Price Pressures In This Cycle May Be A Lot Stickier

Authored by Bloomberg’s Ven Ram,

Quite a number of market observers expect inflation to be sticky.

There is news for them: recent prints on inflation from New Zealand and all the way across in Canada show that price pressures in this cycle may be a lot stickier.

Which is why it’s hard to see a silver lining yet for shorter-maturity bonds, including Treasuries.

Earlier in the week, third-quarter readings out of Auckland showed that consumer prices rose 2.2%, a full 50 basis points higher than in the prior period.

Economists were actually expecting inflation to slow.

Over in Canada, consumer prices rose 6.9% last month, more than the median estimate.

What may be surprising about those numbers is that they came despite a decline in gasoline prices, so what is on display is essentially the second-round effects of inflation, which are hard to shake off once entrenched. It’s the natural instinct of economic participants to pass on rising fuel costs to consumers, but I have never heard of a trucker rolling back his earlier price increase because, you know what, crude prices have fallen.

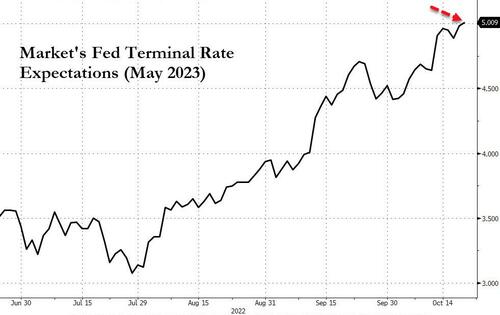

Prints like those in recent months from across the developed world have spurred investors to keep pushing estimates for terminal rates in their respective economies successively higher.

In the US, the Fed’s own dot plot at the end of last year showed a peak rate of 2.1%. By March this year, that estimate had climbed to 2.8%, which was subsequently lifted to 3.8% and then to 4.6% last month. The markets, meanwhile, are pricing in a rate circa 5%. Just one year ago, had someone mentioned a 5% Fed funds rate, they would probably have been laughed out of the room.

And yet each passing print in the economy is threatening to push us from a world that was awash with negative rates just a couple of years ago to one of not just low positive interest rates but one where 5%+ is now conversation du jour.

With the Fed yet to see tangible results for all its tightening so far, the risks are skewed toward the monetary authority raising rates higher and higher to engineer an alignment of demand with supply. That only means front-end Treasury yields climbing to levels many of the younger traders may have never dealt with.

Tyler Durden

Thu, 10/20/2022 – 10:32