FOMC Preview: Time To Step Off The Brake

As Goldman trader John Flood describes in his end-of-day market recap note (available to pro subs) the day on Goldman’s trading desk, “it was a 4 on 1 – 10 scale in terms of overall activity levels w/ most investors relatively frozen in terms of playing offense ahead of FOMC tomorrow.”

So with everyone frozen until 2pm tomorrow – and many could be very surprised if the Treasury announces some actionable news on Treasury buybacks during tomorrow’s 8:30am Refunding announcement which could spark a far bigger risk rally than Powell sounding modestly on the dovish side – here is a preview of what to expect: as we noted yesterday, a fourth successive 75bps rate hike has long been pretty much nailed down but the subsequent path of hikes is now up for grabs and will be the focus from this week’s meeting.

As DB’s Jim Reid wrote on Monday , “it feels inconceivable to us, given how spectacularly forward guidance has broken down across the global markets over the last 12 months, that Powell will try to guide too aggressively for December, especially with two payrolls (one this week) and two CPIs to come before they meet again.” In light of this, DB’s economists currently believe that 75bps is still likely in December, but that January could mark a downshift whilst still seeing upside risks to their terminal rate expectation of 5% given the recent inflation data and evidence that r-star has risen. Even WSJ Fed mouthpiece, Nick Timiraos, tweeted at the weekend “Consumers have a big cushion of savings. Corporations have lowered their debt-service costs. For the Fed, a more resilient private sector means that when it comes to rate rises, the peak or “terminal” policy rate may be higher than expected.”

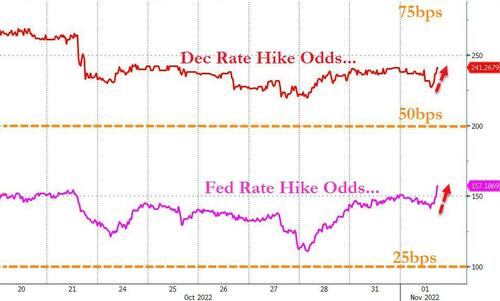

To be fair in his WSJ article that went viral 10 days ago he did mention that 2023 Fed forecasts could be upgraded. However the market mostly focused on the near-term downshift possibilities (that changed today because while tomorrow’s 75bps hike is a lock, the odds of a 75bps hike in Dec jumped today and the odds of a 50bps hike in Feb also jumped notably).

Over the weekend, Goldman came out with a slightly different scenario then DB: the bank’s economics team – which also expects a 75bps hike this week – had updated its terminal rate estimate to 4.75-5% in March, and sees hikes set for: 75bps in Nov, 50bps in Dec, 25bps in Feb, 25bps in March (with March here being the new add).

As Goldman’s Jan Hatzius wrote, there are three possible reasons why the FOMC could end up hiking past the February meeting, as the bank now expects:

First, inflation is likely to remain uncomfortably high for a while, which could make continuing to hike in small increments the path of least resistance.

Second, more rate hikes might be needed to keep the economy on a below-potential growth path now that the fiscal tightening has mostly run its course and real income is growing again.

Third, the FOMC might need to do more if a future pivot causes a premature easing of financial conditions.

(More details in the full note available to pro subscribers).

It is unclear which of these three possible routes might eventually lead the FOMC to tighten by more than it currently plans, but Goldman thinks “it is more likely than not that one of them will.” Goldman also updated its scenario analysis of possible Fed paths to reflect the bank’s revised baseline forecast: the average view (the green line on the right side of Exhibit 3) is now slightly higher than before and is roughly in line with market pricing for 2023 (the orange line on the right side of Exhibit 3), which has moved up more meaningfully since our last update a month ago.

What is notable in the Goldman forecast is the bank’s recent insistence that inflation will remain “uncomfortably high for a while” which could make hiking for longer than currently planned the path of least resistance.

We would discount this, for two reasons: i) it comes from the same bank which one year ago we mocked for “convincing” its clients every week that inflation would be transitory and ii) the coming recession will spark massive job losses which will far outweigh the adverse impact of higher inflation, as the growing complaints from the Bernies, Warrens and other democrats make clear.

Shifting away from Goldman, Morgan Stanley is more dovish, writing in its FOMC preview that it expects the Fed to increase the policy rate by an additional 50bp in December and 25bp in January, for a peak rate of 4.625%: “The Fed then holds rates there for an extended period until beginning to normalize policy with a 25bp decrease December 2023.” Some more from the MS preview:

With little doubt around the policy decision at hand, the focus of this meeting will be squarely on the signals the FOMC is sending around a possible step-down in the pace of rate hikes in December. Currently, the market is placing a 50% probably of a 75bp hike in December – giving the Fed full optionality to make a game time decision. There are multiple ways of signaling the possibility of a step down, largely related to acknowledging concerns around the extent of tightening already implemented. Most immediately, the paragraph on current conditions could include an observation that financial conditions have tightened, and the discussion of future policy moves could be softened from referencing “ongoing increases” in the future.

