Feds Scrutinizing Block’s Square And Cash App, Eyeing If Transactions Funded Terror And Skirted Sanctions

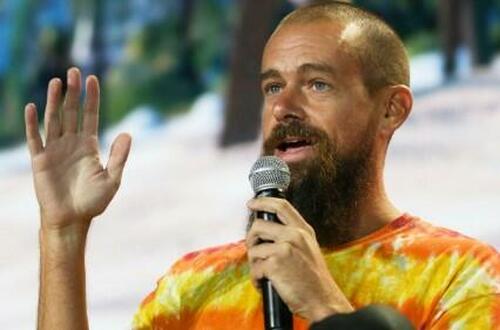

Federal prosecutors are investigating compliance issues at Block, the fintech firm co-founded by Jack Dorsey, according to a new report from NBC, citing “two people with direct knowledge”.

Questions about the company started swirling back in March 2023 when short seller Hindenburg Research released a report called “Block: How Inflated User Metrics and “Frictionless” Fraud Facilitation Enabled Insiders To Cash Out Over $1 Billion”.

In it, they concluded that “the ‘magic’ behind Block’s business has not been disruptive innovation, but rather the company’s willingness to facilitate fraud against consumers and the government, avoid regulation, dress up predatory loans and fees as revolutionary technology, and mislead investors with inflated metrics.”

Now, a former employee has shared documents revealing insufficient customer information collection, transactions involving sanctioned countries, and cryptocurrency dealings with terrorist groups, the latest report from NBC says.

The employee claims many transactions weren’t reported as required, and Block failed to address the breaches despite being notified. The documents detail transactions with entities in sanctioned countries, including Cuba, Iran, Russia, and Venezuela, as recent as last year.

One former told NBC: “From the ground up, everything in the compliance section was flawed. It is led by people who should not be in charge of a regulated compliance program.”

“It’s my understanding from the documents that compliance lapses were known to Block leadership and the board in recent years,” Edward Siedle, a former Securities and Exchange Commission lawyer who represents the former employee and participated in the discussions with prosecutors told NBC.

Cash App, a mobile payment platform under Block’s ownership, faced allegations of compliance failures from two other whistleblowers in mid-February. Introduced in 2013, Cash App enables instant money transfers and stock and Bitcoin purchases. By December, it boasted 56 million active transacting accounts and $248 billion in inflows over the previous four quarters.

Block commented to NBC: “Block has a responsible and extensive compliance program and we regularly adapt our practices to meet emerging threats and an evolving sanctions regulatory environment. Our compliance program includes systems, tools, and processes for sanctions screening, as well as investigating and reporting on sanctions issues in accordance with our regulatory obligations.”

They continued: “Continually improving the safety and security of our ecosystem is a top priority for Block. We have been and remain committed to building upon this work, as well as continuing to invest significantly in our compliance program.”

Federal prosecutors are also examining Square, another key component of Block’s operations, which serves millions of merchants. According to documents provided to prosecutors and reviewed by NBC News, Square allegedly failed in basic customer due diligence on international merchant sellers and mistakenly reimbursed some merchants’ funds frozen for sanctions violations.

The documents also reveal that new customers triggering sanctions alerts were allowed to conduct transactions before resolution, with instances of inadequate screening against sanctions keyword lists, the report adds.

Cash App, due to its design, also apparently heightened compliance risks, NBC wrote. A document highlighted the challenge, stating that stored balances in Cash App are typically depleted by the time of review, limiting the platform’s ability to block or reject funds.

The former employee also informed prosecutors of findings from an external consultant hired by Block, which identified nearly 50 deficiencies in monitoring suspicious activities and screening for sanctions violations.

Board members including Lawrence Summers and Sharon Rothstein have also recently departed the company.

Tyler Durden

Wed, 05/01/2024 – 11:50