Index Funds: A Bigger Slice Of The Pie

Submitted by Ryan Fitzmaurice of Marex

More money, more power

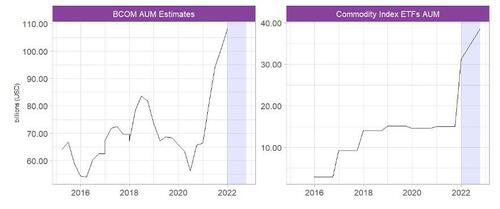

As regular readers will know, commodity index products have registered significant outflows since mid-June when the Fed started its aggressive hiking policy. However, it is important to understand that prior to then, commodity index products had witnessed a huge resurgence in investor interest on the back of soaring inflation, and what is quickly becoming stagflation. In fact, the net inflow into commodity index ETFs from January 2021 through May 2022 was an astounding +21 billion USD. However, since June, roughly -8 billion of that capital has been pulled out, leaving the net inflow since2021 at a still impressive +13 billion. So, despite the recent reversal in trend, investor capital allocated to index products is at or near the high end of history, and this is certainly true with respect to recent years. In fact, Bloomberg estimates that over 100 billion of capital is benchmarked to the BCOM index alone, as of the end of last year. Using this year’s commodity index ETF inflows and Assets Under Management (AUM) as a proxy, it is logical to assume that figure is even higher now. When considering the many other commodity indices that are out there, the total capital benchmarked to commodity indices is likely north of 200 billion, with some estimates much higher.

Leveraged funds vs real money

In terms of speculative money flows, index investors are just one piece of the pie, alongside CTA, risk-premia, fundamental discretionary, global macro, and other strategies. As we described here, index investors tend to be a distinct group of traders made up of real money players such as asset allocators, pension funds, endowments, and the like. On the other hand, most non-index strategies are usually associated with fast-money players or hedge funds. One key difference between the two groups is the use of leverage, with non-index funds typically using a large degree of leverage in their trading strategies while index investors allocate risk on a fully collateralized notional basis. For example, a hypothetical 100mm USD deployed in a non-index funds could be easily leveraged many times over given futures only require roughly 10% margin with spreads requiring even less. In contrast, the same 100mm invested in an index is done on a notional basis, and the capital not used by margin is invested in T-bills or other debt instruments. In that sense, non-index strategies tend to contribute much more to open interest levels given their use of leverage compared to index funds. So, despite the recent trend of capital leaving index funds, it is non-index funds that are largely responsible for the dramatic decrease in open interest since 2019, leaving index funds with a bigger piece of the speculative pie.

A Vol-constrained world

Another key distinction between index and non-index funds is their approach to position sizing. For index funds, demand for inflation protection and portfolio diversification are the key drivers of capital flows and ultimately position sizes. On the other hand, most non-index funds use one of many volatility-based methods to allocate risk such as Value-at-Risk

Why is this important?

Since June, the outflows from the index space have been significant in notional terms, but since these are non-leveraged investments, the number of futures contracts is less substantial than it may seem. As we explained, the massive reduction in open interest levels has come from non-index funds given their use of leverage and volatility-driven position sizing. Moreover, this year’s spike in market volatility will be filtering through risk models for at least the next year and potentially much longer given commodity markets are still contending with a slew of macro factors and poor liquidity. This means that open interest is likely to remain subdued from non-index funds who are constrained by volatility.

As a result, index funds are left with a much larger slice of the speculative pie and with that comes greater market influence. Furthermore, this is a trend we could even see exacerbated should index flows resume their upward trend given that inflation protection and portfolio diversification are likely to remain in high demand.

Looking forward, we believe it will be more important than ever to track index money flows and to understand index dynamics and strategies in order to successfully navigate today’s highly volatile commodity markets.

Tyler Durden

Fri, 10/21/2022 – 07:20