Silvergate Rises 19% After Hours Friday After Stating It Has No “Loans Or Investments” In FTX

Like almost every other equity related to crypto over the last week, Silvergate Capital, which we have written about extensively over the last few years, nosedived on the news of FTX’s collapse.

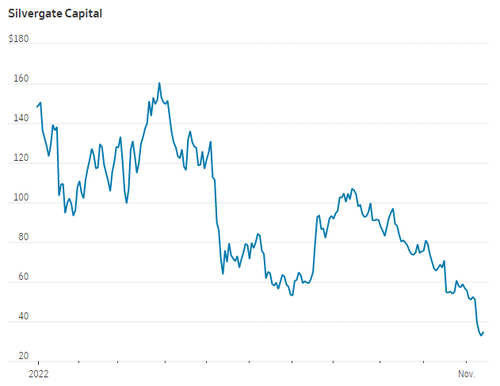

The stock has had a triumphant fall from grace, plunging from highs of $160 per share in early 2022 to lows near $26 on Friday before the cash session, as one new headline after another crossed the wires, offering up insight as to just how devastating FTX’s collapse could be for the crypto world.

But on Friday after hours, the bank cleared the air in terms of its exposure to the FTX blowup, issuing a statement that it had no loans or investments in FTX, but rather that less than 10% of the bank’s deposits were from FTX.

Alan Lane, Chief Executive Officer of Silvergate, said:

“In light of recent developments, I want to provide an update on Silvergate’s exposure to FTX. As of September 30, 2022, Silvergate’s total deposits from all digital asset customers totaled $11.9 billion, of which FTX represented less than 10%. Silvergate has no outstanding loans to nor investments in FTX, and FTX is not a custodian for Silvergate’s bitcoin-collateralized SEN Leverage loans. To be clear, our relationship with FTX is limited to deposits.“

The company then confirmed that the rest of its leveraged loans and banking infrastructure was safe: “To date, all SEN Leverage loans have continued to perform as expected with zero losses and no forced liquidations. As a reminder, all SEN Leverage loans are collateralized by Bitcoin, and we do not make unsecured loans or collateralize SEN Leverage loans with other digital assets.”

“Silvergate’s platform was built to support our clients during times of market volatility and transformation, and the SEN has continued to operate as designed and without interruption. As a federally regulated banking institution that is well capitalized, we maintain a strong balance sheet with ample liquidity to support our customers’ needs,” the bank said.

It then reminded investors that Lane would participate in a fireside chat at the Oppenheimer Blockchain & Digital Assets Summit on Thursday, November 17, 2022. We’re sure that’ll prove to be an interesting conversation.

For the time being, however, Silvergate’s statement was able to rein in some of the damage to the company’s stock: after touching $26 pre-market on Friday, the bank closed the day +1.74 at $34.42, before adding another 19.15%, rising to $41.01 in the aftermarket session, after the company released its statement.

Tyler Durden

Sat, 11/12/2022 – 14:30