This Is The Worst Run For ‘Dip-Buyers’ Since Greenspan Unleashed The ‘Fed Put’

“Buy the dip” has been an American tradition since 1987. The first truly modern global financial crisis unfolded in the autumn of that year. October 19, 1987, has become the day known infamously as “Black Monday. It set forth a chain reaction of market distress that sent global stock exchanges plummeting in a matter of hours. In the United States, the Dow Jones Industrial Average (DJIA) dropped 22.6 percent in a single trading session. This loss remains the largest one-day stock market decline in history and marks the sharpest market downturn in the United States since the Great Depression.

That is when, Alan Greenspan, then Federal Reserve chairman, came forward on October 20, 1987, with a statement that would shape traders’ actions for decades. Fed Chairman Alan Greenspan said,

“The Federal Reserve, consistent with its responsibilities as the Nation’s central bank, affirmed today its readiness to serve as a source of liquidity to support the economic and financial system.”

Prior to this markets were seen as a much riskier venture. The great legacy from the events taking place in 1987 is rooted in the actions and swift response of the Fed, that the central bank would backstop markets.

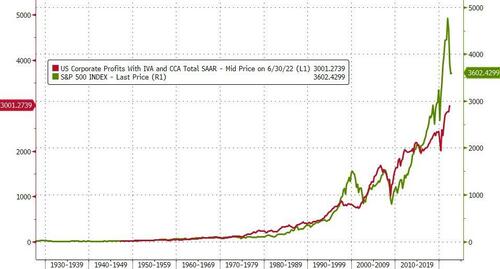

This premise has grown over time with a Fed Put supporting dip-buyers for the last decade or more… and enabled the vast decoupling between current valuations and underlying fundamentals.

It became a mantra…

However, as Bloomberg’s Elena Pipina reports, employing a dip-buying strategy has been a losing one all year, with a steady stock-market decline since January steamrolling any impulse of optimism.

The danger of trying to catch the bottom in the current environment has been on display all year, but it’s getting particularly painful now.

The buy-the-dip strategy, which relies on the stock market’s ability to bounce back from drawdowns, is having its worst run since 1991, data compiled by Barclays Plc show.

A meaningful turnaround will likely require conviction that central-bank hawkishness has already peaked, a line of thinking that some deem as wishful.

“In terms of psychology, you can point to all those sentiment surveys which have been washed out almost from the beginning of the first decline,” said Doug Ramsey, chief investment officer at The Leuthold Group.

“Four, five cycles we’ve been through this, and people are looking for new and imaginary ways to detect a breadth thrust.”

In fact, as Bespoke notes, the only year since the 5-trading day week started that has seen a higher percentage of down days was 1974…

The reason we bring this up is simple – tomorrow’s CPI print is likely to be pitched as the next ‘buy the dip’ opportunity.

However, while history is an unreliable guide, prior inflation-day sessions have been rough for equity bulls, with the S&P 500 falling in seven of the nine instances this year…

Consensus expects to see inflation increase 8.1% from a year ago in September. Anything above the prior reading of 8.3% could put the stock market at risk of a quick 5% tumble, according to JPMorgan’s trading desk.

As SpotGamma notes, since the October monthly OPEX deltas are fairly large, there is plenty of fuel to extend the CPI reaction to a large 5% rally, or push us down to the 3500 Put Wall. The key insight here is this CPI trigger will spark a multi-session directional trend into October OPEX.

Recall that headlines matter more in large negative gamma regimes, where algos spark an initial reaction which is reinforced by options hedging flows.

After October OPEX we arrive to another window of catalysts including various global central bank meetings, an FOMC and US midterm elections. Therefore we view the CPI reaction as fairly limited in duration (i.e. into Oct OPEX).

Tyler Durden

Wed, 10/12/2022 – 13:46