Red New Deal?

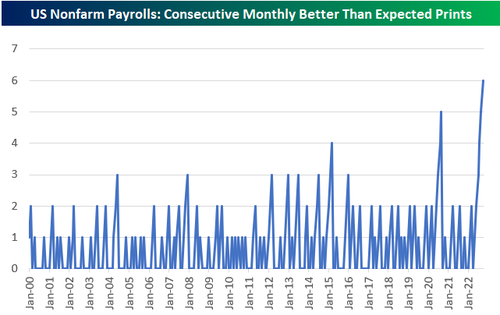

Nonfarm payrolls beat for the 6th straight month, which as @BespokeInvest notesk is the longest streak since 1998…

That ‘good’ news spiked rate hike expectations today…

Source: Bloomberg

…and that means that 75bps, 50bps and 25bps are now a lock for Nov, Dec, and Feb FOMC meetings respectively…

Source: Bloomberg

Today’s payrolls reaction wiped out a lot of the hope for pause/pivot. Nasdaq crashed by more than 4% and the Dow and S&P plunged more than 3% before a late day bid into the close…

But stocks did managed to close the week green, with Nasdaq the weakest of the bunch (barely holding green) and Small Caps best…

This was the Nasdaq’s first positive week (barely) in the last four weeks.

As stocks caught down to the reality being priced into the hawkish terminal Fed rate expectations shift…

Source: Bloomberg

All the majors remain in ‘bear market’ territory, down over 20% from their highs…

Source: Bloomberg

Energy was the week’s big winner with Real Estate and Utes stealing the jam out of defensively positioned traders’ donuts…

Source: Bloomberg

Defensives ended the week lower but despite today’s carnage, cyclicals managed slid gains…

Source: Bloomberg

“Most Shorted” Stocks crashed today, back to recent support…

Source: Bloomberg

Exxon had its greatest weekly return ever, which as Meta collapsed pushed its market cap above the giant tech platform’s for the first time since 2016…

Source: Bloomberg

But amid all that chaos, VIX only pushed up t 32…

Credit market stress is starting to accelerate with the gap between higher- and lower-rated bonds widening as funding costs surge and earnings weaken.

Source: Bloomberg

Treasury yields pushed higher yet again today (+6-8bps), erasing all the early week’s compression. The curve was pretty uniformly higher in yield on the week with the long-end the marginally ugliest horse in the glue factory…

Source: Bloomberg

10Y yields are pushing back up towards 4.00% once again this week…

Source: Bloomberg

Big rollercoaster in the dollar this week ending marginally stronger vs its fiat peers…

Source: Bloomberg

Bitcoin tumbled along with stocks today, breaking back below $20k to end the week almost unchanged from last Friday…

Source: Bloomberg

Spot Gold fell back below $1700 today after a strong surge earlier in the week…

Source: Bloomberg

Silver futures were down but managed to hold above $20 for now…

Oil was up for the 5th straight day today (surging over 5%) rallying over 17% on the week for the 2nd best week since May 2020 (after WTI went negative). WTI closed back above $92 for the first time since August…

And that is not good news for America’s drivers… or President Biden…

Source: Bloomberg

And finally, the good news is, we’re about half way through this collapse…

Source: Bloomberg

When will the central banks fold?

Source: Bloomberg

Biden’s ‘Red New Deal’ is just what the voters ordered…?

Tyler Durden

Fri, 10/07/2022 – 16:00