The FOMC statement may also add a reference to global financial conditions, reflecting concerns about the effects that interest rate hikes have had on the global financial system. “Watching closely” in this regard, similar to language used by Vice Chair Brainard in her speech on October 10, would send a very strong message that the committee will look to step down – should the data allow.

Decreasing the pace of tightening could appeal to both hawks and doves – slower rate hikes would better enable reaching a higher peak rate (hawks), and would also allow more time to respond to the incoming data (doves). Nevertheless, the Committee will not want to signal that a step down in the pace of rate hikes signals an earlier end to tightening or a lower peak rate, limiting the dovishness that markets may try to associate with the preference for a step down to a 50bp hike.

(More in the full note available to pro subscribers).

Next, Newsquawk summarizes the consensus view, noting that the Fed is expected to hike its target Fed Funds range by another 75bps to 3.75-4% (money markets have 75bps priced at a 98% probability) with a firm focus on the guidance and Powell’s presser as the FOMC looks to step down its pace of tightening approaching its expected terminal rate, roughly in the 4.5-5% area some time in May/June.

Ahead of the blackout, Fed insider Timiraos at the WSJ noted the FOMC is barreling towards a fourth straight 75bps hike in November, adding that the meeting could serve as a critical staging ground for future plans, including whether and how to step down to 50bps in December; Fed’s Daly also gave remarks calling on the need to step down the pace of tightening. Timiraos wrote, “Some officials are more eager to calibrate their rate setting to reduce the risk of overtightening. But they won’t want to dramatically loosen financial conditions if and when they hike by 50bps (instead of 75).

One possible solution would be for Fed officials to approve a half-point increase in December, while using their new economic projections [in Dec.] to show they might lift rates somewhat higher in 2023 than they projected last month.” Those concerns around loosening financial conditions will already be top of mind for the Fed given the spike higher in long-end inflation breakevens that have been accompanied by a pick-up in stock appetite, fall in Treasury yields, and a weakening Dollar seen in wake of the WSJ article, not to mention the dovish developments at the ECB and BoC which have only added to central bank ‘pivot’ pricing. As such, Powell will likely push back on the ‘pivot’ narrative at the November FOMC, and perhaps front-run the December SEPs in hinting towards a higher terminal rate than the 4.6% median dot in the September SEPs and stressing a “higher for longer” stance as a means to counter the dovish signalling of a reduction in the pace of hiking in the backdrop of little progress made on the inflation front.

Shifting away from these qualitative forecasts we next look at what JPM had to say, which is again on the quantitative side, and in keeping with previous scenario analyses (see “JPM’s Fed Day Scenario Analysis“, “JPMorgan’s Payrolls Scenario Analysis“, and “How To Trade The CPI: Scenario Analysis From JPMorgan“), JPMorgan trader Andrew Tyler writes that as he thinks about Fed scenarios, “consider that of the prior 6 meetings this year, markets have rallied into Fed Day on 3 occasions and sold off into the day on 3 occasions. Post-Fed Day, there is a similar hit rate with markets closing higher as of that Friday three times; and, by the next Wednesday markets have been up 3x and lower 3x. 2 weeks after the Fed, markets have been up 4 of 6 times; when they are up, the SPX is up and average of +4.1% vs. +1.3% across all 6 observations.” And since the hike for this meeting is known (75bps), and all that matters what hints Powell shares on the rate hike path, Tyler’s recommendation is to “keep an eye on terminal rate expectations; Friday we closed with terminal rate expectations of 4.90%” This number has since spiked back over 5% following today’s much hotter than expected JOLTS print.

Which is not to say that Powell can’t surprise: he can, and as the last two FOMCs showed, he certainly will if he wants to (that said, the question whether the Fed chief wants to crash markets one week before the midterms is also rather pertinent). Below are Tyler’s six scenarios for Wednesday’s FOMC:

50BPS HIKE; DOVISH PRESS CONFERENCE – of the scenarios, this is the least likely and the most bullish. It is difficult to conceive of a scenario where this outcome occurs given inflation levels and a tight labor market. Should this outcome occur, the immediate reaction could produce a double-digit 1-day return for Equities. The last time the SPX had such a strong 1-day return was in Oct 2008 when the SPX was +10.8% on Oct 28 and +11.6% on Oct 13. Given the low liquidity environment, this time the SPX is looking at +10% to +12%. Once again, this scenario would lead to the biggest stock market gain in 14 years.

