Jittery Futures Coiled Tightly Ahead Of Today’s Jobs Report Main Event

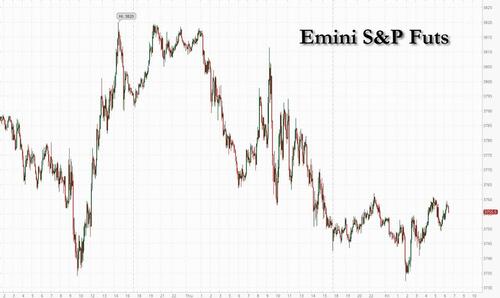

S&P futures rebounded from an overnight drop and swung between gains and losses as investors looked forward to the week’s main event, the September payrolls report, for clues on what the Fed will do next after a raft of hawkish Fed doused expectations on Thursday for a quick halt to rate hikes. Nasdaq 100 futs fell 0.3%, trimming deeper losses, amid a sharp premarket drop for semiconductor stocks prompted by a plunge in AMD which slumped after it preannounced much weaker-than-expected 3Q revenue and margins . Meanwhile, S&P500 futures on the S&P 500 Index traded little changed, although the benchmark was poised for the best weekly advance since June. Treasuries drifted lower, the dollar was flat, and cryptos were unchanged.

In premarket trading, Credit Suisse shares gained 7.9% after the lender offered to buy back debt securities for as much as CHF BN, in a show of financial strength after recent concerns about the bank’s solidity. Shares are up 14% this week, best weekly return since June 2020. They have recovered from a 12% intraday drop on Monday, when the stock slumped to a fresh low Shares are 49% down YTD. On the other end, chipmakers led the slide in early New York trading. Besides AMD’s 6% plunge, Nvidia Corp. and Intel Corp. fell more than 2% each amid concern that a slowing world economy will sharply dent semiconductor demand. Here are some other notable premarket movers

Twitter shares fell as much as 1.9% to $48.45 in US premarket trading on Friday, trading almost 10% below Elon Musk’s offer price of $54.20 as the deal is said to be contingent on receiving $13 billion in debt financing, according to people familiar with the matter. They were flat by 6am in New York.

Chip stocks were lower in US premarket trading after Samsung and AMD reported disappointing figures within hours of each other. The announcements signaled a deteriorating climate for global chip demand affecting the entire personal computers supply chain, including chipmakers, semiconductor equipment makers and PC manufacturers. AMD -6.4%, Nvidia -3.3%, Intel -2.8%.

Pot stocks rallied in US premarket trading on Friday, set to extend Thursday’s gains after President Joe Biden pardoned thousands of Americans for possession of marijuana and ordered a review of its legal status, sparking hopes that decriminalization of the drug was drawing nearer and a more favorable regulatory environment for cannabis-related firms. Tilray Brands +9%, Canopy Growth +9%, Cronos Group +2.4%.

DraftKings shares jump as much as 9.2% in US premarket trading on Friday, boosted by a report that the sports-betting firm is said to be nearing a sizable new partnership with Disney’s ESPN, signaling that interest in legalized sports betting in increasing. DraftKings trades at a price-to-sales multiple of 4.2 times, according to Bloomberg data, down from a peak of around 37 times reached in March 2021.

Levi Strauss shares fell as much as 4.6% in US premarket trading on Friday after the jeans maker cut its adjusted earnings per share and net revenue growth outlook for the full year, stoking worries that it could be tough for retailers in the near-term as the company grapples with the impact of a stronger dollar, weakness in its European markets and supply-chain disruption.

Payoneer Global jumps as much as 8.4% in premarket trading following news that the company will join the S&P SmallCap 600 index before trading opens on Oct. 12.

Lyft shares fall 3.7% in US premarket trading after RBC downgraded the ride- sharing firm and slashed its PT, saying its bull case for the stock looks increasingly less likely.

Aehr Test Systems jumped 9% in extended trading after the semiconductor manufacturing company reported net sales growth and improved adjusted earnings in the fiscal first quarter.

As previewed earlier, today’s main event is the jobs report and as JPM noted, prior to Friday’s NFP (and CPI next Wednesday), the market has been oscillating between the “hawkish Fed” and “Fed pivot” narrative. While the JOLTS Job Openings and the ISM Manufacturing employment index showed more evidence of a slowing labor market, the stronger than expected ADP/ISM Services once again proved the economy still remains strong and therefore weakens the hope of a near-term pivot from the Fed. In a nutshell, according to JPM’s trading deks, with consensus expected tomorrow’s NFP to print +255k, Equity bulls would need a print ~100k to see the market alter its Fed expectations (full preview here).

