Institutions, Retail Investors Flood Back Into Stocks After Best Week In Months; Target FAAMG, Chinese Stocks

Maybe they got tired with sitting on their hands (and the proverbial “sidelines”) or have run out of stocks to sell (or short), but for whatever reason last week, when the S&P 500 soared +4.7%, its best week since June, both institutional and retail investors flooded back into the market at near record amounts.

According to Bank of America’s weekly Equity Client Flow Trend report (available to pro subs), clients were net buyers of US equities for the sixth straight week, with inflows into both stocks and ETFs. Buying was led by hedge fund clients; private clients were also buyers (for the fourth straight week). On the other end, institutional clients sold equities after buying for two weeks.

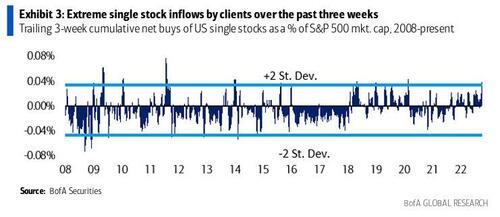

Some more details: over the last three weeks, inflows into single stocks (as a % of S&P 500 mkt. cap) were in the 99th percentile of history since ’08 and two standard deviations above average, and still in the 92nd percentile excluding corp. client buybacks.

This is notable because as BofA’s Jill Carey Hall notes, the prior times 3-week single stock flows as a % of mkt. cap were this extreme were followed by above-average S&P 500 returns over the subsequent 1/3/6/12 months (i.e. it’s not a contrary indicator). But as a caveat, BofA notes that while most prior instances of extreme (+2 st. dev.) inflows following the Global Financial Crisis typically were preceded by extreme (-1 st. dev.) outflows in the several months prior, this wasn’t the case this time. Separately, BofA also notes that cumulative inflows YTD have also been the most positive in series history.

Digging even deeper into the breakdown we find the following:

Clients bought stocks across seven of the 11 GICS sectors last week, led by Tech (fifth week of inflows), Health Care, and Communication Services (eighth week of inflows). Financials and Energy stocks saw the largest outflows.

In retrospect, clients should have been dumping Tech and buying Energy but after losing enough money, they’ll learn.

Notable shifts based on rolling 4-wk. avg. flows: Consumer Discretionary flows recently turned negative for the first time since April;

Meanwhile, Communication Services 4-wk. avg. inflows are at record highs; BofA’s work suggests the sector is still crowded and sees risk that Tech earnings may not be as defensive this downturn (case in point: today’s megacap devastation).

Also of note, buybacks have remained elevated (due to 10-b5 plans as most companies are in buyback blackout) and above typical seasonal trends since the start of Oct., suggesting corporates may be taking advantage of valuations amid the sell-off. According to BofA calculations, YTD client buybacks as a % of S&P 500 mkt. cap (0.19%) are above ’21 levels at this time (0.18%) but still below ‘19 levels at this time (0.30%).

But it’s not just institutions and corporations themselves buying (and buying back) stock: according to the latest Vanda Research note, one week after the stock research service found that retail investors were the most bearish since June, retail investorsare once again “aggressively buying” reporting companies.

This week, most of the purchases were concentrated in FAANGMT, with NFLX – which soared after earnings last week – in particular experiencing a surge in interest. And while institutions are still not brave enough to re-enter the space after the worst rout in history, retail investors – who like Pavlovian dogs just wait for a dip, any dip, the bigger the dip the better, to duy- flooded into Chinese ADRs which were among the most bought stocks as individual investors saw the sell-off as a buy-the-dip opportunity. And while retail flows remain largely in line with the YTD average, Vanda expects them to rise and reach late July levels (>US$ 1.5 bn x day) as the rebound consolidates.

Digging into the data, Vanda confirms what we noted above, namely that “the recent stock rally seems to be driven by a surge in institutional investors’ sentiment rather than by retail investors’ flows” although those are also on the rebound. One place this can be seen is in the premium traded by professional investors in call relative to put options, which is slowly reverting to bullish levels seen over the summer. And although retail investors’ trading of call options remains subdued, Vanda has already noticed an increase in OTM calls volumes mainly in reporting tech companies such as: GOOG, META, NFLX and MSFT.

One place where retail investors are again turning aggressive, is in their increasing purchases of FAANGMT stocks this week. The rolling monthly average inflows are close to US$ 300MM per day – in line with the late summer of 2020, during the AAPL and TSLA split (for reference, Goldman expects some $5BN in stock buybacks every day starting Friday through year-end). Although the most bought stocks remain TSLA and AAPL, META and NFLX also experienced a surge in interest. This is another trend that Vanda expects to continue over the coming weeks.

Narrowing down the tech universe of most popular stocks, Vanda notes that, in its view, retail investors’ bid for NFLX continues to be one of the major forces behind the stock’s outperformance. Indeed, having almost doubled in the past few months, NFLX has stock recovered almost all the losses accumulated since last April’s sell-off; the streaming company has outperformed the Nasdaq since then. Vanda suspects that the stock price is now supported by momentum flows which are not necessarily backed by stronger fundamentals.

What are the odds retail has another capitulation incident? According to Vanda, risk of retail capitulation recede as equities continue their grid higher. In similar style to May/June ’22 waning retail metrics marked what appears to be another local bottom in US indices. And as equities hold their advance this week, some of the typical retail purchase patterns show improvements at the margin (e.g., daily net flow, dip-buying intensity, breadth of stocks purchased). Nevertheless, the health of the average retail book remains fairly poor with average performance from peak still hovering around -33%.

But while retail investors have been aggressive in the US, one place they have gone absolutely hog wild is China: on Monday, retail investors’ purchases of the top China ADRs surpassed levels last saw during the Shanghai lockdowns earlier in March (net US$ +157mn). Alibaba, NIO and Pinduoduo were the biggest beneficiaries with US$ 92, 32 and 12mn of net flows, respectively, on the day. Unsurprisingly, BABA attracted close to 60% of retail inflows into China ADRs as it experienced its largest daily drop (-12.5%) since Christmas’ eve 2020 when China launched an antitrust investigation against the company. Still, despite this recent uptick in inflows Vanda don’t expect retail investors to become a driving force behind China ADRs in the near-term as volumes are still only a fraction of what markets witnessed in 2020-21.

One final observation: while retail investors have yet to make the return to crypto, they appear to already be chasing after other unloved assets, such as bond ETFs. The chart below clearly shows the stark change in retail behavior around purchases of Bond ETFs – from contrarian to momentum chasers. This may be the result of the Fed’s hawkish stance since the Jackson Hole symposium. In the months before the conference, retail investors appeared to be buying dips as a way to secure higher yields (and perhaps as a capital appreciation play as well). Since late August, however, the move higher in yields saw a coincidental collapse in bond ETF inflows as retail went through somewhat of a capitulation moment.

Recently Vanda also observed another interesting dichotomy – with significant flows into long-dated bond ETFs (US$ 73mn in TLT, TMF), matched by a significant increase in short-dated HY corporate bond ETFs flows (US$ +12mn in SHYG). It appears as though retail is positioning for a further flattening of the US yield curve, while trying to extract higher yields from short-dated junk bonds. While hardly market-moving (the sizes are tiny), retail moves in the bond markets offer some insights around some of the bearish pockets of the retail market.

Tyler Durden

Wed, 10/26/2022 – 14:20