The Wall Of Worry Knows No Bounds

By Peter Tchir, chief macro strategist at Academy Securities

The Wall of Worry Knows No Bounds

There is no shortage of risks for markets and companies to worry about right now. Today’s T-Report will be short because some of these things have been discussed lately:

Top Secret – Russia’s Nuclear Threat. Markets had a brief respite as stories about potential talks between Russia and possible intermediaries to Ukraine circulated, but those faded by the end of the week as Putin (and increasingly Belarus) stuck to the hardline approach.

For Your Eyes Only – OPEC+. The more I think about this report, the more concerned I am that we’ve bled our strategic reserves to very low (if not precarious) levels when there remains so much uncertainty around Russia, the Middle East, and Venezuela. The only place with “certainty” seems to be domestically where the energy industry still seems to be under attack rather than encouraged.

The Defense of Taiwan. We haven’t completed the trilogy yet, as we will wait for what comes out of China this weekend, but if Xi mentions reunification in a major way, it is yet another thing for markets to worry about.

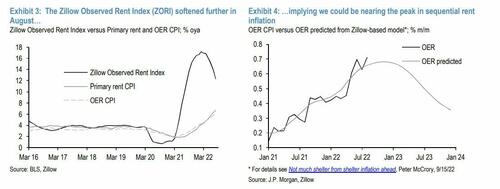

The other reason today’s T-Report will be short is because I’m undergoing Clockwork Orange style reprogramming to accept that housing inflation is running at the hottest levels it has been in 3 decades according to CPI!

OER Seems Crazy. I cannot come to grips with using data that seems nonsensical to determine policy. There are many explanations as to why it lags (in addition to potential calculation biases), but that just makes it explainable (i.e., still not sensical). Scientists wouldn’t let bad, or inaccurate, or stale data affect their analysis, so why should economists? As you can tell, at the time of this writing, the shock therapy isn’t working well.

But as scary as nuclear war, oil shortages, deteriorating relationships across the Middle East, and the risk to Taiwan is, they barely form the foundation of the current wall of worry!

I’ve Lost Track of What to Worry About in the U.K.

I’ve literally lost track of the narrative around why the U.K. is a huge problem.

Corporate Taxes! Remember that line from the original Wall Street movie – “Your boy really did his homework, Fox. And you’ll have the shortest executive career since that Pope that got poisoned.” Well, even Bud Fox might feel sorry for Kwasi Kwarteng.

Limited “whatever it takes.” Draghi turned an entire continent around when he uttered “whatever it takes,” even though he had little (if anything) ready to back it up. “Whatever it takes” with the present deadlines and likely limited resources isn’t really “whatever it takes,” even adjusting for the British sense of humor.

LDI. Overleveraged is still overleveraged even if you try and give it a fancy new name, though LSS (Leveraged Super Senior) and CPDO (Constant Proportion Debt Obligation) were still more interesting than LDI, and far more damaging.

I’m not sure what is left for the U.K. to do, but the one takeaway that we cannot forget is that we have witnessed a top 10 country (with a developed economy and a seasoned bond market) succumb to complete disarray!

That loss of faith in such a major market is concerning as it begs the question of “could it happen here”? To that, I have two things that I feel the need to point out:

Could we see a “failed” German bund auction? The mechanics for U.S. Treasury auctions are very different than how German government bund auctions are managed. I vaguely remember that there has been concern about this in the past, and given what has gone on in England, it is yet another worry.

Maslow’s Hierarchy of a Credit Bubble. I need to update the chart, but one thing that I argue in this report is that any Financial Crisis Starts with “Safe” Assets. It seems paradoxical at first, but it is how and where “safe” assets are used that ensures that when they crack, calamity will ensue. From the S&L crisis, to Russia/LTCM, to WorldCom/Enron, to AAA MBS and Greece, the biggest problems come when safe assets are no longer deemed safe. While I’m not alarmed about sovereign debt, it made its way onto my crisis bingo card in a hurry after the U.K.’s cracks were highlighted.

Weekly and Daily Options Give CDS a Good Name

Despite starting my Wall Street career as a credit derivatives structurer (they weren’t traded enough back in the day to warrant being called a trader), many people, including some still on this distribution list, like to tell me that Credit Default Swaps were the worst invention ever on Wall Street. That says a lot. The combination of gamma, low liquidity, and stop losses (Trader of the Year Awards) seems to determine not just how any given day normally trades, but as we saw on Thursday of last week, these things can also fuel massive intraday moves (i.e., the 6% swing in the Nasdaq from high to low).

CDS may be bad (I beg to differ), but a lot of people are noticing and complaining about these products and the impact they are having on markets.

The Data

At this point:

I’m not sure how to predict next week’s data at all.

More importantly, I’m not sure I’d pay good money to know the data in advance. This is because I’m not sure how markets will respond given positioning, options, and the wide array of data and news that is impacting markets.

I continue to believe that:

QT is a drag and FX is increasingly a problem not just for corporations, but for investors of all stripes as they revisit the cost of hedging dollar denominated assets back to their own currency.

Inventories are a Major Problem. It will be interesting to see if various sales, such as early Prime, will clear excess inventory or not.

Data should weaken over time.

The messaging that we are getting on earnings calls is key to inferring where the economy is headed.

Stagflation is NOT a Stable State in an economy such as ours. Though I guess if you compare old data with new data, it is possible to have one show inflation and the other show recession.

Cracks are appearing and we need to be “ready” for new hits. Cracks tend to expose more cracks.

Bottom Line

If it seems like I’m mentioning a lot of 2007 and 2008 terms, it is because I am. This market and the global economy seem fragile to me. On the other hand, Wall Street traditionally has to climb a wall of worry, and since this wall knows no bounds, it might be time to put on that climbing gear!

It is a bit nerve wracking that there is some evidence that positioning isn’t as negative as sentiment (i.e., it might be “cool” to sound bearish, but positioning hasn’t caught up). I’m not sure I buy that argument, but it is in the back of my mind.

I’ve also been on the Darkest Before the Dawn view since the start of October. Weirdly, the S&P 500 is violently unchanged since then! It closed at 3,585 on the 30th and 3,583 on Friday. There have been so many opportunities to be right or wrong since then that the “darkest before the dawn” call seems wrong, but it’s actually been ok.

The bet, for better or worse, is that the market will either price in a pivot or a soft landing, or it will decide that it has already priced in too many negatives (in conjunction with QT and Fed hiking) and rally. Options will help. Then we can worry about my bigger fear which is the dreaded hard landing.

The only strategy worse than “hope” might be “climbing the wall of worry” but I like it for now, caveated by the guiding principles of late:

Be small.

Be nimble.

Use options as much as reasonably possible (when vol isn’t prohibitive).

There were signs last week (at least until Friday) that we could climb that wall of worry and I think that we will see more of that this week!

Tyler Durden

Sun, 10/16/2022 – 17:30