Bonds Battered, Bitcoin Bid, But The Dow Soars To Best October Ever

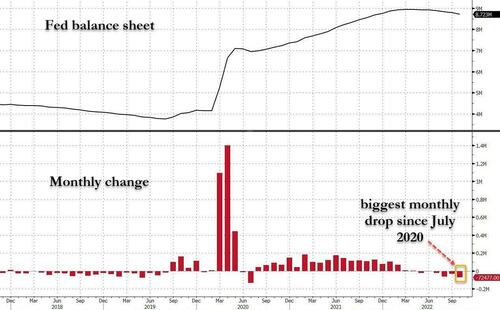

Treasury yields are up for 3 straight months, Gold is down in price for 7 straight months, and despite the biggest drop in The Fed’s balance sheet since July 2020, stocks soared…

Ugly sentiment signals from Chicago PMI and Dallas Fed this morning did not provide the normal ‘bad news is good news’ juice and short-term rates markets also shifted hawkishly ahead of this week’s FOMC meeting…

Source: Bloomberg

But on the month, the market appears to be pricing in a more aggressive hawkish fed followed by a more aggressive dovish Fed…

Source: Bloomberg

With 75bps locked in for Wednesday and the odds of 75bps in December also rising again…

Source: Bloomberg

But on the month, the big story is in stocks with The Dow smashing higher as Nasdaq underperformed…

It was the best monthly return for the Dow since Jan 1976 (+14.41%), the 2nd best month for The Dow since 1936, but the Best October for The Dow ever…

And we note that on the day, when The Treasury announced bigger than expected borrowing, bonds and stocks took a spill in the last hour today…

Source: Bloomberg

Treasuries tanked as stocks soared in October with the long-end significantly underperforming…

Source: Bloomberg

The 10Y yield wavered around 4.00% all month…

Source: Bloomberg

The 3m10Y yield spread finally inverted this month (though steepened back out today)…

Source: Bloomberg

The dollar ended the month very modestly lower (basically unchanged), despite a few wild swings during October…

Source: Bloomberg

The Brazilian Real interestingly rallied today after far-left Lula won the presidential election (after opening significantly weaker, as expected). Presumably some uncertainty reduced and the fact that a right-leaning parliament will basically gridlock any of his most ‘socialist’ extreme poliicies…

Source: Bloomberg

We do note also that this rip higher also filled the gap from the 24th, so don’t hold your breath.

Most of the crypto majors rallied in October with Ethereum notably outperforming Bitcoin…

Source: Bloomberg

The last week has seen ETH surge relative to BTC…

Source: Bloomberg

In commodity-land, crude prices managed strong gains but copper and precious metals were basically unch…

Oil prices fell on the day amid some notable volatility and Biden’s threats…

But NatGas was the big mover, ripping over 11% higher on the day amid cold weather fears…

Finally, bear in mind that we have seen this pattern of stocks ramping on ‘pivot/pause’ hope while STIRs continues to shift hawkishly before…

Source: Bloomberg

And it did not end well the last two times.

Tyler Durden

Mon, 10/31/2022 – 16:00