Office Tower Turmoil In NYC Worsens Ahead Of Trillion Dollar Maturity Wall

A combination of factors, including remote work, an exodus of progressive cities, higher interest rates for longer, and diminished credit availability, continues to pressure the office tower market nationwide. The latest example of challenges facing the $20 trillion commercial real estate market comes from New York City.

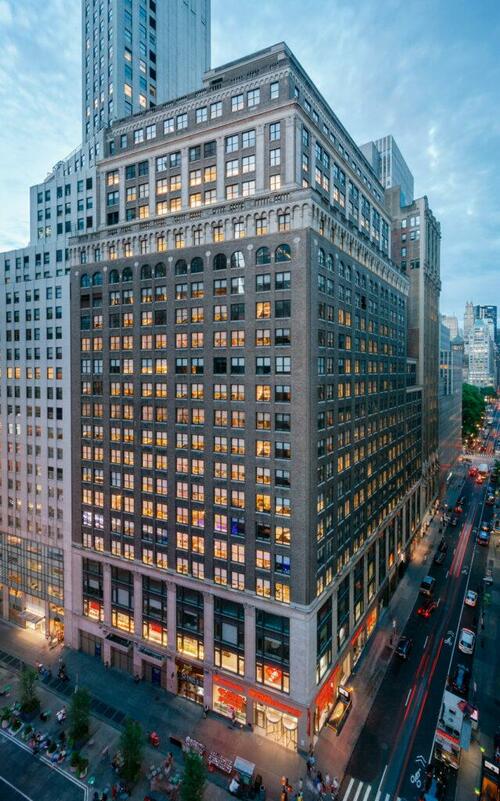

Bloomberg reports that the $400 million loan backing 1440 Broadway, a 25-story tower at the corner of Broadway and 40th Street in Midtown Manhattan, has fallen into delinquent status.

The loan was bundled into commercial mortgage-backed security called JPMCC 2021-1440.

“One of the loans responsible for this meaningful month-over-month increase was the $399 million 1440 Broadway loan securitized in JPMCC 2021-1440,” JPMorgan analysts led by Chong Sin, Terrell Bobb and John Sim wrote in a note to clients.

The analysts said the deal sponsors “failed to pay the loan’s balloon payment last month, and now the loan is considered non-performing matured.”

According to JPM data, the serious delinquency rate for office loans hit 7% in April, the highest level since the first half of 2017.

1440 Broadway has been plagued with a drop in office space demand. One of its largest tenants, WeWork, downsized after declaring bankruptcy in late 2023. Another top tenant, Macy’s, has struggled with sliding foot traffic because of fewer office workers in the city. On top of this, the high-interest rate environment has pushed up the cost of financing.

Here’s additional color of the property from JPM:

“… The property’s two largest tenants at securitization, WeWork and Macy’s, have presented significant challenges to the continued performance of this loan. At securitization, these two tenants accounted for 70% of the property’s rental income. However, Macy’s vacated the property at the end of its lease term in January 2024. WeWork declared bankruptcy earlier this year but has worked with the property’s sponsors to amend the terms of its lease. WeWork negotiated a 40% decrease in rent as it is now expected to pay just $44 psf for its space in the building as opposed to the $73.26 it was originally paying. WeWork will gradually pay more for its space as the amended lease terms do include steps up in rent. Additionally, WeWork was able to shorten the length of its lease. WeWork’s lease was originally intended to end in 2035 but is now expected to end in 2028. We estimate that the property’s occupancy rate is now at 58% and a 52% decline in gross rental income from the prior year.”

Looking at citywide office occupancy trends, card-swipe data from Katle Systems shows below 50%, an ominous sign office workers aren’t returning in droves.

The CRE mess is far from over. In fact, it is a rolling disaster, with the real fireworks coming later this year if interest rates remain elevated.

In a recent note, we cited Mortgage Bankers Association data showing that $929 billion—20% of the $4.7 trillion total—in commercial mortgages held by lenders and investors are due later this year. The figure is up 28% from 2023 and inflated by amendments and extensions from prior years. Nevertheless, borrowers must now bite the bullet and pay up or default.

Remember that surging CRE defaults risk triggering hundreds of small regional bank failures. We warned about this in a March note titled “$1 Trillion In 2024 CRE Maturities Could Lead To Hundreds Of Bank Failures.”

Tyler Durden

Wed, 05/08/2024 – 18:55