No Relief From Powell’s Hawkish Hangover: Tech Wrecks, VIX Vexed, Yield Curve Crushed

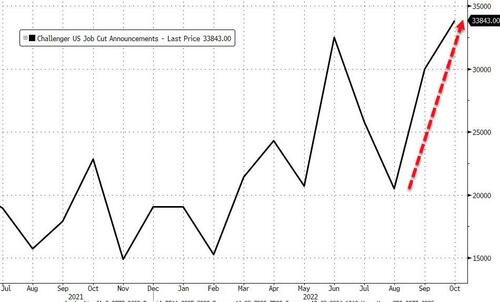

The day started with a hangover from Powell’s rug-pull; then the Bank of England hiked rates as expected, warned of a longer recession, and told the market its expectations were too hawkish; Challenger printed the highest number of job cuts since the pandemic lockdowns…

…then Services surveys showed the economic situation in the US is growing uglier at the same as unit labor costs grew at the fastest pace in over 40 years.

The result was stocks (mostly tech) and bonds lower in price, the dollar stronger, gold weaker, and Fed terminal rate expectations higher-er (to 5.20% in June 2023), as subsequent rate-cut expectations hawkishly declined (rates ‘higher for longer’ just as Powell wanted)…

Source: Bloomberg

On the day, The Dow and Small Caps desperately tried to stay unch, the S&P lost further ground, and Nasdaq was monkeyhammered (down 2%). Things traded sideways for much of the afternoon until the last 15-20 mins when everything went pear-shaped and puked…

The Nasdaq is down over 6% from the highs yesterday right before Powell started speaking (that’s over $800 billion in market cap)…

VIX closed lower today despite equity weakness…

…as hedges were monetized?…

As SpotGamma noted earlier, Powell seemingly didn’t give traders a reason to buy stock yesterday, but didn’t do enough to bring new levels of fear – there wasn’t enough hawkishness to lead traders to “pay up” for puts, as is clear from the fact that the S&P’s vol skew plunged to new record lows…

Source: Bloomberg

Treasuries extended their (price) losses today with the short-end dramatically underperforming (2Y +8bps, 30Y +1bps). We do note that bonds were bid during the US session however (until the EU close), having dumped overnight (during the EU session as Japan was closed)…

Source: Bloomberg

2Y yields at their highest since 2007

Source: Bloomberg

The 2s10s curve hit its most inverted level since 1982…

Source: Bloomberg

The dollar extended its surge off the dovish lows from yesterday…

Source: Bloomberg

As cable was pounded lower…

Source: Bloomberg

Gold extended yesterday’s losses today (ending down another 1%) but was bid during the US session…

Oil prices extended yesterday’s losses with WTI back down to $88…

And NatGas prices tumbled even more…

Finally, now that Powell has removed the hope once again, stocks have a long way to catch down to bonds’ reality…

Source: Bloomberg

And next week is chock-full of event risk with elections and CPI… and this should send a shiver of fear up market participants’ backs…

Source: Bloomberg

Something bad is going in the market’s pipes – as one wizened old credit trader remarked to us: “The thing about trying to break the economy is that you always break the market first…”

Tyler Durden

Thu, 11/03/2022 – 16:01