“Is Consumer Travel Spending Easing?” – BofA Identifies New Trend As Travel Companies Miss Earnings

One theme we’ve spotted this earnings season has been an increasing number of companies warning about low-income consumers.

From McDonald’s to Starbucks to Tyson Foods, executives on earnings calls have warned about mounting headwinds hitting the working poor.

Last Tuesday, Starbucks CEO Laxman Narasimhan told investors on a call, “Our performance this quarter was disappointing and did not meet our expectations,” adding that significant headwinds originate from a “cautious consumer.”

A similar message was shared by McDonald’s last week when execs reported lower-than-expected quarterly sales growth.

On Monday, Melanie Boulden, who oversees Tyson’s Prepared Foods business, warned, “The consumer is under pressure, especially the lower-income households.”

Then, on Wednesday, credit card data from the Federal Reserve showed households finally hit a brick wall. Credit card debt growth in March plunged to the smallest monthly increase since the Covid crash.

This morning, Bank of America’s trading desk also spotted some weakness in consumer-sensitive stocks, this time in the travel industry.

“Theme Alert? Consumer Travel Spending easing?” BofA’s analysts asked.

They pointed out a list of disappointing earnings across the travel industry:

$EXPE miss/guide

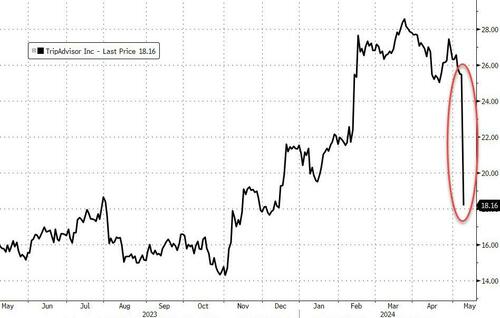

$TRIP miss

$CMCSA parks commentary

$DIS parks’ moderation’ or normalization

$UBER slight bookings miss

Tripadvisor experienced its worst intraday decline ever, with its stock plunging by as much as 38%. This was due to the online travel firm’s announcement that it had called off a deal to sell the company.

Did the lack of ‘deal premium’ suddenly expose investors to the the reality that Gen-Z and millennials can no longer afford their stimmy-funded “experiences” as the economy slows.

Taking a deeper dive into markets, the Dow Jones US Travel & Leisure Index peaked in late March and fell 7.5%. The index is up against heavy resistance.

Interestingly, the Transportation Security Administration’s airport checkpoint data still shows robust travel demand.

Bank of America’s trading desk may be onto something here, a trend that other companies are also starting to notice: low-income consumers are cracking in the era of failed Bidenomics.

Tyler Durden

Wed, 05/08/2024 – 21:35

Recent Comments