The Fed And Powell: What Now?

By Peter Tchir of Academy Securities

The Fed and Powell

The statement added language highlighting that the Fed would take into consideration the cumulative amount of hikes and the lag effect of hikes. That was viewed positively by myself and markets. It was the first nod to the “lag effect” we’ve seen, which was taken to mean the Fed is dialing back on their hikes.

The press conference was used to disabuse the market of that notion. The press conference was taken as hawkish for a few reasons:

Potentially higher terminal rate (this was new).

Higher rates for longer (not sure this was new).

Willingness to overshoot because they can cut if needed (this was new).

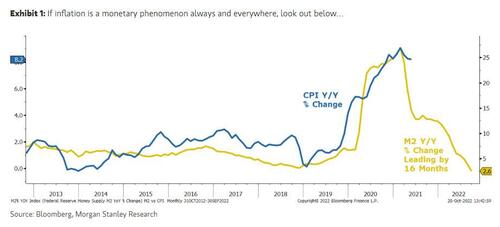

Little progress on inflation (from the group that transitory all of last year).

Mention of CPI (which is highly likely to overstate rent for the coming months because of how it was calculated and concerns those of us who don’t like reliance on data that seems out of sync with what is occurring in real time).

Powell killed the rally, took stocks and bonds down hard and we are seeing that continue overnight and into the morning session.

What Now?

The “buy everything” rally has pulled back, with the S&P 500 back to 3,745 (where it was on 10/21. The 10-year yield is back to 4.2%, just below the 4.22% on 10/21.

We will get more Fed speakers. They will “clarify” the message.

The “hope” for bulls (and I am still in that camp, though having to re-think it after yesterday’s reversal which highlighted positioning that wasn’t extremely bearish) is data dependence.

Bulls need to see progress on the inflation front in the official data.

Getting weaker than expected inflation data is my base case. While the Fed doesn’t see it, many economists and companies see it.

Whether that can show up in the data the Fed watches most closely is the question as OER for example, incorporates old data and is catching up to the rent inflation it missed from almost a year ago.

The least concerning issue is that Powell isn’t seeing inflation as his track record on predicting inflation has been mediocre at best. (difficult not to wonder what things would look like had that cut QE last spring and started hiking last fall, but no use crying over spilled milk).

Most concerning is the renewed pressure on the Euro and the Yen. FX volatility is gut wrenching for investors, companies and even countries. Some viewed yesterday’s changes in the statement as a subtle sign that the Fed was paying attention to concerns from other countries that the strong dollar policy was hurting them. Well, we are right back to that.

With yields back to their highs and threatening to break into uncharted territory, aided by potential foreign selling and it all being so fresh in our minds that we went weeks without treasuries catching a bid on their march higher, it is difficult to be bullish anything here.

On the other hand, for the first time since Jackson Hole, the Fed seems data dependent and is not on a pre-set course, which should be bullish (but is concerning that it hasn’t been bullish since the presser).

Basically leaves me licking some wounds, reducing position size, and trying to re-evaluate whether there is hope for the everything rally? I think there is, but price action is telling me to tread extremely carefully.

Tyler Durden

Thu, 11/03/2022 – 12:50