Spiking Rates And “Plummeting Affordability” Have Priced Low Income Homeowners Out Of The Market

Submitted by QTR’s Fringe Finance

Just days ago Zero Hedge reported that rent-controlled vacancies in New York City have soared. And it should also be no surprise that just yesterday they wrote about a mansion outside of Philadelphia that cost $35 million to build, but recently sold for just $9.26 million.

That’s because indications are that Philadelphia, like many other home markets in the northeast, is seeing ownership rates collapse. My friend, and Philly-based realtor Kira Mason wrote this past week about how the city’s affordability issue “just got a lot worse” relative to where it stands against other Northeastern cities. These are her thoughts.

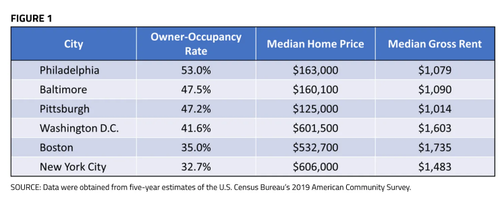

Philadelphia has long been praised for its affordability when compared with other cities in the Northeast. Due in large part to relatively low-cost housing and some very compelling grants and regional loan programs, it has a higher percentage of individuals living in homes that they own than do DC, New York City, Baltimore, Pittsburgh, and Boston. But despite higher levels of homeownership, a key element of wealth-building, over 23% of Philadelphians live below the poverty line (double the US average).

Homeownership is an important piece of keeping that number from getting even higher, and I fear and suspect that the shift taking place in the housing market today will further stratify a Philadelphia that is already starkly divided along class lines.

Even before interest rates made their historic jump above 7% this fall, homeownership numbers in our city had started to decline. In 2019, they were down almost 9% from their highest recorded level of 58.2% in 2006. Many will attribute this shift to developers outbidding first time buyers in Philadelphia’s most affordable neighborhoods. I saw this firsthand in 2020 and 2021; those of my buyers who had the biggest hurdles to overcome on their paths to home ownership were repeatedly losing bidding wars to investors, even when putting forth offers that were significantly above asking price with favorable non-monetary terms.

While wages remained stagnant between 2013 and 2021, Philadelphia’s median residential sales price rose a staggering 80%. If wages had grown at the same rate as did the median sales price, the annual income of the average Philadelphian would have been almost $112,000 in July of 2021: an insultingly far cry from reality.

While rates were at historic lows in 2020 and 2021, many lower income Philadelphians were able to become homeowners despite rising prices. Now that rates have spiked above 7%, plummeting affordability to its lowest level in 37 years, these buyers are the first to be ejected from the market. Fortunately there are programs available to help keep rates as low as possible for buyers from a range of financial circumstances, but even the most competitive interest rates these days can be a tough pill to swallow.

For buyers with lower incomes, Pennsylvania Housing Finance Agency (PHFA) loans or Fanny Mae’s HomeReady loans are often a good fit. For buyers dealing with lower credit, FHA plans are generally offered. All of the above help keep rates and terms as favorable as possible by today’s standards.

Get 50% off: If you enjoy this article, I would love to have you as a subscriber and can offer you 50% off for life: Get 50% off forever

Higher income buyers have the option of buying a lower priced home in order to keep their monthly payments within bounds. Lower income buyers are limited by the bottom bracket of available home prices, and are therefore liable to be priced out of the market completely. A buyer in spring of 2021 with a 2.8% rate with a 10% down payment on a $300k house would have had a monthly principal and interest of $1,609. Today, at 7%, their monthly payment would be $2,296- a 42% increase. Today’s affordability strain makes the members of this population who are able to remain in the market at all especially likely candidates for higher risk loan offerings like Adjustable Rate Mortgages (ARMs) and temporary rate buydowns (TBDs).

ARMs, which had their reputation as a risky loan product cemented with the housing crisis of ‘08, are seeing renewed demand. Buyers are rightfully suspect of these loans with the crisis in recent memory, but ARM applications are still on the rise. They now comprise about 12% of total mortgage applications, up from 3% at the start of the year. Though this is fairly low in absolute terms, the recent spike has brought ARM applications to their highest level since 2008: nothing to sniff at.

