Stellar 20Y Auction Has 2nd Highest Stop Through On Record

What a difference a month makes: last month, when inflation prints were coming red hot, one couldn’t find a willing buyer for the 20Y auction with a microscope, and as a result we saw a 2.5bps tail, tying the biggest on record. Well, fast forward to today when after two big misses in the form of lower than expected CPI and PPI, we just got the 2nd best 20Y auction on record.

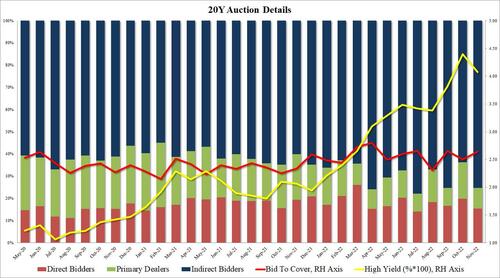

Printing at a high yield of 4.072%, the auction priced not only more than 30bps below October’s 4.395%, the first sequential yield drop since August, but also stopped through the When Issued 4.101 by 2.9bps, which was the second highest stop through on record with just April’s 3.0bps higher.

The bid to cover of 2.64 was also very solid, printing above last month’s 2.50% and above the six-auction average of 2.53%.

The internals were also stellar, with Indirects taking down 75.3%, the third highest on record, and well above the 70.3% recent average; and with Directs taking down 15.4%, below the 17.6% recent average, that left Dealers holding 9.2%, the lowest since September and well below the recent average of 12.1%.

The news of the strong auction sent yields across the curve to session lows, with the 10Y sliding briefly below 3.70%…

… and since CTAs are still max short bonds and will soon be forced to cover, expect a big move lower in yields starting any minute now.

Tyler Durden

Wed, 11/16/2022 – 13:19