The $31 Trillion Dollar Question – Can The Fed Afford To Pivot?

Authored by Tom Luongo via Gold, Goats, ‘n Guns blog,

In my other role as a secret apologist for Russia and Vladimir Putin, I was contacted yesterday by Sputnik News to comment on the official US debt number surpassing $31 trillion. I’m always grateful for the opportunity to talk about these issues.

I am, after all, a fiscal hawk extraordinaire.

At the same time, I’m completely hip to why Sputnik (and RT) wanted to discuss this issue. They are running their own framing campaign, propaganda if you will. I’m no one’s useful idiot when it comes to these matters.

They may have been looking for a dissident American voice to berate the US for its reckless spending, which fits the Russian media narrative that the US cannot sustain its current pressure campaign against Russia.

This is meant to counter the West’s narrative that Russia can’t sustain its military operations in Ukraine.

Hey, everyone’s got a truth to tell. I get it, it’s a war out there. All I can do is make the best use of the opportunities in front of me and tell my version of those truths. Because talking about things truthfully may actually get us one step back on the path towards peace rather than global war. That said, if I see no upside to the opportunity, the best thing to do is turn it down politely and wait for the next one.

At the same time we all have to realize that Russian media outlets have a hard time booking guests at this point due to the massive political pressure. So, as always, I see the opportunity as a way to talk to everyone to further understanding these things, not just feed one side’s attempt to shift the Overton Window.

In this particular case the US debt is a major issue and part of my general thesis of how the gameboard maps out in real time — faction by fractious faction. So, I was happy to throw my thoughts into the mix.

In short, the US is staring at a massive fiscal decision in the coming months and years. The situation isn’t insolvable but it also isn’t going to be easy for get through. We’re staring at a global recession, at a minimum, as well as a sovereign debt crisis in the West and in some Emerging Markets. Turkey has already been blown up.

However, the US is still a major player in the global financial system and the Federal Reserve the most powerful of these institutions. Understanding the Fed’s role in fixing what is broken is something all sides need to consider.

So, while, I’m sure it pleases my Russian paymasters (sic) that I believe there’s a split at the top of the US political establishment, it may not afford them the opportunities they think that split implies.

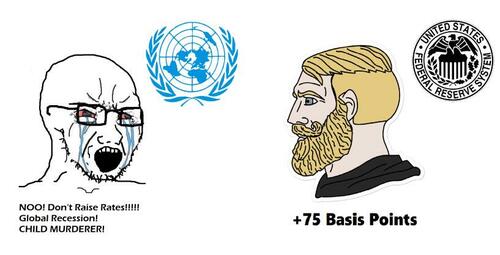

The reality is that the Fed has charted its own path here and this week’s pathetic appeal from the United Nations to urge central banks from raising interest rates is the best evidence I can present to you that my arguments about the Fed are correct.

The UN basically asked the Fed to, “Think of the CHILDREN!” Bail out the world for the common good. Now is not the time for unilateral action. Think globally, act locally.

You know, all the usual bromides to cover the reality that a hawkish Fed gores the wrong people’s oxen.

But the not-so-subtle point I think Sputnik was trying to make is that can the Fed actually do this with the US dealing with a $31 trillion debt overhang.

It is the question of the century.

For me, it’s simple. We won’t ever know if we don’t try. And given that the alternative to a few years of global depression to burn out the excesses of the Davos-controlled Fed during the Bernanke/Yellen years or turning the West over to Klaus Von CommieSchnitzel and his Minority Report future, I don’t think the decision is a difficult one for most people to make.

Here is the full Q&A between myself and Sputnik to ponder.

According to the NYT, the breach of the threshold comes at an inopportune moment, as historically low interest rates are being replaced with higher borrowing costs as the Federal Reserve tries to combat rapid inflation. What consequences does this policy bring from a mid-term perspective?

There was so much money printed during the COVID-19 period that it’s left the Fed with a massive dilemma. It needs to flush the global economy of excess dollars and shrink its balance sheet without destroying the US economy in the process.

It’s clear that FOMC Chair Jerome Powell is acting with regards only towards the US’s needs. For the first time in decades the world is having to come to grips with the idea that the Fed will not be there to bail them out if they get into trouble.

