China Stocks Crash As Xi Tightens Grip On Power

Shares in Chinese companies crashed Monday morning as traders were spooked by the consolidation of power by President Xi Jinping. After a weeklong Party Congress, Xi was confirmed for a third presidential term on Saturday.

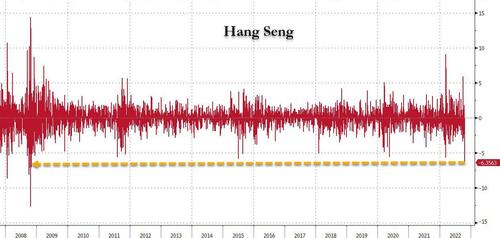

Traders fear more stringent regulations on technology companies pushing these stocks very deep into the red. The Hang Seng Index plunged to a 13-year low, dropping more than 1,000 points before closing around 15,180. The index saw a 6.4% drop, the most significant one-day drop since 2008.

The Hang Seng Tech Index dropped as much as 9%. The index is down more than 74% since peaking in 1Q21.

The offshore yen resumed its decline, tumbling by 1.3% – the biggest one-day slide since August 2019, to a record of 7.31.

China tech companies such as Alibaba and Tencent plummeted more than 11% in Asia. Internet search company Baidu closed down 12% while Meituan plunged 14%. BABA shares listed in the US are down more than 11%, trading at 2016 lows.

Nasdaq Golden Dragon China Index slumped 12%.

Downward press in Chinese stocks comes at the end of the 20th Chinese Communist Party Congress, which has solidified Xi’s third term, surpassing the historical precedent of a two-term limit and is now the longest leader since Mao Zedong. This has undoubtedly alarmed investors with more political uncertainty and regulatory headwinds.

“While Chinese politics have long been opaque, this sharp consolidation of power is adding to investor unease. Equity valuations, already near a 10-year trough, will likely face more pressure if international investors demand a higher risk premium,” Mark Haefele, CIO at UBS Global Wealth Management, said.

Xi’s consolidation of power also suggests an end to zero-Covid restrictions seemed less likely, while the latest economic data shows a weak recovery.

“Now that the new Politburo standing committee is packed with Xi’s own picks and those in rival factions … were all out, it becomes clear that no other political elite dares to challenge his policy mistakes or even deviate however slightly from his preferred policy agenda, which of course over the past few years has focused on favoring the state sector at the expense of the private one,” Xin Sun, senior lecturer in Chinese and East Asian business, at King’s College London, told CNBC via email.

Marvin Chen, a strategist at Bloomberg Intelligence, said after the leadership transition is finalized, traders will “focus on the economy and mending the property sector.” He said the property market is a fragile sector of the economy, adding, “still, these may take time. We may not see much change to Covid policies in the near term.”

The selloff in Chinese stocks is appealing to some investors though they said an inflection point of when to buy is still unknown. This was explained by Xiadong Bao, fund manager at Edmond de Rothschild Asset Management in Paris:

“A lot of bad news have been baked in and the market correction is clearly overshooting, but we’re still looking for an inflection point which is unclear for now.”

Besides leadership fears and a souring economic outlook, traders avoid Chinese stocks. One reason is because of the Biden administration’s economic war on Beijing. Then the Federal Reserve’s aggressive monetary tightening made emerging market equities unappealing.

“Foreigners are selling out of tech now,” said Hao Hong, partner and chief economist at Grow Investment Group. “Right now, except the historical precedents and cheap valuation, there is nothing working for Chinese tech.”

So with China stocks set for the most significant drop since the global financial crisis — traders and asset managers continue to shun these stocks as there are too many overhangs and not enough positive upside catalysts in the near term.

Tyler Durden

Mon, 10/24/2022 – 10:01