Here’s What The Fed May Say Today… And Three Things To Watch For

Earlier today we shared an extended preview of what the Fed may do both today – as a reminder, a 75bps rate hike is assured at 2pm – as well as in December and onward, where banks are split, with some expecting a 50bps “slowdown” in the pace of hiking, while others – such as Barclays and DB – expect the Fed to keep pressing on:

Bank of America: 75 bps, 50 bps

Barclays: 75 bps, 75 bps

Citigroup: 75 bps, 50 bps

Deutsche Bank: 75 bps, 75 bps

JPMorgan Chase: 75 bps, 50 bps

Goldman Sachs: 75 bps, 50 bps

Morgan Stanley: 75 bps, 50 bps

Wells Fargo: 75 bps, 50 bps

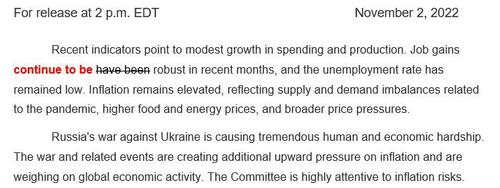

And while we said that it’s less important to the market what the Fed will say today, others disagree: as an example here is Bloomberg’s Ven Ram who breaks his proposed statement redline as follows, starting with the top where he expects only “cosmetic changes.”

Going down the statement, the BBG strategist notes that the key part will be changes to its third paragraph:

Scenario A:

If the Fed sticks to the current version of that paragraph, attention will turn to whether Chair Jerome Powell will acknowledge such a shift in his press conference.

Scenario B:

The Fed may, however, choose to explicitly acknowledge that it could be done with its jumbo increases for this cycle with a change along the following lines, which will send yields lower and stocks sharply higher:

There is also opportunity for dissent in the vote:

Statement aside, and since there is no SEP (projections) all traders get is the statement and the subsequent press conference, here are the three things traders can expect from today’s FOMC according to Ram:

Size of hike & explicit guidance:

The markets are well positioned for another 75-basis point increase, the fourth consecutive jumbo hike and probably the last for the cycle of such a magnitude, which means traders will be focused on what the Fed has to say about its intentions for December. Any explicit acknowledgment that the Fed is looking to slow the pace of its increases going forward in its statement will spur speculation of a lower terminal rate as an immediate reaction and cause front-end rates to rally.

Scope for dissent:

At least one or several members have seen a year-end Fed funds rate of 3.9% according to the latest dot plot, which will be met today if the Fed acts in line with market pricing. These participants would effectively seek a smaller hike of 50 basis points today and another of the same magnitude if they are still sticking with what they had penciled in just September.

Fed Kansas City President Esther George, who voted in favor of a smaller hike in June, may dissent again. The Fed should raise rates to a restrictive level while avoiding too much haste, which could “disrupt financial markets and the economy in a way that ultimately could be self-defeating,” she remarked last month.

Messaging from Powell:

In the absence of any explicit message in the statement about a slower pace of increases going forward, it is likely that Chair Jerome Powell will telegraph such an intent in his press conference. That wouldn’t, however, amount to a dovish pivot — it would merely align the Fed’s messaging with what is found in its dot plot, the median of which projects the year-end rate at 4.4%.

While Powell may concede ground on a slower pace of tightening, he is unlikely to budge on the level of the terminal rate he sees. With inflation many miles away from its 2% goal and the labor markets still tight, the Fed is unlikely to signal that it may be done early next year or even later for that matter. The message that Powell is likely to drum home is that the economy is losing momentum, but “we will do what it takes” to get inflation down and toward the Fed’s target.

More in our full preview earlier today.

Tyler Durden

Wed, 11/02/2022 – 13:00