The data will follow hawkish comments from Fed officials. Chicago Fed President Charles Evans said the benchmark rate will probably be at 4.5% to 4.75% by next spring, and Minneapolis Fed’s Neel Kashkari said the central bank is “quite a ways away” from pausing its campaign of rate increases.

“Barring an unexpectedly shocking number, I do not think today’s release will prompt the Fed to change tack,” said Stuart Cole, the head macro economist at Equiti Capital. “This has certainly been the message that various Fed officials have been promulgating.”

Meanwhile, according to Bloomberg, US Treasury yields are heading for a 10th week of increases, the longest streak since 1984, as the Fed stays resolute in its fight against inflation despite recent data suggesting a cooling of the economy. Investors are being swayed between hopes for an end to monetary tightening by March next year and concern over the possibility of a deep recession that such a pivot would underscore.

At the same time, investor focus is increasingly trained on signs of a weaker earnings-reporting season. Besides Thursday’s dour trading update from European oil major Shell, underwhelming figures from AMD and South Korean Samsung Electronics Co. are reinforcing concerns for the global economy.

“The issue of the Fed pivot remains the main factor restricting risk appetite,” Sebastien Barbe, the head of emerging-market research and strategy at Credit Agricole CIB, wrote in a note. “Cautiousness should remain in place ahead of the US jobs report. Given the repeated hawkish comments by Fed speakers, this may not be enough to sustainably support risk appetite.”

In Europe, the Stoxx 50 fell 0.2%. FTSE MIB outperforms, adding 0.2%; IBEX lags, dropping 0.5%. Tech, consumer products and retailers are the worst-performing sectors. Here are the biggest European equity movers:

Renault shares climb as much as 4.8%. The automaker is raised to outperform from neutral and PT hiked to EU55 from EU35 at Oddo on its successful operational recovery and accelerating “product offensive.”

Credit Suisse shares gain 8.4% after the lender offered to buy back debt securities for as much as CHF3bn, in a show of financial strength after recent concerns about the bank’s solidity.

Telenor shares jump as much as 5.1%, the most since July 2020, after the telecom operator agreed to sell a 30% stake in its Norwegian fiber network to a consortium led by KKR and Oslo Pensjonsforsikring.

Storytel gains as much as 11%, the most since August, after the Swedish publishing house released preliminary streaming revenue for the third quarter that was slightly above guidance, according to DNB

European chip stocks are under pressure on Friday after industry bellwethers AMD and Samsung posted results that widely missed analysts’ expectations. ASML drops as much as 2.9%

Adidas shares decline as much as 3.2% with UBS saying the uncertainty about its partnership with Kanye West’s Yeezy brand is a “negative development” for the sportswear group.

Ocado shares decline as much as 3.1% after PT cut to a Street-low 420p from 595p at Morgan Stanley, which maintains an underweight rating on the grocery delivery group and says the case for its automated model has “got harder.”

Building materials group Marshalls slumps 28% after it warned on a slowdown in demand for its landscaping products, prompting Peel Hunt to cut earnings estimates.

Asian stocks fell, on track to snap a three-day winning streak, as Federal Reserve officials reiterated their hawkish views and tech shares weighed. The MSCI Asia Pacific Index declined as much as 1.3%, with tech and consumer discretionary shares falling after five Fed officials on Thursday separately signaled inflation remained too high in the US. Some chip shares slid after Advanced Micro Devices’ preliminary third-quarter sales missed projections and Samsung reported disappointing preliminary quarterly results. Meanwhile, China’s electric-vehicle firms led declines on the Hong Kong market as concerns grew over weaker-than-expected orders. Vietnam’s stocks tumbled to the lowest in almost two years as a wave of forced selling hit the market amid concerns about rising interest rates. Liquidity remained relatively low with the onshore China market closed for the Golden Week holiday. The Asian gauge remains on track for its best week since July after weak US economic data earlier fueled hopes that the Fed may be less aggressive in tightening. Traders will scrutinize the US payroll data out later Friday for signs of economic slowdown and the impact on monetary policy. “Clearly the equity market is still playing chicken with the Fed around,” Joshua Crabb, head of Asia Pacific equities at Robeco, told Bloomberg Television. The interest-rate environment “is here to stay and that will continue to put pressure on some of the more highly valued sort of companies.”

