we can point to, but both stocks and bonds went higher (at least as of time of writing). Perhaps there is some truth to an observation a trader once made to me: “bears sound smart, but bulls make money

Tyler Durden

Fri, 05/10/2024 – 18:05