Structurally Higher Rates Await UK After Credibility “Shattered”

By Simon White, Bloomberg Markets Live reporter and strategist

The UK has lost both fiscal and now monetary credibility, increasing the risk of structurally higher inflation and rates.

The UK’s fiscal credibility was lost, or severely compromised, late last month with the botched announcement of the new government’s fiscal plan. The market reaction lit the fuse for the unwind of LDI funds, inherently short-volatility structures that have triggered asset sales for collateral calls as higher rates push receiver interest-rate swaps more out of the money.

The disorderly unwind of positions threatened to upend the whole market, prompting the BOE to announce a temporary gilt-buying operation right at the time it was supposed to be shrinking its balance sheet.

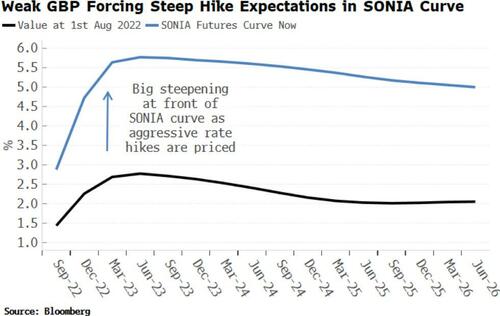

Still, it was too little late. Gilt yields continued to rise yesterday, prompting the BOE to announce today it would add inflation-linked bonds to its emergency purchases. As I write, yields are off their highs, but this piecemeal, incremental approach has not been sweeping enough to conclusively cap yields. Moreover, short-term rates have also increased quickly, which has imminent consequences for the mortgage market.

Both the fiscal and monetary authorities have squandered their credibility. The implications are considerable.

When investors do not believe the government has a credible plan to reduce the debt burden, tighter monetary policy can actually increase inflation expectations. Tighter policy squeezes growth, raising the debt-to-GDP ratio. Investors perceive the government will try to inflate this away, and so inflation expectations rise.

This is amplified by a loss of monetary credibility. If investors do not believe the BOE can credibly tighten policy as it has to backstop the bond market indefinitely, then the bank may find itself in the situation of owning ever more of the gilt market, increasing financial risks and elevating long-term inflation expectations.

The UK’s vast twin deficit means credibility is of paramount importance: foreigners have no need to buy your debt, especially when your currency’s use as a reserve asset is dwindling (sterling has fallen to about 3% of global reserve assets). If the BOE proceeds with QT next month, problems will multiply, with Royal Bank of Canada expecting a spike in gilt issuance next year. Financial repression is a mounting risk in the UK, as captive buyers are sought for government debt.

Shattered credibility means inflation expectations will remain elevated, embedding themselves into structurally higher rates. Credibility is slow to build, and quick to be lost: do not expect the UK’s fortunes to turn around any time soon.

Tyler Durden

Tue, 10/11/2022 – 10:25