Treasury “Has Not Made Decision” Yet On Buybacks; Holds Quarterly Debt Sales Unchanged

Yesterday we said that “with all the focus on the Fed tomorrow, it will be delightful(ly ironic) if the Treasury steals the show with a TSY buyback announcement during the 8:30am refunding announcement.”

With all the focus on the Fed tomorrow, it will be delightful if the Treasury steals the show with a TSY buyback announcement during the 8:30am refunding announcement.

— zerohedge (@zerohedge) November 1, 2022

Of course, as discussed extensively, a Treasury buyback – something that has not been done in earnest since the early 2000s – would be the functional equivalent of a QE/operation twist hybrid, only one conducted not by the Treasury, and thus any affirmative announcement today would have had an even bigger impact on markets than anything Powell would say at 2pm.

So fast forward to today’s 8:30am refunding announcement when amid the buyback discussion we read the following:

Treasury is currently studying potential buybacks. In August, the Treasury Borrowing Advisory Committee provided updated analysis on buybacks, building on a presentation from 2015. This quarter, Treasury asked the primary dealers for their views on questions related to several potential uses for buybacks, including liquidity support and cash and maturity management. In addition, Treasury continues to meet with a broad variety of market participants in order to assess the costs and benefits associated with buybacks. Treasury expects to share its findings on buybacks as part of future quarterly refundings. Treasury has not made any decision on whether or how to implement a buyback program but will provide ample notice to the public on any decisions.

In other words, no buyback yet… because a quick skim of the associated TBAC discussion materials (which we will present in a follow up post) shows that Treasury buybacks are indeed coming, to wit:

Debt Manager Taylor then reviewed primary dealers’ views on a potential Treasury buyback program. Dealers generally thought a Treasury buyback program was worth further exploration. Some dealers focused on potential benefits for market liquidity, while others noted the potential utility for cash and maturity management. Most recommended that potential buybacks be conducted in a regular and predictable manner, consistent with Treasury’s framework for debt issuance. In terms of financing the purchases, most dealers suggested that the necessary increases to matched-maturity on-the-run issuance sizes would not meaningfully affect the maturity distribution of the debt, would be manageable to auction, and would not materially erode the liquidity premia associated with on-the-run securities. On the size of a potential program focused on market liquidity, most advocated for scaling buybacks to help support liquidity in a typical market environment. Finally, dealers highlighted the importance of clear communication from Treasury about the goals and implementation details of any potential program.

What comes next:

The Committee asked about Treasury’s next steps regarding buybacks. Deputy Assistant Secretary Smith indicated that Treasury was still gathering information regarding the potential costs and benefits of buybacks under a variety of use cases, including liquidity support and cash and maturity management, and that Treasury had not yet made any decision about whether or how to implement a buyback program. The Committee thought it was prudent for Treasury to study this issue further.

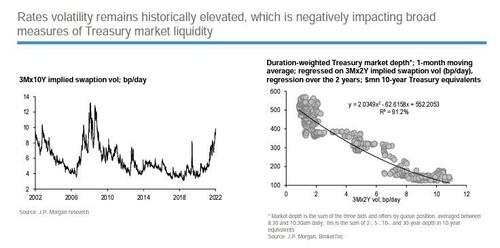

With liquidity in Treasuries this year collapsing as trading volumes and volatility surged in wake of the most aggressive pace of Fed tightening in decades, numerous strategists have said buying back so-called off-the-run securities – debt that’s no longer a current benchmark – might help improve trading conditions.

Buybacks aside, there were no surprises in terms of actual bond issuance in the coming refunding week, where – as expected – the US Treasury halted the longest string of cutbacks to its quarterly sales of longer-term debt in about eight years, showcasing the end of a period of historic reduction in the fiscal deficit.

A rapidly shrinking budget gap – thanks to the end of pandemic-relief spending and by an economic recovery that spurred record tax revenues – allowed the Treasury to reduce its so-called quarterly refunding auctions the past four times. But that is all changing fast, and the deteriorating fiscal outlook – and the coming recession – are contributing to a bump in estimated borrowing needs. And the Federal Reserve’s continuing runoff of its portfolio of Treasuries is forcing the government to issue more debt to the public. In fact, as the Treasury hinted at on Monday when it unveiled its latest Q4 debt Sources and Uses, it will need to issue $150BN more than previously expected…

… the consensus is quickly shifting to a “return to normalcy” and bigger TSY auctions now that we have troughed.

