Goodbye TINA – Hello BAAA

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

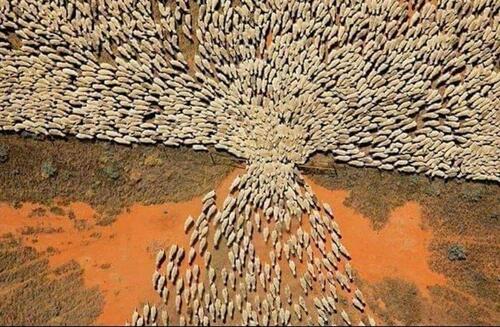

Sheep are timid, nervous, and easily frightened animals. For similar reasons, some fixed-income investors are often described as sheepish. Investing sheep get anxious about stock market volatility and are worried when economic, financial, and geopolitical risks increase. With stock valuations still high and bond yields respectable, it may be time to say goodbye to TINA and listen to the bond sheep crying BAAA.

The popular Wall Street acronym of the last decade is TINA– There Is No Alternative. TINA implied there was no alternative to holding stocks since bond yields were so low. Before this year, the limited upside in bond prices and meager yields made it tough to argue against TINA.

The bond market sheep are now speaking up and saying BAAA. With U.S. Treasury yields around 4% and corporate bonds yields even higher, we might want to consider BAAA– Bonds Are An Alternative.

To help appreciate BAAA, we share the expected returns of stocks and bonds. The analysis will help you decide if the bond sheep are on to something.

Expected Returns

Computing expected returns for bonds is simple; look at the yield. If a ten-year bond yields 4%, then barring a default, an investor will earn 4% annually for ten years.

Future stock returns are unknown. However, we can use valuation ratios and statistics to establish a range of expected results. It is often said that trading on valuations is difficult. That is because, over short periods, there is no correlation between valuations and returns. But, over more extended periods, valuations are excellent barometers of future returns.

For instance, the graph below from John Hussman (2014) highlights how well eight different valuation ratios predicted returns for the subsequent ten-year periods. The difficulty in spotting the actual ten returns in the graph, amongst the predictions for said returns, tells you how meaningful valuations are as predictors of long-term returns.

Given the strong correlation between valuations and long-term stock returns, we share a few graphs to help form expectations on what the next ten years may hold for stocks. This allows us to compare them to Treasury and investment-grade corporate bond alternatives.

Valuations and Returns

The following scatter plots compare three valuation ratios and the subsequent ten-year total return (dividends included) on the S&P 500. The data points represent each quarter’s valuation and subsequent return. The circle highlights where the valuation is today. The intersection of the circle and trend line marks the ten-year annualized return expectation. The valuation ratio (x-axis) is not the actual ratio but the ratio measured in standard deviation from the average. This method helps better compare the three valuations.

As shown below, the three valuation ratios provide an expected range of +5% to -2.5% annualized total returns.

Stock Expectations vs. Bond Yields

Before comparing expected stock returns and current bond yields, it’s worth contemplating that a stock investor should demand a return premium versus bond yields. The premium accounts for taking on more price and return volatility and additional risks. Since 1950 investors have earned, on average, a 5.53% total return premium for owning stocks over bonds.

As we share below, an investor can buy a ten-year U.S. Treasury note at 3.95%, which is better than the average of the three expected stock returns. Further, an investor can take some credit risk and earn nearly 6% on investment-grade corporate bonds. Doing so would easily beat expectations for stock returns.

Expected stock returns are on par with risk-free Treasury yields but woefully below the premium spread investors should demand. The simple conclusion is that for the entirety of the next ten years, bonds are the better bet.

Pervalle Also Says BAAA

To gain further evidence for our theory, we share a graph from Teddy Vallee, founder of Pervalle Global. His chart below compares the return of the price ratio of the S&P 500 (SPY) to 20-year UST Bonds (TLT) versus the average of the S&P 500 dividend yield and earnings yield less the thirty-year U.S. Treasury yield. If the strong correlation holds, bonds (TLT) may significantly outperform stocks (SPY) over the next two years.

Per Teddy Vallee: “The regression implies a negative return for stocks relative to bonds 2 years out.“

Cycles Say BAAA

To further back up our relative return expectations, we present another graph. The chart below plots the running ten-year excess returns of stocks versus bonds. To calculate the excess return, we compare the prior ten-year stock total return and the prevailing ten-year UST yield at the start of the ten-year period.

Excess returns are cyclical. Periods of solid excess returns are often followed by periods with lower or negative excess returns. In November 2021, the ten-year excess return peaked at 14.21%, the second-highest level in over 110 years. The odds are future excess returns will pale in comparison.

Summary

Bond sheep have a voice for the first time in a long time. No one knows what the future holds, but the cry of BAAA is undoubtedly more tempting than the worn-out battle cry of TINA!

Tyler Durden

Wed, 10/12/2022 – 10:45