BoE Hikes Rates By Most In 30 Years, Pushes Back Against Hawkish Market Expectations

The Bank of England hiked rates by 75bps as expected (7 voted for 75bps, 1 voted for 50bps, and 1 voted for 25bps) after CPI soared to a 40-year high in September.

This is the biggest BoE rate-hike in three decades (eighth hike in a row and the biggest since 1992), but we note that the Monetary Policy Committee (MPC) pushed back aggressively against the hawkish market expectations ahead.

…the peak in rates will be “lower than priced into financial markets”

The BOE is expressly dovish in trying to guide market expectations on interest rates lower:

“The majority of the Committee judges that, should the economy evolve broadly in line with the latest Monetary Policy Report projections, further increases in Bank Rate may be required for a sustainable return of inflation to target, albeit to a peak lower than priced into financial markets.”

Valentin Marinov, head of G10 currency research at Credit Agricole:

The BOE is “sending a clear signal that the Bank Rate path expected by the markets ahead of the policy meeting is too high. The outcome contrasts sharply with the hawkish message from Fed Chain Powell yesterday and could trigger further drop of the GBP-USD rate spread, adding to the headwinds for GBP/USD.”

BoE commented on recent market volatility:

There have been large moves in UK asset prices since the August Report. These partly reflect global developments, although UK-specific factors have played a very significant role during this period.

The MPC expects more economic pain ahead…and implies the UK is already in recession, and that GDP will fall for eight straight quarters until mid-2024.

GDP is expected to decline by around 3/4% during 2022 H2, in part reflecting the squeeze on real incomes from higher global energy and tradable goods prices.

GDP is projected to continue to fall throughout 2023 and 2024 H1, as high energy prices and materially tighter financial conditions weigh on spending.

And while they see inflation rising, they forecast it to rise less than previously guessed:

CPI inflation was 10.1% in September and is projected to pick up to around 11% in 2022 Q4, lower than was expected in August, reflecting the impact of the EPG.

The risks around both sets of inflation projections are judged to be skewed to the upside in the medium term, however, in part reflecting the possibility of more persistence in wage and price setting.

Edward Hutchings, Head of Rates at Aviva Investors:

“This will most likely mark the peak in pace of tightening, especially with the Bank highlighting financial markets are pricing too much too soon. Next up for the UK will see the focus shift to the Autumn Statement to see what the Chancellor’s fiscal plans are, but in the meantime the headlines point to gilts being relatively more supported, however the currency less so.”

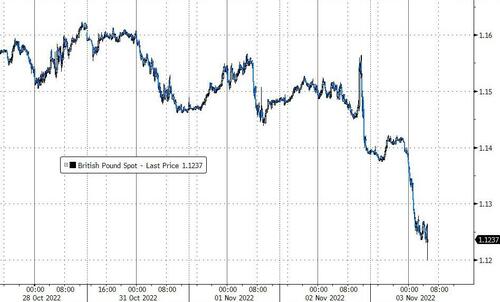

Cable extended its losses…

2Y Gilt yields tumbled but then reversed…

The tone of the statement is a stark contrast from what we heard from the Fed’s Jerome Powell yesterday, and explains the move lower in the pound versus the dollar. It speaks to how the UK economy remains far more fragile.

* * *

As we detailed earlier, this is what we expected (courtesy of Bloomberg’s Ven Ram)…

Decision:

Interest-rate traders are well-positioned for a 75-basis point increase from the BOE, and it would be a shock if the central bank delivered a smaller hike. The big question will be whether the BOE will commit to keep going at a faster pace or signal that the move would be a strict one-off measure.

With the markets pricing a terminal rate of circa 4.70%, an underwhelming move would imply the BOE has to keep going longer.

Dissent:

Given where retail-price inflation is in the UK, the BOE’s policy may just be approaching neutral territory. So it was a surprise that we got one member pressing for just a 25-basis point increase at the previous meeting — before when the policy rate was even lower. In other words, one should perhaps expect such uber-doves to dissent again, though it’s not clear if a second member may join that chorus. We may get a 8-1 vote or a 7-2 in favor of a 75-basis point move.

Forecasts:

With the government’s fiscal plan having been deferred to Nov. 17, the BOE’s new macroeconomic forecasts may be moot before the ink dries on the print. Given the likely fiscal tightening and in light of Deputy Governor Ben Broadbent’s comments that rates perhaps don’t need to rise as high as the markets are pricing, inflation could be projected to fall below target, with colleague Dan Hanson estimating that the previous estimate for annual consumer-price inflation for mid-2025 may be below September’s 0.8% assessment. The BOE is also likely to lower its economic growth forecast given rising interest rates and a slowing housing market, among other things.

The front end of the gilts curve may dominate action in the aftermath of the decision, with the long end perhaps likely to display a more tentative intent ahead of Downing Street’s fiscal plan. Regardless of any knee-jerk reaction, the pound will continue to take its cue from what’s happening elsewhere in G-10.

Tyler Durden

Thu, 11/03/2022 – 08:14