Big Tech Profits Set To Fall Most In Three Years

By Jeran Wittenstein, Bloomberg reporter and analyst

Once the key growth engines for the S&P 500 Index, megacap technology stocks are slated to enter this earnings season with diminished stature: profits are expected to fall by the most in at least three years. That’s a prospect that should frighten investors hoping for an end to this year’s bear market.

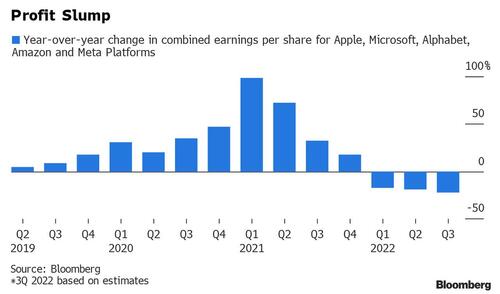

The five biggest firms by revenue among this cohort — Apple, Microsoft, Alphabet, Amazon.com and Meta Platforms — are mired in a profit slump, with earnings per share projected to fall 22% from the same quarter of 2021, data compiled by Bloomberg show.

After losing roughly $3 trillion in market value combined this year amid slowing economic growth and surging interest rates, the group’s weighting is around the lowest in more than two years. But it still accounts for about a fifth of the benchmark — more than the utilities, energy and consumer sectors combined.

That makes the tech giants as important as ever for the direction of the S&P 500. And with Wall Street analysts projecting that megacap tech profits will rebound in the year ahead, any signs of weakness in their forecasts means trouble for the broader market, according to Gina Martin Adams, chief equity strategist at Bloomberg Intelligence.

“The consensus still expects a relatively rapid recovery in fundamentals to emerge next year,” she said. “If the companies can’t confirm this forecast, this important segment of the S&P 500 may finally capitulate.”

Investors are on alert, she said, after Tesla Chief Executive Officer Elon Musk said last week that demand has been affected by downturns in China and Europe.

Microsoft and Alphabet will be the first to report, on Tuesday after markets close. Meta Platforms follows Wednesday and Apple and Amazon on Thursday.

The group is poised for the third consecutive quarter of falling profits, a stark contrast from the past two years, when the quintet consistently posted solid double-digit growth.

The headwinds have been relentless. The Biden administration is exploring the possibility of export controls that would limit China’s access to emerging technology that US tech firms are working on.

While S&P 500 and Nasdaq futures rose on Monday, the Hang Seng Tech Index dropped as much as 9.3% amid the risks posed by President Xi Jinping’s move to stack his leadership ranks with loyalists.

Meanwhile, Fed officials are expected to deliver a fourth straight three-quarter point hike next month to combat soaring inflation. Higher rates have punished tech-share valuations because they’re used to discount the present value of profits expected far in the future.

Tighter US monetary policy has also driven the dollar to the strongest levels in decades, denting earnings, especially for companies like Apple and Microsoft that derive a big chunk of sales overseas. The greenback has only strengthened since Microsoft warned in June that the currency’s surge would erode sales.

While valuation multiples have deflated from earlier this year, investors hardly appear eager to dive in. The ratio of long positions to short bets in megacap tech firms is lower than it’s been 98% of the time since 2018, JPMorgan Chase & Co. analysis shows.

“For some companies, given their balance-sheet strength and market positions, it is hard to imagine them continuing to see the declines they’ve already had,” said CJ Bangah, tech, media and telecom leader at PricewaterhouseCoopers. “However, there are other companies — especially ones that unduly benefited during the pandemic, when there was outsized growth and optimism about their strength — where I think we’ll continue to see weakness.”

Tyler Durden

Mon, 10/24/2022 – 09:05