While ARMs are growing in popularity, the real engine behind the plodding forth of the entry level housing market, to whatever degree it is still doing so, are temporary rate buydowns. These are the ARMs of 2022, and though they are without a doubt a safer proposition, they are not without their risks. I haven’t seen a deep dive into all of their implications, so let’s get into it.

First, a definition: a temporary rate buydown (TBD) is a device in which a seller or builder pays the buyer’s lender to offer them a lower rate for a given number of years. The buyer him or herself is not permitted to contribute. Once the sale is consummated, monthly payments and their associated interest rates begin on a graduated schedule, rising annually until reverting to what they would have been had the buydown never been enacted. Like an adjustable rate mortgage, this gives the buyer the opportunity to pay a lower principal and interest for a period of time. Unlike an ARM, every month’s rate (and associated payment) is known in advance.

While the predictability of a temporary rate buydown makes it a safer bet than an ARM, the truth is that many buyers who opt for either of these programs are doing so with the intention of refinancing in the future. In either case, if home values drop significantly enough, they would be prevented from following through with any refinancing plans, leaving them to contend with either an unpredictable future rate (ARMs) or a higher-than-desired monthly payment (TBDs). Let’s say a home is purchased today for $325k at 5% down and the buyer makes use of a 2-1 temporary buydown. If they later want to refinance, homes in that range would need to appraise for at least $320k in order for the refinance package to work.

While concerning, it’s important to keep in mind that the presence or absence of a TBD cannot factor into a buyer’s loan eligibility. These loans are still underwritten at the base rate. If a buyer is prequalified for a loan of a given amount, their lender has determined that they are capable of paying off the loan with or without a temporary rate reduction. This offers some real stability, but I can’t help but see the danger of buyers wedging themselves into homes at the very tops of their budgets because they are enamored with those year one and two rates. I’ve often thought of maximum prequalification amounts as akin to credit card limits: just because someone says you can, doesn’t necessarily mean that you should. I always advise my buyers to purchase below their means if they can afford to do so.

Temporary buydowns are not a long term financial plan. They are a temporary solution that should be used with full understanding and caution. – Laura Corley, CrossCountry Mortgage

We’re on the brink of a recession, and if history repeats itself, the same population opting for TBDs and ARMs could also be the first to face layoffs. Many of these buyers expect to either make more money in the future or refinance their home if it appreciates normally. What if neither of these scenarios come to pass? We could find ourselves with today’s buyers underwater in the not-too-distant future.

Temporary buydowns have become a popular option because they appear to help everybody in what has proven to be an exceedingly (and increasingly) difficult market. They offer sellers higher net proceeds when compared with a price reduction that would result in an equal monthly payment for the buyer, they help buyers to manage soaring monthly housing costs, and they help real estate agents and mortgage lenders to continue transacting at a business-sustaining pace. Their full implications are yet to be seen. For now, we should be keeping as close of an eye on seller assist data as we do on home prices, especially as the homes that went under contract this and last month settle in November and December.

Almost everyone is feeling the pain of today’s viciously unhealthy housing market. Buyers who finance at all price points are getting sucker punched by high rates, cash buyers are still transacting on Philly homes that are 35% more expensive than they were three years ago, and anyone compelled to sell is often getting less than their neighbors did and waiting longer to get it. But many first timers and less financially solvent buyers are being forced to quit before they’ve even begun. I think we’re likely to see Philadelphia’s historically impressive homeownership rate take a serious hit in the years ahead, with potentially far-reaching consequences for the health of the city as a whole. Those who remain on the market should be advised to proceed with caution; all of us could benefit from revising our boomtime “consumption without consequence” mindset to better suit our impending reality.

—

You can share this post by clicking here: SHARE and you can subscribe to QTR’s Fringe Finance, free, here: SUBSCRIBE.

About Kira Mason

Kira is a realtor with Berkshire Hathaway Fox & Roach and The Kevin McGillicuddy Team, winner of the 2021 Chairman’s Circle award and ranked within the top 1% of the national Berkshire Hathaway HomeServices network. She independently won Homesnap’s “Fastest Growing Agent” award in 2021 and specializes in the purchase and sale of residential real estate in Philadelphia.

Kira runs the Substack Gritty City Real Estate, which you can read & follow free here and she is @kmasonrealtor on Twitter. She can be reached via e-mail at the address: contact@kiramasonrealtor.com.

Tyler Durden

Tue, 11/01/2022 – 13:20