Japanese stocks dropped as investors remained cautious over the outlook for Fed policy and awaited an upcoming monthly US payrolls report. The Topix fell 0.8% to 1,906.80 as of the market close in Tokyo, while the Nikkei 225 declined 0.7% to 27,116.11. Mitsubishi UFJ Financial Group contributed the most to the Topix’s decline, decreasing 2.2%. Out of 2,168 stocks in the index, 569 rose and 1,495 fell, while 104 were unchanged. “There is uncertainty whether US interest rate hikes could be 75bps or 100bps during the FOMC meeting in November,” said Naoki Fujiwara, chief fund manager at Shinkin Asset Management. “We are watching the unemployment rate and wage growth.”

Stocks in India ended flat on Friday but posted their first weekly advance in four, helped by a recovery in metal companies. The S&P BSE Sensex was little changed at 58,191.29 in Mumbai, while the NSE Nifty 50 Index dropped 0.1%. For the week, the gauges rose 1.3% each. Tata Consultancy Services was the most prominent decliner among the Sensex 30 companies, dropping 1.3%. The country’s biggest software exporter will kickoff quarterly earnings season Monday. Titan was among the best performers after reporting strong sales growth for three-months through September. Eleven of the 19 sector sub-indexes compiled by BSE Ltd. retreated, led by oil & gas companies, while consumer durables makers were the top performers. A measure of metal companies was the top gainer for the week, posting its best advance since July.

In FX, the Bloomberg Dollar Spot Index slipped 0.1% as the dollar fell against all Group of 10-peers apart from the kiwi. Demand for dollar topside exposure in the long-end remains strong ahead of the payrolls report.

The euro rose above $0.98 and Bund yields climbed by up to 4bps as real yields continued to push higher alongside ECB tightening wagers.

The cable led G-10 gains to trade above $1.12 after reversing early European session weakness. Yields on gilts rose by 3-6bps.

The New Zealand dollar rose against the greenback as the nation’s bond yields closed up to 10bps higher.

Australian dollar and Norwegian krone strengthened somewhat. Australian yields rose up to 7bps.

The yen snapped a two-day decline as traders weigh the risk of an intervention by Japanese authorities to support the currency after it weakened past 145 per dollar. The currency is still set for an eighth straight week of declines

In rates, Treasuries were slightly cheaper across the curve after most yields reached weekly highs while maintaining narrow ranges ahead of September jobs report. Gilts and bunds weigh, underperforming Treasuries. US yields cheaper by up to 3bp across belly of the curve, cheapening 2s5s30s fly by 3.5bp on the day to around 12bp, up from as low as -13.7bp on Tuesday; 10-year yields around 3.85%, richer vs bunds and gilts by 6bp and 2bp. UK 10-year yield rises 2.5bps to 4.19%, while German 10-year climbs 4.5bps to 2.13%.

In commodities, US crude futures rose to approach $89 a barrel, on course for the biggest weekly surge since March. Spot gold is little changed at ~$1,713/oz. Bitcoin is contained within very narrow parameters, essentially pivoting the USD 20k mark as we head into the NFP release.

To the day ahead now, and the highlight will likely be the aforementioned US jobs report for September. Otherwise, data releases include German industrial production and Italian retail sales for August. From central banks, we’ll hear from the Fed’s Williams, Kashkari and Bostic, as well as BoE Deputy Governor Ramsden. Finally, EU leaders will be meeting in Prague.

Market Snapshot

S&P 500 futures down 0.2% to 3,748.50

STOXX Europe 600 down 0.2% to 395.56

MXAP down 1.1% to 143.02

MXAPJ down 1.3% to 463.87

Nikkei down 0.7% to 27,116.11

Topix down 0.8% to 1,906.80

Hang Seng Index down 1.5% to 17,740.05

Shanghai Composite down 0.6% to 3,024.39

Sensex down 0.3% to 58,069.57

Australia S&P/ASX 200 down 0.8% to 6,762.77

Kospi down 0.2% to 2,232.84

German 10Y yield little changed at 2.13%

Euro up 0.2% to $0.9813

Brent Futures up 0.1% to $94.53/bbl

Gold spot up 0.0% to $1,712.81

U.S. Dollar Index down 0.24% to 111.9

Top Overnight News from Bloomberg

Investors poured the most money into cash since April 2020 on fears of a looming recession, but stocks could see further declines as they don’t fully reflect that risk, say Bank of America Corp. strategists