50BPS HIKE; HAWKISH PRESS CONFERENCE – a slightly more likely scenario; this outcome could stem from a Fed that is increasingly concerns about financial stability as it balances growth and inflation. However, it seems far more likely that the Fed gets Fed Funds to 4% before they begin to balance their considerations. This outcome is still very bullish and the SPX would rally +4% to- +5%.

75BP HIKE; DOVISH PRESS CONFERENCE – this is second most probabilistic outcome in JPM’s view. While a stepdown from 75bps to 50bps is reflected in the DOTS, this is still a Fed that appears nervous about loosening financial conditions, of which Equity levels are an input, so a dovish press conference seems less likely than a hawkish one. If you saw the Fed give explicit guidance for the December meeting, then that is likely viewed as a dovish outcome. SPX jumps +2.5% to +3%.

75BP HIKE; HAWKISH PRESS CONFERENCE – this is the most likely outcome with Powell retaining optionality for December and 2023 meetings while emphasizing the current risks to inflation moving higher. Even with a hawkish press conference, we may see language suggesting that a stepdown from 75bps is coming, which softens the blow. This outcome feels like the one that is most expected by bond markets, so we may not see a significant move in yields which keeps Equities from melting down. SPX down 1% to up 0.5%.

100BPS HIKE; DOVISH PRESS CONFERENCE – given recent publications from WSJ, this outcome feels as unlikely as seeing a 50bps hike. Should this outcome occur, it may mean that the Fed both wants a higher terminal rate and that it wants to complete the tightening cycle this year. The Fed could do 100bps here and December, taking Fed Funds to the 5.00% – 5.25% level. Speaking with clients who invest in EM, this is lower range of where they think the Fed should take rates. Separately, the market may digest this move as the Fed having prior knowledge of where next week’s CPI prints; the previous CPI prints triggered a -4.3% day. In this scenario, the SPX falls 4% – 5%.

100BPS HIKE; HAWKISH PRESS CONFERENCE – this is the best outcome for bears or for Equity investors waiting for this latest rally to dissipate. This outcome likely ends this latest rally irrespective of what CPI does next week. Here this would seem to be a Fed reassessing its own inflation forecasts, which some investors feel is too optimistic. Here you likely see a significant selloff across all risk assets as bonds reset higher. This type of shock, especially when considering the WSJ articles, could see Equities retest YTD lows. SPX falls 6% to 8%.

To summarize visually, stocks could move… a lot.

While the above forecast may be just a tad ridiculous and extreme, another market-linked observation comes from Bespoke which notes that the ”S&P 500 once again finds itself lower between FOMC meetings, for 8th time in past 10 periods; current decline has been more modest than some historic drops (like 13% decline prior to June meeting).”

Since tomorrow’s statement will not contain any surprises – as noted above 75bps is a lock – we will skip a projected redline as most attention will be on Powell’s press conference comments, and instead remind readers of why the market has turned much more dovish in recent weeks: as Morgan Stanley economists note, they expect the Fed to prep for a step down in the pace of hikes at the upcoming FOMC meeting as hinted by recent Fedspeak quotes below which show that the Fed appears ready to ratchet down the hawkishness, especially as the Fed continues to believe in the idea that monetary policy works with “long and variable lags” (see quotes below).

Daly, October 21: A benchmark rate in range of 4.5%-5.0% is a ‘very reasonable estimate’ of how high rate needs to go…the time is now to start talking about stepping down, from the 75bp pace of hikes.

Harker, October 19: I expect we will be well above 4 percent by the end of the year. Sometime next year, we are going to stop hiking rates. At that point, I think we should hold at a restrictive rate for a while to let monetary policy do its work…If we have to, we can tighten further, based on the data.

Kashkari, October 19: My best guess right now is yes, do I think inflation is going to level out over the next few months, the services, the core inflation, and then that would position us some time next year to potentially pause.

Bullard, October 20: The goal is to move to some meaningfully restrictive level that will push inflation down. But it doesn’t mean that you go up forever

One final reason why it’s time for the Fed to turn dovish is growing liquidity concerns: as we have discussed extensively over the past few weeks, Treasury market liquidity has been challenged in recent months, there could be a question linked to the Fed’s role in supporting Treasury liquidity, especially with the backdrop of recent BoE intervention in Gilts. While changing QT or balance sheet policy in general has a very high bar, the Fed could be asked about regulations like the SLR, and the possibility of exempting Treasuries from SLR calculations. While few expect any announcements or new headlines from Chair Powell, it will be important to see what kind of guardrails, if any, the Fed wants to put around Treasury liquidity issues. An unexpectedly large hawkish surprise would lead to further fractures in Treasury market liquidity.

Much more details in the full FOMC previews available to pro subscribers, from DB (link), JPM (link), Goldman (link) and MS (link) and Newsquawk (link)

Tyler Durden

Tue, 11/01/2022 – 21:45