‘Buy All The Things’ – Poor Payrolls Sends Rate-Cut Hopes Soaring

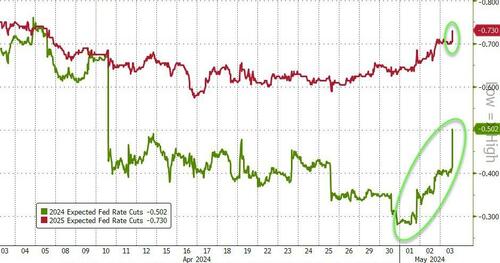

‘Bad’ news is back to being good news for markets as a disappointing rise in payrolls pushed rate-cut expectations higher. 2024 is now fully pricing in two rate cuts and 2025 an additional three rate-cuts…

Source: Bloomberg

As Academy Securities’ Peter Tchir writes, this report should be very good for bonds.

Establishment survey of 175k.

The Household report showed an increase of 949k full time jobs (while part time jobs declined by 914k). Great news even as the overall net total was “only” 25k.

The weaker data is in line with what we’ve been seeing in other reports. If anything, NFP still looks high, relative to other bits of employment data we get (most noticeably the JOLTS quit and hire rates, which are below where they were at any time in 2019 or 2018).

Average hourly earnings declined a smidge. Hours worked down a touch. Both good for those looking for Fed cuts.

The participation looks unchanged, buy maybe the labor force overall grew, as we saw a small uptick in the Unemployment Rate to 3.9%. Far from a bad number, but moving in the right direction if you are hoping for Fed cuts.

Normally as you parse through the data, you find some mixed signals, but so far, the report seems to be universally, good enough for the economy AND good enough for the Fed.

Who Wins?

Those still clinging to two cuts as their base case (I’m in that camp). Though markets are pricing in Sept/Dec rather than June/July (which I might have to move on).

The market has pulled forward expectations for the first cut to September…

Bond yields. Though with the 10 year already down to 4.47% I’d start reducing position size. I still like 4.4% to 4.6% as a “range” and think deficits and supply will weigh on the longer end of the yield curve once the initial wave of optimism passes.

Maybe stocks? The initial reaction if for stocks to do well. Makes sense if stocks still really seemed to move with bonds. As we’ve seen, time and again, the correlation between low yields and higher stocks is not particularly strong. This number is “good enough” that both stocks and bonds can rally, but what will hold and what will rise further from here?

I think it is a good opportunity to buy value, small cap and banks. Toss in some commercial real estate. I think we will see relief spread to those sectors at the expense of sectors with valuation concerns.

The dollar is tumbling…

Gold and crypto are rallying…

While on Fox Business yesterday, with Charles Payne, he told me not to tell people I’m invested in China (jokingly at the end of the segment) I can’t resist showing this chart. The Nasdaq 100 really hasn’t done much since the end of January, and while this chart doesn’t capture the rally in futures this morning, I don’t think we are out of the woods yet, unless it can retake the 50 day moving average.

Good luck, but I don’t think this data will stand the test of time as helping all markets.

While it is strong enough to keep any sort of “economic slowdown” noise very low, that noise will start increasing, as NFP finally joins a list of other jobs data not moving in the right direction.

Tyler Durden

Fri, 05/03/2024 – 09:17