Walmart Surges After Beating Expectations, Boosts Forecast, Unveils New $20BN Buyback

Walmart Surges After Beating Expectations, Boosts Forecast, Unveils New $20BN Buyback

Q3 Earnings season unofficially closed with a bang this morning when retailing giant Walmart reported blowout results, beating across the board, and boosting sales and EPS forecast; specifically, Walmart forecast a smaller then previously forecast fall in annual profit – it now sees adjusted EPS for the year down 6%-7% versus its prior view of down 9%-11% – as demand for groceries holds up despite higher prices, while discounts on clothing and electronics attract more inflation-hit shoppers to the top U.S. retailer’s stores. The company also demonstrated improved inventory management, and raised its full-year net sales expectations and announced a new $20 billion share buyback plan, pushing its shares up more than 7% in premarket trading.

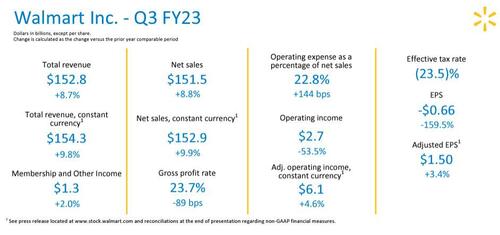

A quick look at what WMT reported for Q3, which saw beats across virtually every category:

Revenue $152.81 billion, +8.7% y/y, beating estimates of $147.88 billion

Adjusted EPS $1.50, beating estimates of $1.32 (excludes $1.05/Shr from opioid settlements)

Total US comparable sales ex-gas +8.5%

Walmart-only US stores comparable sales ex-gas +8.2%, beating estimates of +3.46%

Sam’s Club US comparable sales ex-gas +10%, beating estimates of +7.03%

2-year same store sales stack +17.4%, beating estimates of +13%

Walmart-only US comparable ticket +6%, beating estimates of +2.5%

Walmart-only US comparable transactions +2.1%

Change in US E-Commerce sales +16%, estimate +1.05%

Digging into the details of Walmart’s sparkling comparable sales number, The average ticket was up 6% in the third quarter — no big surprise at a time of high inflation. But transactions rose 2.1%, which is twice the gain from the previous quarter. Wall Street will like that — it’s a sign that shoppers are seeking Walmart out.

Sales of food and other essentials that fill much of Walmart’s shelf space have proved resilient, even as shoppers cut back on discretionary spending amid decades-high inflation. The company’s heavy discounting and focus on keeping prices lower than rivals have also helped it take market share from smaller players. However, those moves have hit the company’s gross profit margins, which tumbled 89 basis points in the third quarter ended Oct. 31.

Some more details on the quarter:

3Q Intl Net Sales Hit by $1.5B FX Headwinds

U.S. 3Q Inventory Increase Relates to Inflation

Raises Year Outlook on Strong Results for Q3

New York AG Secured a $3.1B Settlement From Walmart to Combat Opioid Crisis

The Quarter Included $3.3 Billion Related to Opioid Settlements

Walmart also showed improved inventory positioning vs prior quarters, and reported that 3Q inventory increased 12.4% Y/Y, a sharp improvement from the 25.6% Y/Y at the end of Q2. Walmart enters the holiday quarter with inventories valued at nearly $65 billion, up from about $60 billion three months ago. Speaking on the earnings call, CFO John Rainey said that about 70% of the increase in inventory is due to inflation, not unit volumes. That’s a sign he’s confident that the company is getting a handle on the inventory problem that hammered profit earlier this year as Walmart was forced to offer discounts to move goods such as apparel, electronics and home goods.

Looking ahead, the company’s 2023 forecast was also solid, if a little weaker at the Q4 point:

The company said it expects fiscal 2023 adjusted earnings per share to fall 6% to 7%, compared to its previous forecast of a 9% to 11% decline.

Walmart said it expects fiscal 2023 net sales to increase 5.5%, compared to its previous forecast of a 4.5% increase, and above the consensus estimate of 4.19%

Walmart forecast holiday quarter U.S. same-store sales, excluding fuel, to increase about 3%, below estimates of a 3.4% increase.

Fourth-quarter adjusted earnings per share are expected to decline 3% to 5%, compared to analysts’ estimates of a 4.5% fall.

Here are the five key take homes from WMT’s results according to Bloomberg:

Raising the forecast: Walmart improved its full-year profit outlook after a big beat on adjusted EPS during the third quarter. The company now expects EPS to fall only 6% to 7%, compared with the previous forecast that called for a decline of as much as 11%. Shares are up more than 6% in pre-market trading.

Consumers: Walmart said its forecast “assumes a generally stable consumer in the US, continued pressure from inflation and mix of products and formats globally.” Emphasis on “generally stable consumer”: In other words, the nation’s largest retailer says shoppers are still hanging in there despite inflation.

Grocery: The retailer says it’s gaining market share, according to third-party data, and comparable sales in the US soared 8.2%. Notably, Walmart said unit volumes in food rose after a slight decline in the previous quarter. The takeaway: More and more US shoppers are going to Walmart for its low prices. The company said last quarter that it was getting more business from higher-income customers, and that seems to be continuing.

Inventory: Walmart is reining in the surge in stockpiles that has forced it to cut prices on an array of goods this year. Inventory rose only 13% in the quarter compared with last year, a much slower pace than in the last two quarters. And gross margin, a broad measure of profitability, was in line with estimates, signaling that markdowns weren’t worse than expected.

International: CEO Doug McMillon had particularly kind words for Flipkart, the company’s majority-owned business in India, and Walmex, its operation in Mexico and Central America. Walmart has been paring its international portfolio but those two regions along with China and Canada are still key markets.

As for what Walmart’s results suggest about the broader US economy, on one hand, the sales beat could point to consumer resilience despite growing concerns about recession. But on the other hand, it may indicate that Americans who typically shop at higher-end brands are trading down to Walmart as they seek lower prices.

To ensure the market reaction to its earnings was favorable, the company approved a new $20 billion share buyback authorization, replacing existing program, which had about $1.9 billion remaining at the end of 3Q.

Walmart stock rose more than 7%…

… with the solid results and guidance from WMT also helping push peer retailers higher: Target, Costco and Dollar Tree all climb, with TGT up as much as 3.9%, COST +2.4%, DLTR +2.7%, Macy’s +1.3%.

Tyler Durden

Tue, 11/15/2022 – 08:27