Cryptos Dump After Robinhood Reveals SEC Wells Notice Related Related To Its Crypto Listings

For all its positives, bitcoin is perhaps the only security that prices in the same news over, and over, and over again (especially when the news is bad).

We saw this last month when bitcoin tumbled repeatedly after every single fake attack in the fake “Iran-Israel war”, as if it was pricing nuclear Armageddon over and over instead of actually reading between the lines of the staged theater between the two middle-eastern states. It eventually rebounded and recouped most losses but not before finding something else to be just as shocked over, even though this too is not news at all.

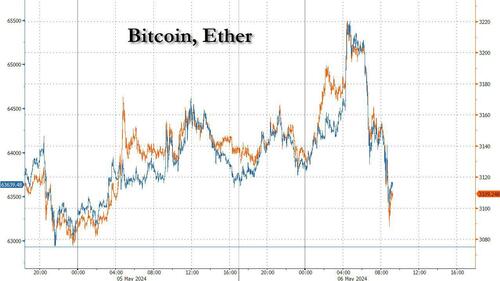

Moments ago, bitcoin and other cryptocurrencies dumped sharply when Bloomberg reported that Ken Griffen’s favorite retail frontrunning exchange, Robinhood, has received a Wells Notice, i.e., it has been formally warned by regulators that it may face an enforcement action tied to its cryptocurrency dealings.

The so-called Wells notice – which gives a company time to rebut the agency’s allegations and doesn’t necessarily indicate an enforcement action will follow – from the SEC concerns Robinhood Crypto and its cryptocurrency listings, custody of cryptocurrencies and platform operations, the company said in a regulatory filing Monday.

The agency’s staff told Robinhood that it made a “preliminary determination” to recommend that the SEC file an enforcement action.

The result could be an injunction, a cease-and-desist order, disgorgement and other penalties or limits on activities, according to the filing. The company was previously subpoenaed and has cooperated with the investigation, Robinhood said.

Dan Gallagher, chief legal, compliance, and corporate affairs officer at Robinhood Markets wrote in a May 6 blog post:

“After years of good faith attempts to work with the SEC for regulatory clarity including our well-known attempt to ‘come in and register,’ we are disappointed that the agency has decided to issue a Wells Notice related to our U.S. crypto business.”

Gallagher added that Robinhood doesn’t see any of its listed assets as securities:

“We firmly believe that the assets listed on our platform are not securities and we look forward to engaging with the SEC to make clear just how weak any case against Robinhood Crypto would be on both the facts and the law.”

Of course, anyone with a room-temperature IQ would have been able to anticipate this turn, which comes about a year after the SEC served Coinbase with an identical Wells Notice, and which comes just days before the SEC has to rule – negatively, at least until the courts force it to reverse its decision – on whether to greenlight an Ethereum ETF, something which Liz Warren’s pocket fascist enforcer, Gary Gensler, has sworn he will not allow simply because it goes against the interests of Warren’s biggest backers. To be sure, eventually the courts will greenlight an ETH ETF, just as Larry Fink requires in order to complete his vision of tokenization as “the next generation for markets” but not before some token resistance from the anti-crypto Democrats in Congress.

And while we wait, bitcoin and ETH both dumped on the news – as of course they always do because the algos that trade them have a 10 millisecond attention span and can’t be bothered to even google that what they are reacting to has been widely priced in countless times in the past.

It goes without saying that the rebound is just a formality at this point as the algos that sold just minutes ago on the Wells Notice “news” forget why they sold, and being a momentum ignition program higher, but the bigger question is whether the end of the anti-cyrpto Biden admin in early November will be the biggest pro-bitcoin catalyst in recent history, far bigger even than the halving.

Tyler Durden

Mon, 05/06/2024 – 09:19