Specifically, the Treasury said it will sell $96BN of long-term securities at its the quarterly refunding auctions next week. This was in line with the August operation, (which was $98BN but after accounting for previously planned trims to two-year note sales). Dealers had correctly predicted an unchanged total. The refunding auction sizes are also unchanged from the most recent new issue or reopening. The Dec. 5-year TIPS reopening will increase by $1b while the Jan. 10-year TIPS new issue will be maintained.

Treasury to sell $40BN of 3-year notes on Nov. 8; unch from October

Treasury to sell $35BN of 10-year notes on Nov. 9; unch from October

Treasury to sell $21BN of 30-year bonds on Nov. 10; unch from the Aug refunding, and up $3BN from October

And visually:

According to the Treasury, this issuance will raise new cash from private investors of approximately $40.7 billion.

Reversing an earlier trend, the Treasury refrained from further cutbacks in the sales of 20-year bonds, which have struggled this year with dimmed levels of liquidity. Only a few dealers had predicted such a move, after past reductions of the maturity.

The $96BN refunding was smallest since May 2020, and compares with a peak of $126b first reached in Feb. 2021; auction sizes across the curve began rising in 2018 to finance tax cuts and surged in 2020 to finance federal pandemic response. However, over the past year, Treasury gradually decreased nominal coupon and FRN auction sizes “to better align issuance with forecasted borrowing needs.”

The Treasury said that it “believes that current issuance sizes leave it well-positioned to address a range of potential borrowing needs, and as such, does not anticipate making any changes to nominal coupon and FRN new issue or reopening auction sizes over the upcoming November 2022 – January 2023 quarter.”

Separately, Treasury Inflation-Protected Securities (TIPS) auctions during the quarter are projected to include a $15b 10-year second reopening in Nov., a $19b 5- year reopening in Dec. and a $17b 10-year new issue in Jan.

“Given Treasury’s desire to stabilize the share of TIPS as a percent of total marketable debt outstanding and continued robust demand, Treasury will continue to monitor TIPS market conditions and consider whether subsequent modest increases would be appropriate,” it said, noting that gross issuance of TIPS to increase by $14b in 2022 after $17b in 2021.

Buybacks aside, the TBAC said that regarding the request for public comment on additional post-trade data transparency on secondary-market transactions by Aug. 26, most comments received were “broadly supportive of efforts to incrementally increase” transparency, with differences of opinion on the appropriate pace and extent; dialogue will continue at Nov. 16 conference co-hosted by New York Fed and an inter-agency working group.

Elsewhere, the Treasury didn’t offer any update on when it expects the federal debt limit to become binding on its operations.

Finally, the TBAC also discussed the financing recommendations for the current and subsequent quarter. it noted that while near-term deficit estimates have increased somewhat, the T-bill share of outstanding debt is expected to remain near the lower end of the Committee’s recommended range. Primary dealer projections for issuance are reasonably consistent for FY 2023, though they vary significantly for FY 2024 given varied expectations on economic growth and the timing for SOMA run-off. The Committee said it “recommends maintaining auction sizes at current levels for this quarter and next. The Committee also recommends $1 billion increases in 5-year TIPS reopening in December.”

Overall, TBAC concluded that the recommended path of auction sizes for the current and next quarter should allow Treasury to meet its financing needs in an efficient manner while maintaining flexibility to accommodate further meaningful financing needs should they arise. Over a longer horizon, this issuance path is expected to:

keep the average maturity of Treasury debt and its average duration roughly unchanged;

leave the T-bill share of outstanding debt within the recommended 15% to 20% range;

and gradually increase the share of TIPS in outstanding debt.

In summary, the net new bill issuance over the next three months will be around $250 billion and another $300 billion in the first calendar quarter of 2023, or over $500 billion total which should – in theory – help mitigate the drawdown in reserves at the Fed as money funds buy them and switch out of RRP (so far that has not happened, as RRP balances remain unchanged at record highs, while reserves continue to tank).

That said, given the considerable uncertainty surrounding the economy and projected borrowing needs, TBAC said that “Treasury will need to retain flexibility in its approach”; the projection is also subject to the debt ceiling not being a binding constraint; but if it is, then Treasury can draw down some of its $596 billion in cash balance.

Tyler Durden

Wed, 11/02/2022 – 09:19