Credit Suisse Crashes Most Ever After Admitting It Suffered A Bank Run And Breached Liquidity Requirements

Two weeks ago, the NYT mocked “amateur investors” for piling up in a historic, “meme” short bet against the troubled Swiss bank Credit Suisse, which it argued was nowhere near as distressed as rumors suggested and when discussing the violent plunge in the stock price said that “the timing puzzled the bank’s analysts, major investors and risk managers. Credit Suisse had longstanding problems, but no sudden crisis or looming bankruptcy.”

Well, in retrospect it did, because as today’s shocking “radical overhaul” by Credit Suisse – which included massive layoffs, new equity injection, a strategic outside investors (apparently Saudi money talks and fake woke anger about Jamal Khashoggi walks), and a complete business restructuring – showed, the second largest Swiss Bank was indeed on the brink.

And it wasn’t just on the brink of insolvency: as Bloomberg today also reports, the (former) Swiss banking giant, was this close to a liquidity crisis too!

On Thursday, Credit Suisse said one or more of its units breached liquidity requirements this month when depositors pulled their money amid speculation about the lender’s turnaround plan.

Translation: the bank admits it suffered a bank run, something which the NYT shoudl have been reporting on instead of mocking all those who were shorting the bank to oblivion… and as we now learn, with justification.

According to a bank statement, the withdrawals were triggered by “negative press and social media coverage based on incorrect rumors” and made worse because the bank had limited its access to debt markets in the weeks before it unveiled its restructuring plan. Liquidity and funding ratios for the group as a whole have been maintained at all times.

But… but… how is it “incorrect rumors” if the Swiss bank ended up having a bank run, the very thing said rumors were warning about.

Circular sarcasm aside, we appreciate the bank’s “explanation” but if all it took to put a giant bank out of business was “negative press and social media coverage” then not a single bank would exist today. Which begs the question: why is Credit Suisse once again prevaricating, especially since it just admitted its entire former business model was just hours away from total collapse.

“These outflows have partially utilized liquidity buffers at the group level and legal entity level, and we have fallen below certain legal entity-level regulatory requirements,” the bank said.

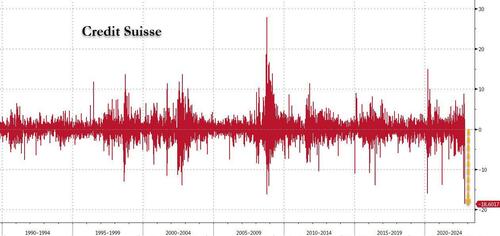

Sorry, bank, but if all it takes for your liquidity to fall below legal regulatory requirements are a few tweets, then you probably shouldn’t exist in the first place. Which, incidentally, is the hard lesson that those who believed the NYT and bought the stock – because, you see, it was all meme traders’ fault – are learning today: the Swiss stock just tumbled the most on record.

Tyler Durden

Thu, 10/27/2022 – 14:00