Friday’s “Sucker-Punch” Rally & Wednesday’s ‘Elephant In The Room’ Event Risk

On Friday morning, SpotGamma warned traders to be on the lookout for a “sucker punch” rally over-stimulated by 0DTE flow, and markets were given a full-on “uppercut”.

Heavy 0DTE volume was once again showcased, with the largest volume strike being 100k 10/28 3900 calls. This is incredible given that the SPX opened at 3810! This 0DTE flow is pure leverage which serves to ramp the market higher.

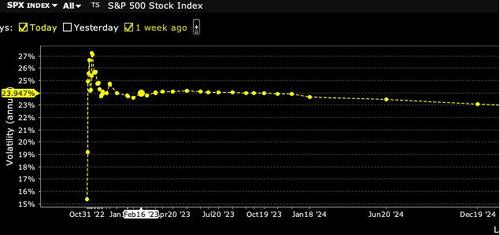

Additionally, as anticipated, we also saw IV get crushed, particularly ultra-short-dated (read: put-fuel for a rally). This very short dated IV crush was supplemented by the idea that the Fed is going to soften its stance on Wednesday. As shown below that short dated IV is quite low now relative to Wednesdays elevated levels.

SPX Vol term structure

All of which Friday saw the options complex higher slide higher, which is something we generally read as an options market acceptance of higher equity prices.

Of course, the elephant in the room is Wednesdays FOMC, which holds the fate of equities, and which Nomura’s Charlie McElligott warns the irony of the central bank “step-down” meme seen around the globe (RBA, BoC, ECB) in recent weeks – which has explosively rallied “financial assets” (both Risk-Assets and Sovy Bonds) – is that for the Fed, downshifting in say Dec from 75bps to 50bps and beyond actually allows them to extend-out the hikes longer…

…and in-fact, avoid the potentially of slamming breaks too hard, which would then elicit the Rate cuts which the STIRS market continues to hold onto for back half next year.

All of which can be seen in the chart below as despite the equity exuberance, STIRS are shifting notably hawkishly…

So said another way, “stepping-down” is, perversely, the Fed’s way of seeking-out an alternate path to actually avoid Rate CUTS next year from a “hard landing” accident…and instead, keeping Rates “high for longer”….hardly “rage bullish”.

However, equities are holding near this 3905 strike of the monthly Put Spread Collar which trades later today, where the Dealer is short 14k of said 3905 Puts, which meant a lot of $Delta bot on the Friday melt-up to said strike…BUT for today, if the market remains below strike (as we are again currently), the option will bleed from a 52 Delta to 100 Delta – leading to an incremental ~$2.6B of Delta to sell

But As McElligott notes, as we’ve seen in other short-squeezes and bear-mkt rallies this year, perhaps the largest reason we could keep rallying in Stocks this week is a somewhat counter-intuitve psychological / behavioral catalyst which is paired with exceedingly illiquid markets, meaning investors risk being “trapped in their under-positioning” into year-end, with less Dealer balance-sheet as they begin to protect PNL:

The idea is that as we have seen big “upside reversals” on seemingly “hawkish / bad news” days of late (e.g. the last CPI upside surprise day), is that IF you don’t begin to cover shorts and / or or buy-the-dip and “net up” exposure again into an actual “hawkish” Fed catalyst….then you are almost certainly going to be covering or “netting-up” exposures up another +6% to +10% from here on a (God-forbid) “DOVISH” Fed message

This is what could surprise – and hurt – the most this week, which could see us overshoot into that 4000 + SPX level which goes beyond the current “Valuation” rationalization of 17x’s $230 = 3910

However, the Nomura strategist warns to be careful what you wish for…

Frighteningly, EVERYBODY who is an Equities “bear” has now “built-in” my recent observation regarding the market’s recent reflexive “FCI easing” surge (US Dollar and Real Yields cratering lower, Credit Spreads tighter, Equities Vol and Skew smashed) as their justification for expecting a move LOWER in Stocks this week, following the recent central bank “step-down” trend—where Chair Powell and the Fed are forced to “push-back” on the recent easing in FCI, and instead, slam the door on premature pivot talk, as inflation / labor / wages continues to run hot

This gained further steam over the weekend with WSJ’ Timiraos tweet storming like crazy—and even appearing on “Face the Nation” Sunday—hammering a similar message: that financial conditions have actually EASED further both since last hike…but into stronger inflation, labor and wage data, and all as the US consumer holds excess household savings to continue and “cushion” against higher rates / higher inflation—“For the Fed, a more resilient private sector means that when it comes to rate hikes, the peak or “terminal” policy rate may be higher than expected”

Accordingly, the “right” outcome this week would be Fed / Powell HAMMERING a hawkish message to reverse this recent “impulse easing” in FCI, stocks trade lower and bonds selloff again, as there is no basis for “pivot / step-down” relief until the data softens meaningfully… because a reacceleration in “wealth creation” and “animal spirits” within US markets and economy would be extremely counter-productive to the “demand-side” inflation-killing needs of the FOMC.

It happened in June/July and Powell curb-stomped it…

Will it happened again?

Tyler Durden

Mon, 10/31/2022 – 12:12