Credit Market Cracks Start To Appear As Three Companies Sideline Investment Grade Bond Sales

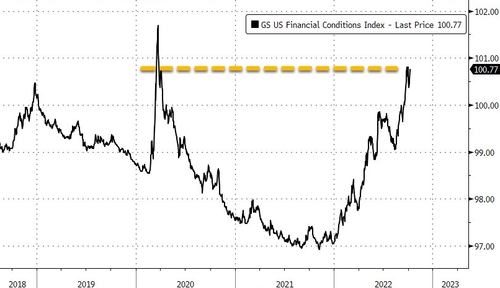

US financial conditions have tightened considerably this year and are near Covid highs as the soaring dollar and deepening yield curve inversions suggest the Federal Reserve’s aggressive tightening campaign might trigger a recession. Cross-asset volatility has crept into credit markets and spooked players in the US corporate bond market this week ahead of key economic data points.

Bloomberg said an informal survey of corporate bond dealers revealed three companies looking to sell bonds into the US investment-grade primary market were sidelined due to tighter financial conditions. Dealers wouldn’t say which companies stood down as volatility is expected to jump around the US Producer Price Index data release tomorrow and Consumer Price Index report the next day. Some companies are writing this week off and waiting until next week to get more clarity on the corporate bond market after the data points, which would be a vital indication of the Fed’s intensity to hike interest rates next month.

Instead, companies chose to hold off, raising the possibility that there will be very few or even no sales this week. Overnight, we heard of a couple of Yankee issuers opting to move their deals to next week based on the fragility of the credit markets and overall weaker tone overseas.

Borrowers are understandably nervous to sell fresh bonds with so many uncertainties facing the global economy, most notably the path of monetary policy tightening as central banks try to tame inflation. –Bloomberg

Bloomberg added: “Yankee issuers were anticipated to take the reigns this week but it appears most potential borrowers are running far away from the primary market at the moment.”

Financial conditions are moving higher with the Fed’s policy goals of taming the worst inflation in decades and have yet to trigger signs of dysfunction in corporate debt markets.

The US high-grade CDX, a key measure of perceived credit risk, just recently hit a new year-to-date high.

However, signs of stress are emerging on the Fed’s investment grade corporate bond market distress indicator (CMDI).

Remember what JPMorgan Chase CEO Jamie Dimon predicted Monday: US recession next year and “panic” in credit markets that could lead to another 20% decline in the value of stocks.

“The likely place you’re gonna see more of a crack and maybe a little bit more of a panic is in credit markets,” Dimon warned.

The question remains if what we’re seeing now is some of the first cracks emerging…

Tyler Durden

Tue, 10/11/2022 – 14:45