Apollo Slapped With Lawsuit Alleging “Widespread Fraudulent Human Life Wagering Conspiracy”

Apollo Global Management has been entangled in a scandalous lawsuit and accused of acquiring illegal life insurance policies on senior citizens through a complex web of shell trusts.

The company allegedly used an affiliate, Financial Credit Investment, to manage about a $20 billion portfolio of stranger-originated life insurance policies, effectively engaging in what the lawsuit claims:

“In short, Apollo has been carrying out a widespread fraudulent human life wagering conspiracy designed to not only hide its involvement, but to create the false appearance that the policies it owns are somehow legitimate.”

The complaint continues:

“Worse still, when Apollo senses a claim is going to be brought, it attempts to dissolve its shell entities to give itself yet another layer of protection.”

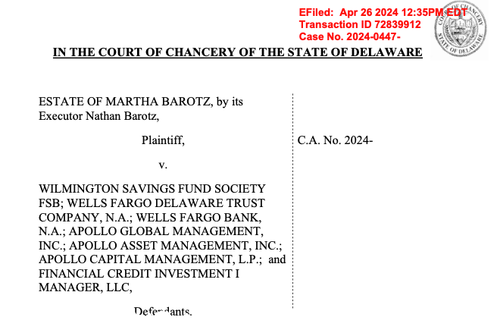

This scheme was designed to give the policies the illusion of legitimacy. Martha Barotz’s estate initiated the legal action filed in Delaware’s Chancery Court last Friday. It raises serious questions about Apollo’s ethical practices.

“In this way, the senior citizens have no idea who owns a policy on their life, and who wants them dead,” the suit said, adding, “Apollo was fraudulently and illegally using these shell entities to perpetuate human life wagers not only on the life of Mrs. Barotz, but on the lives of hundreds (if not thousands) of other senior citizens.”

Bloomberg first reported on the lawsuit. Responding to BBG’s note, Joshua Rosner, a Graham Fisher & Co. managing partner, wrote on X that Apollo’s actions are “mind-bending and horrifying.”

Even as a co-author of “These are the Plunderers: How Private Equity Runs and Wrecks America”, which details how rapacious Apollo is… this is mind-bending and horrifying! They should be fried. https://t.co/6NxzpaXRSR pic.twitter.com/TPx2GUvnpS

— joshua rosner (@JoshRosner) April 30, 2024

“Apollo should have its insurance licenses pulled in every state by the @naic. They predate retirees and pensioners through pension risk transfers and now we find they take out life insurance policies against seniors. @AARP,” Rosner said.

#athene #appollo should have its #insurance licenses pulled in every state by the @naic. They predate #retirees and #pensioners through #pension risk transfers and now we find they take out life insurance policies against seniors. @AARP https://t.co/OdthIMcrCo

— joshua rosner (@JoshRosner) April 30, 2024

Rosner asks one heck of a question: “With Apollo managing hospitals, nursing & hospice facilities & also the retirement accounts of seniors, are they essentially taking a straddle position on seniors by buying life insurance policies on them?”

One has to ask: with Apollo managing hospitals, nursing & hospice facilities & also the retirement accounts of seniors are they essentially taking a straddle position on seniors by buying life insurance policies on them? @naic @AARP @BenSasse @HawleyMO @GovRonDeSantis… https://t.co/OlTYQop1t4

— joshua rosner (@JoshRosner) April 30, 2024

One X user asks: “Did they take out life insurance on Alfred Villalobos and Jeffrey Epstein?”

Tyler Durden

Tue, 04/30/2024 – 18:40