Stocks Spike After WSJ ‘Fed Whisperer’ Hints At Pause/Pivot

WSJ Fed whisperer Nick Timiraos has set the narrative once again this morning, writing that while 75bps is a done deal for the November meeting, the FOMC discussion will be a “critical staging ground” for potential step down to 50bps in December.

The Fed is barreling towards a fourth straight 75-basis-point rate rise at the November FOMC meeting.

⁰That meeting could serve as a critical staging ground for future plans, including whether and how to step down to 50 basis points in December https://t.co/vPMSXDjHL8

— Nick Timiraos (@NickTimiraos) October 21, 2022

Simply put, Timiraos explains that some Fed officials want to discuss a slowing of the velocity of rate-hikes (to 50bps in Dec from 75bps exp) without triggering a stock market melt-up (and subsequent easing of financial conditions). So Timiraos’ report is a strawman meant to shake out the initial reactions and build the narrative that 50bps is still a significant hike…

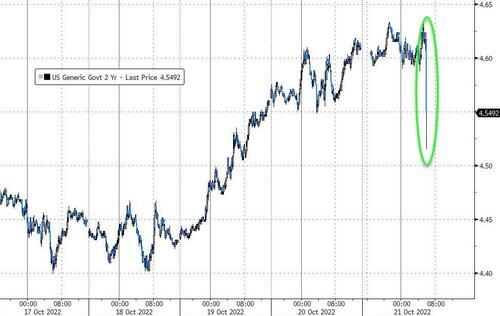

2Y Treasury yields reacted (dovishly) immediately to Timiraos’ comments…

And of course algos ramped stocks higher…

The problem is, Fed rate hike expectations shifted modestly lower but rate-cut hopes tightened suggesting this looks more like a ‘pause’ than a ‘pivot’ being priced in…

And the odds of hikes in Nov, Dec, and Feb remain high but have fallen on this report (8% odds of 100bps in Nov, 40% odds of 75bps in Dec, 45% odds of 50bps in Feb)…

More signaling… despite constant hawkish chatter this week from Fed speakers. However, the market seems to be interpreting this as a ‘pivot’ when it is very clear what is being discussed is a hike-and-hold, higher rates for longer.

Investors are anticipating a sequence of pivots, from a slowdown in rate rises to a stop in rate rises to rate cuts. “They keep jumping ahead to the last pivot, and we’re a long way from the Fed cutting rates,” said Kathy Bostjancic, chief U.S. economist at Oxford Economics.

“The equity market has been so eager to see pivots by the Fed,” she said.

“Fed officials have to explain that 50 basis points is still a meaningful increase.”

We give the last word to Minneapolis Fed President Neel Kashkari, who said Tuesday: “The problem for me with trying to say, ‘Hey, it’s time to pause,’ is we’re not even sure that we’ve got rates high enough to push services inflation down.”

Tyler Durden

Fri, 10/21/2022 – 09:17