The medium term will be a period of extreme dollar strength. Because during this loose dollar period, post-2008, the world loaded up on cheap dollar-denominated debt. That is now reversing itself hard. Emerging markets and even developed markets like the UK, Europe and China are vulnerable to this reversal of dollar outflow.

The political problem for the “Biden” administration is that this is making it very difficult for them in this mid-term election cycle. “Biden” wants inflation down but they baked far too much of it into the global economy contain it even with this aggressive rate hike cycle from the Fed.

This sets the Fed and Congress at odds with each other. But it also sets the stage for a political shift after November. If Congress tries to keep spending beyond its means then the US will enter a very ugly inflationary cycle that the Fed is powerless to contain.

Do you see any alternatives to the existing policy?

Yes. Congress needs to rein in spending to previous levels. The Fed is doing its job raising the cost of capital to divert money out of the unsustainable and into the sustainable. Monetary policy can signal entrepreneurs and investors to rebuild what’s degraded and look to where the economy has been neglected.

But it can’t do that if Congress also wants to get in the act spending money that fuels keeping prices too high and crowding out investment where it wants to go, rather than where Congress wants it to go.

This will require a complete 90-degree shift in our political thinking, similar to the Reagan/Volcker years. We have half of the policy in place, Powell acting like fir Arthur Burns and implying he will also be Volcker.

We need the other half of the policy by getting rid of the ruinous and reckless “Biden” politics of envy – eating the rich, fomenting wars, etc.

But, sadly, I see “Biden” and the people he’s aligned with only wanting war to cover the insolvency of national governments.

Who are the losers and winners in this situation?

If the Fed can help force a political rethink in the US, and the national polling seems to suggest that Americans are ready for this, then a more balanced US fiscal and monetary policy coming into the 2024 presidential cycle would make most of the world a winner because it would put an end to the current insanity.

In the short to medium term, however, the pain for much of the world will be intense, including the US. Much of the deflation in certain sectors of the US economy from the Fed’s intense interest rate policy should be offset by capital inflow from those who have lived beyond their means because of the weak dollar in the past.

The prime beneficiaries of this have been Europe and their overly generous entitlement/pension systems, which are teetering on full collapse as we saw in the UK recently, and China with its massive trade surplus with the US.

The winners will be those who produce and export base commodities. Because in broad strokes, assets inflated through easy credit for over a decade, like gov’t bonds, stocks, real estate and mid-to-high end consumer goods, will be deflating. On the flip side, base commodity prices, the main driver of inflation today, will continue rising – oil, gas, gold, metals, food, etc.

In short, the easy money of the post-2008 era fueled stock, bond and real estate booms which will now bust, suppressing investment into base commodities. With the credit cycle reversing so too will this dynamic.

If servicing the debt becomes more expensive, what will it mean, in practical terms, for the country’s economy? How can this situation affect ordinary Americans?

The downside of all of this is that US debt servicing will rise, helping to force Congress into tightening its belt. If “Biden” doesn’t stop trying to spend money in ways that would make drunken sailors think twice, then he’s deliberately trying to destroy the US fiscal position to degrade the country he’s supposed to be leading. It will be evidence of his administration being staffed in all key positions with vandals.

The US has a lot of debt that needs rolling over in 2023. It will have to happen at higher rates. The Fed will likely stop rate hikes in Q1 to help that situation. But a slow down in government spending without the concomitant relaxing of regulations to free up the flow of capital will keep the US economy sputtering for 2023 even with the inflow from overseas.

Even with a GOP win in November, the battle for the future here will be intense. I don’t expect it to go well and it means recession, political paralysis and the possibility of the White House to continue pursuing ruinous policy because Congress abdicated all of its responsibilities towards foreign policy to the president two decades ago after 9/11.

Practically, after the mid-terms, we will all struggle with high energy and food prices, limited good employment options, frozen capital searching for a decent investment while the economy slowly unwinds the ugly situation it is currently in where supply and demand for basic goods and services are completely out of whack, per Powell’s recent statement at Jackson Hole.

My advice to people is the same as it’s been for years. Get and stay out of debt, minimize expenses where you can, and develop strong local communities to assist each other while the geopolitical tensions continue to rise.

p.s. all references to my being a Russian secret agent are pure, unadulterated sarcasm, in case anyone reading this is devoid of a sense of humor, or a Democrat… but I repeat myself

* * *

Join my Patreon if you like big questions

Tyler Durden

Sat, 10/08/2022 – 12:05