Eurozone Exits Recession

By Maartje Wijffelaars and Elwin de Groot of Rabobank

Eurozone leaves recessionary territory

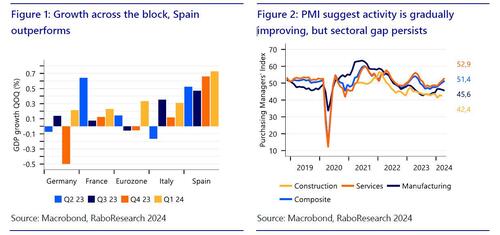

The Eurozone economy grew by 0.3% q/q at the start of the year, exceeding expectations. Growth follows two quarters in which the economy mildly contracted. Among the largest member states, Spain again took the lead, growing by a stunning 0.7% q/q, while Germany, France and Italy all grew at about the same speed. Italy posted 0.3% q/q and France and Germany 0.2% q/q. Notably, growth in Germany follows a downwardly revised -0.5% q/q in 2023Q4.

A breakdown into expenditure components is not yet available, but incoming data from the largest member states suggests that at least net foreign demand contributed positively. Meanwhile, overall investment grew in France and Spain, while Germany’s national statistics office highlighted construction investment as a bright spot. At the same time, consumption made a decent contribution in both France and Spain, but negatively contributed to growth in Germany. Finally, Italy’s statistics’ office merely mentioned that overall domestic demand contributed negatively and net foreign demand positively.

Data on the performance of the supply side is both more mixed and scarce. Data from Northern member states, available so far, suggests that industry did a poor job there, while performance in construction improved and services accelerated. In the Eurozone’s South, all sectors made a positive contribution, with actually a strong acceleration visible in Spain’s entire industrial sector. On the whole, the Q1 GDP report shows an economy in transition to economic recovery, but the underlying rate of expansion is perhaps not as strong as these data suggests.

Acceleration ahead?

The recovery in the Eurozone came faster than we had anticipated and activity surveys had indicated. The main question now is, whether this means we were fundamentally too negative about the state of the economy and further acceleration is to be expected going forward, or if it was mostly a matter of timing. We currently lean towards the latter, but it surely is at the top of our minds as we are heading into our next global forecasting round.

Surveys paint a bit of a mixed bag, with the PMI suggesting activity has been improving recently, while the Economic Sentiment Indicator of the European Commission suggests that the recovery is already behind us and that we’ve entered a stabilisation phase. The main difference is related to the services sector, with the PMI indicating new demand is improving, while it is weakening according to the ESI. Both underscore that the manufacturing continues to be a weak spot, however, with new orders declining at an accelerating speed in April.

Looking at the broader picture, we expect quarterly growth to stick at around 0.3% in the coming quarters (with Q2 still prone to downside risk, but perhaps some upside risk later on in the year). Indeed, consumption should benefit from job security, improving real wage growth and the fact that the largest shock to household interest payments is behind us, while saving rates are still relatively high in most countries. At the same time, however, the tight labour market limits employment and hence consumption growth. Meanwhile, investments are expected to continue to feel the impact of high interest rates, less spare savings at businesses to be used for investment and fiscal tightening in some countries. That said, long-term rates have fallen since their peak last year and are expected to continue to fall, which together with large NGEU funds still available should support investments going forward. Finally, growth of external demand is projected to remain sluggish, with (underlying) weakness in China to persist and the US projected to enter a mild recession in the second half of this year

Inflation outlook unchanged

The April numbers for Eurozone inflation were bang in line with our forecasts. Headline inflation stayed at 2.4% y/y in April, as expected. The core inflation rate declined to 2.7% y/y from 2.9%. Although services inflation dropped to 3.7% y/y from 4%, this was likely driven in part by the timing of Easter (late March instead of April last year). Some 0.1-0.2%-points are simply due to this effect and will therefore reverse in the next month

Energy inflation rose and even food inflation picked up a bit after the sharp falls in previous months. Ex-energy goods inflation dropped to 0.9% y/y, but the pace of the deceleration is starting to wane.

In other words, we have now truly reached the point where we can say that the “last mile is going to be the hardest”. This is underscored by the fact that both core and services inflation rebounded in April, when we look at a Census-X13 seasonally adjusted corrected measure of the annualised monthly change (the ECB’s own seasonally adjusted measure is not available yet).

Tyler Durden

Wed, 05/01/2024 – 03:30