After Xi’s ‘Crowning’, China ‘Surprises’ World With GDP Growth Beat; Yuan Slides

Having delayed the avalanche of macro data just ahead of the Party Congress (with no explanation), and having now ‘crowned’ Xi to his third term, it appears China is more than willing to share what data it decides the rest of the world needs to know now.

With just two minutes notice, China dumped everything from import/export data to GDP to unemployment at 2130ET… and it will likely surprise no one at all that the data was significantly better than expected (well you can’t start a third term on a down note can you?).

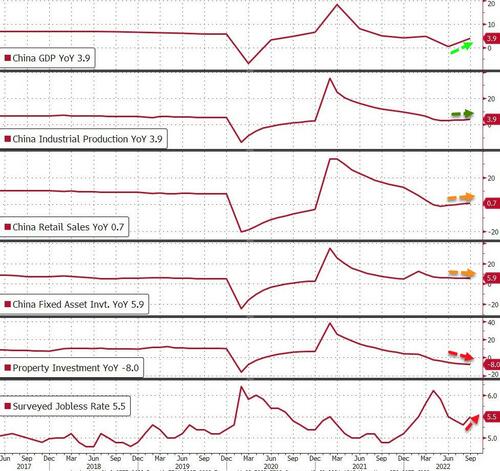

Chinese GDP grew 3.9% in Q3 – significantly better than the +3.3% expected – and far better than the +0.4% recorded in Q2.

Chinese Industrial Production also beat expectations in September (+6.3% YoY vs +4.8% exp)

However, Chinese Retail Sales disappointed in September (+2.5% YoY vs +3.0% YoY exp), as did Fixed Asset Investment (+5.9% YoU vs +6.0% exp) as Property Investment continued to plunge (-8.0% YoY).

Finally, the Surveyed Jobless Rate rose to 54.5% in September (youth unemployment ticked lower in the month, which is interesting given the increase in broader unemployment. Perhaps there are seasonal issues at play such as the new academic year).

And all of this in the face of major rolling lockdowns as Zero-COVID policies remain in place.

Additionally, in dollar terms, China imports and exports were better than expected:

China Sept. Exports Rise 5.7% Y/Y in Dollar Terms; Est. 4.0%

China Sept. Imports Rise 0.3% Y/Y in Dollar Terms; Est. 0.0%

Meanwhile real estate blues persist. New-home prices in 70 cities, excluding state-subsidized housing, dropped 0.28% last month from August as September residential property sales tumbled 15.3% YoY.

Offshore Yuan is falling on the news, despite yet another strong RMB Fix…

The data (and the Yuan slide) comes after significant changes at the top in China, which were not necessarily good for those hoping for a market-friendly government that’s keen on opening to the world.

Tyler Durden

Sun, 10/23/2022 – 22:30