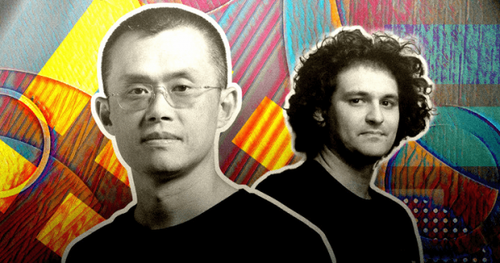

Crypto-Cagematch? Bankman-Fried Blasts Binance Over “False Rumors”

A new battle of the billionaires is brewing (if not boiling over) among the current kings of crypto as tensions between Binance founder Zhao “CZ” Changpeng and FTX founder Sam Bankman-Fried have escalated a war of words on Twitter into actions over CZ’s claims that FTX’s hedge fund’s asset base may not be all it’s cracked up to be.

The drama began early Sunday morning when FTX’s FTT token suddenly plunged as rumors surfaced that a giant whale with 23 million FTT, probably Binance, might be dumping its tokens.

FTT trade volume surged to its highest level in more than a year amid the wave of selling pressure…

Shortly after that initial plunge, Zhao said his company would liquidate its entire FTT holdings in the coming months, on fears that the token might collapse in the same manner as Terra (LUNA) in May 2021.

Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won’t pretend to make love after divorce. We are not against anyone. But we won’t support people who lobby against other industry players behind their backs. Onwards.

— CZ 🔶 Binance (@cz_binance) November 6, 2022

Binance was an early investor in FTX.

Zhao referenced “recent revelations that have came to light,” but did not elaborate publicly.

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

However, his actions come shortly after a Nov 2nd article on CoinDesk that said much the balance sheet of Bankman-Fried’s trading house Alameda Research is comprised of the FTT token.

Cointelegraph reports that, according to the CoinDesk report, Alameda Research had $14.6 billion on its balance sheet as of June 30, with FTT being the largest holding at $5.8 billion, making up 88% of its net equity. In addition, the firm held $1.2 billion in Solana, $3.37 billion in unidentified cryptocurrency, $2 billion in “equity securities” and other assets.

On the other hand, Alameda Research reportedly had liabilities worth $8 billion, including $2.2 billion worth of loans collateralized by FTT.

That, coupled with the firm’s alleged exposure to illiquid altcoins, prompted some analysts to predict its insolvency in the future.

“Alameda will never be able to cash in a significant portion of FTT to pay back its debts,” wrote Mike Burgersburg, an independent market analyst, for the Dirty Bubble Media Substack, noting:

“There are few buyers, and the largest buyer appears to be the very company which Alameda is most closely tied to […] the fair market value of their FTT in the event of large sales would rapidly approach $0.”

Bankman-Fried responded in a brief tweet thread, saying: “A competitor is trying to go after us with false rumors,… FTX is fine. Assets are fine.”

1) A competitor is trying to go after us with false rumors.

FTX is fine. Assets are fine.

Details:

— SBF (@SBF_FTX) November 7, 2022

He went on to note that:

“FTX has enough to cover all client holdings.

We don’t invest client assets (even in treasuries).

We have been processing all withdrawals, and will continue to be.

It’s heavily regulated, even when that slows us down. We have GAAP audits, with > $1b excess cash. We have a long history of safeguarding client assets, and that remains true today.

Concluding with an ‘oilve branch’ perhaps:

“I’d love it, @cz_binance, if we could work together for the ecosystem.”

Notably, as Decrypt reports, Zhao’s actions (and the Alameda leaks) follow weeks of criticism directed at FTX’s founder and Chief Executive Sam Bankman-Fried for regulatory proposals he put forth in a blog post which recommended restrictions regarding DeFi. He has since committed to revising his regulatory position.

While it’s fun to watch billionaire whiz-kids slinging mud at each other, the collateral damage (quite literallY) could be significant for the rest of the crypto universe.

“Overall, FTT is a relatively illiquid token on open markets, so Binance’s plans to liquidate all FTT tokens they hold is quite a significant market event,” Clara Medalie, head of research at analytics firm Kaiko, said.

“Alameda will likely dedicate considerable resources to ensure the price of FTT doesn’t crash.”

In fact, Alameda’s CEO tweeted that her trading firm’s financial condition is stronger than what was reflected by the balance sheet CoinDesk wrote about. She also offered, in a reply to the Binance CEO’s post, to buy his firm’s FTT token holdings for $22 each.

@cz_binance if you’re looking to minimize the market impact on your FTT sales, Alameda will happily buy it all from you today at $22!

— Caroline (@carolinecapital) November 6, 2022

Nothing to worry about at all…

In light of all the Binance vs FTX/Alameda rumors, a quick look at the latter’s “management team”https://t.co/8m1O5aBgyH

— zerohedge (@zerohedge) November 7, 2022

Nevertheless, the FTX outflows continue…

Quite the capital flight from FTX amidst Alameda worries. pic.twitter.com/kd8U6HDG0s

— Dylan LeClair 🟠 (@DylanLeClair_) November 7, 2022

Overall, as Kaiko concludes, it is clear that FTT market makers are working overtime to maintain the price of FTT, which is down 3% over the past day along with most other cryptocurrencies. Despite a massive surge in selling pressure, there is barely a dent in market depth and only a slight increase in price slippage. Ultimately it may be in all parties’ best interest to engage in an OTC transaction as suggested by Caroline Ellison to limit price impacts, especially considering Binance, FTX, and Alameda all risk large losses should FTTs price fall significantly.

Tyler Durden

Mon, 11/07/2022 – 19:00