Watch Live: UK’s Liz Truss To Announce Resignation, Becomes Shortest-Tenured Post-War PM

Update: UK PM Truss is due to make a statement at 0830ET which Sky News is reportedly to resign…

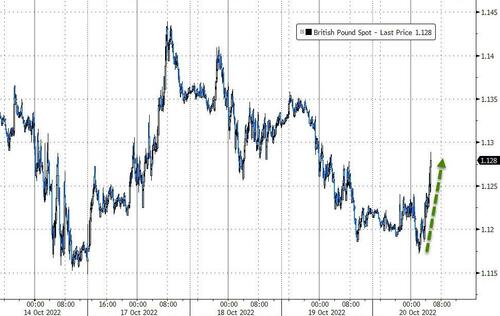

Cable is rallying ahead of it…

* * *

As Rabobank’s Michael Every noted this morning – It’s not dull, is it? An average Wednesday nowadays is a little like The Game of Thrones’ infamous Red Wedding.

“Any man who must say ‘I am the King’ is no true King.”

“We’ve had vicious kings and we’ve had idiot kings, but I don’t know if we’ve ever been cursed with a vicious idiot for a king.”

“Power resides where men believe it resides. It’s a trick; a shadow on the wall.”

In markets, all the initial attention was on inflation: in the UK a surge to 10.1% y-o-y; a slight rounding down in final Eurozone inflation to 9.9% y-o-y; and another jump in Canadian inflation to 6.9% y-o-y. The Fed also made clear that they see potential US GDP growth as much lower than where it sits now, which implies it is still overheating now, so rates need to be higher for longer. Bullard then reiterated our house view that rates will peak much higher than they are now in Q1 2023, and will only be readjusted slightly rather than being slashed back to ridiculously low levels again. As a result, bond yields soared, with the UK the rare exception. US 10s are now at 4.15%, the highest since 2008; Japanese 10s briefly breached their 0.25% target level (as JPY moves towards 150); German 10s are at 2.37%; and Aussie 10s at 4.07%. That’s what power looks like. Or rather a lack of power to prevent inflation.

Back to thrones though, as PM Truss’s government implodes further. Yesterday saw reports of MPs being physically manhandled to vote against their manifesto pledge to their constituents; suggestions the Chief and Deputy Chief Whip manhandling them had both resigned; and Home Secretary Braverman forced to go for sending a personal email(!), replaced by Schapps, who is loyal to the new eminence grise, Chancellor Hunt, and former PM candidate Sunak. It was also reported Defence Secretary Wallace, again floated as a possible new PM, stated he would resign too if Hunt slashed the defence budget, forcing a retreat there. Both as a Brit and a global strategist this a farce; a tragicomedy; embarrassing; and a coup by any other name.

Obviously it’s a political coup: resigning over an email in this day and age?! Braverman’s angry out-the-door letter made that clear, but at least contained rare dignity: “Pretending we haven’t made mistakes, carrying on as if everyone can’t see that we have made them, and hoping that things will magically come right is not serious politics. I have made a mistake; I accept responsibility; I resign.” How much those words need to be said by *many* others – especially the ones now grinning as they assume power again.

Any future portrayal of this drama on Netflix will surely show King Charles muttering “Oh, dear” as the Bank of England plots. After all, The Old Lady precipitated this political crisis by triggering the market crisis by saying now was the time to step back from QE, not all the previous times it had bought Gilts when the money was effectively thrown down the drain in terms of boosting the productive potential of the UK economy. For those who protest that hypothetical, consider that despite all that past QE, the UK is exactly where we find it now: deep in an emerging-market rut. The only logical defence to be made is either ‘Brexit’, in which case look at the mess in Europe, or that the UK would have been even worse off if the BOE had not done the QE it already did.

Worse, the cash-strapped UK Treasury is going to give the Bank of England £11bn to cover the operating losses made via QE! An institution that can literally print money is taking a sum of cash that could cover the cost of four aircraft carriers just when the UK needs to be building them. What will the BOE do with it? Nothing. It just needs it to maintain a balanced balance sheet. Which brings us back to the arguments about stable FX and what central banks’ true roles are within political economy.

Let’s be clear, ill-founded as Thatcherism on steroids was a proposed solution to the UK structural problems, at least Truss was trying something. What we get now is a return to guaranteed technocratic institutional failure – because that was what we all agreed we had in place before Covid. Someone thinking that way too is Bloomberg commentator @izakaminska, who tweets:

“This may suit you now because Liz wasn’t your cup of tea. Fine I get it. She wasn’t mine either. But all you have created is a precedent wherein no politician be they left, right, centre or populist will ever be able to wrestle power back from the markets. When the bond vigilantes + a shouty Twitter mob control political decision making (not politicians) we are basically in the hands of mob rule. The result will be the actual destruction of Britain.

Obviously bond markets matter. But the same bull-headed commitment to pleasing the markets regardless of how they hurt the people of Russia is what brought us Putin. Yeltsin’s commitment to shock therapy regardless of the domestic consequences is what killed democracy there.

Instead of a politician who has the actual guts to be political again (regardless of whether you like her politics, the point is you can vote her out right. That’s how democracy works) we have ended up with custodian PM who is basically there as the front man for the “markets”

We have disdain for Putin being under the thumb of the siloviki or Yeltsin the oligarchs, but that is precisely what we have in Jeremy Hunt. A man who will sell out Britain to please “the markets”. Great.”

The irony is that this is happening in the UK just as the global Game of Thrones is shifting elsewhere. As the Financial Times notes today, ‘Containing China is Biden’s explicit goal’. The article makes the point already underlined here, that despite the odd lack of market interest in the White House order to ban China from accessing US tech, the real economy and real world implications are staggering, and really geopolitical – of the aircraft carrier variety.

Likewise, US Republicans, even more hawkish on China, are making clear if they win next month’s mid-term elections –and they are strong favourites to do so– they will stop funding Ukraine’s fight against Russia. That’s as Putin declared martial law and economic mobilization in provinces neighbouring the newly-conquered territory to boost his war effort.

The implications for Ukraine are worrying, but they are not much better for Europe, which would either have a vast amount of military spending to do, both to support Ukraine and re-arm itself, or a lot of kow-towing and eating of very cold, bloody humble pie. (To be clear, it’s going to eat humble pie either way: the only issue is whose. Indeed, will the US keep supporting Europe is the next question to ask.) Such outcomes would shatter what remains of the technocratic view of how Europe operates, as we already see nationalisations, Covid-era subsidies for years to come, rationing, and talk of emergency measures on supply chains. Regardless, there are probably technocratic EU/ECB officials out there already planning how to rein in state spending so we can get interest rates back down again and please markets.

Let me conclude with a link and a quote from a rant from a furious UK Tory MP from last night: “I’ve had enough of talentless people putting their tick in the right box not because it’s in the national interest, but because it’s in their own personal interest.”

Tyler Durden

Thu, 10/20/2022 – 08:29