Underlying inflation in the euro area is increasingly driven by higher demand, according to the European Central Bank, which has listed the trend among reasons to lift borrowing costs

Inflation expectations among euro-zone consumers held steady in August, according to the European Central Bank, which has been raising interest rates in the face of record price gains

The European Central Bank is ratcheting up pressure on some banks to keep 2022 bonuses in check amid fears about the darkening economic outlook, according to people with knowledge of the matter

A report by the Recruitment & Employment Confederation showed UK companies are starting to impose hiring freezes because of pessimism about the outlook, and employees are deciding “stay put” rather than apply for other jobs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were lower as the region followed suit to the weak performance seen in global counterparts with risk appetite sapped amid the slew of hawkish Fed rhetoric and with participants awaiting the key US jobs data. ASX 200 was subdued by underperformance in the real estate sector and after the RBA Financial Stability Review noted financial stability risks have increased globally and that some households are already feeling the strain from higher rates which is likely to persist for some time. Nikkei 225 was pressured and briefly dipped below the 27,000 level after disappointing data in which Household Spending showed a surprise M/M contraction and with wage growth softer than previous. Hang Seng declined amid weakness in property and tech stocks with sentiment also not helped by reports that the US is to announce new measures that will effectively halt some exports of US equipment to Chinese firms making advanced NAND and DRAM memory chips.

Top Asian News

BoK said it will maintain its stance of raising interest rates going forward to combat inflation which is expected to remain in the 5-6% range for a considerable period of time, according to Yonhap.

RBA Financial Stability Review stated that financial stability risks have increased globally and markets are stressed by synchronised policy tightening, geopolitical tension, higher USD and rising energy prices. RBA also stated that stability risks would be magnified by further substantial tightening in global markets and some households are already feeling the strain from higher rates which is likely to persist for some time.

Japanese top currency diplomat Kanda says has never felt a limit to ammunition for currency intervention, making various steps so as not to face a limit to ammunition when it comes to FX intervention, via Reuters.

Malaysia Cuts Personal Income Tax by 2 Percentage Points

Tycoon Faces Key Vote for Plan to Tap Vedanta Cash Reserves

Gold Set for Largest Weekly Gain Since March as Jobs Data Loom

Taiwan Exports Shrink for First Time Since 2020 on Global Slump

European bourses are modestly on the backfoot, though have trimmed this slightly as the session progresses, in limited newsflow pre-NFP. Nonetheless, are still on track to conclude the week with upside of just over 2% WTD for the Stoxx 600. Stateside, futures are similarly contained and lie either side of the unchanged mark with NQ -0.1% modestly lagging amid yield upside as officials pushback on an imminent pivot. ECB recently told some banks to exercise restraint on pay and dividends amid concerns about a potential wave of defaults, according to Bloomberg.

Top European News

UK PM Truss is watering down former UK PM Johnson’s plans to cut 91k civil service jobs, according to FT.

Irish Foreign Minister Coveney says the new air of positivity has created a flicker of optimism, lots of issues yet to be resolved (re. Brexit/N. Ireland).

Greece Should Take Turkey’s Warnings Seriously, Erdogan Says

Credit Suisse Short Bets Soar Weeks Ahead of Strategy Review

Brexit Grudges Recede as Truss Makes Inroads With EU Allies

New Jupiter Boss to Shake Up Dozens of Funds and Cut CIO Role

Swedish Housing Market Slump Deepens on Rate, Energy Worries

Geopolitics

US President Biden said the nuclear ‘Armageddon’ threat is back for the first time since the Cuban Missile Crisis, according to AFP News Agency.

Japanese government spokesperson Kihara said Japan is to impose additional sanctions against Russia and will freeze assets of more Russians after the annexation of parts of Ukraine, according to Reuters.

US and South Korea are to conduct joint maritime drills involving the US aircraft carrier off the east coast on October 7th-8th, while the South Korean military said it will continue to strengthen its abilities to respond against North Korean provocation through joint drills, according to Yonhap.

US forces conducted an airstrike in northern Syria on Thursday which killed Islamic State leader Abu-Hashum Al-Umawi and another IS official, according to Reuters.

Turkish President Erdogan in a call with Russian President Putin discussed improving bilateral relations, according to the Turkish readout via Reuters.

FX

Typically tense pre-NFP trade has seen the DXY briefly dip below 112.00, to a 111.94 low, before regathering itself and holding marginally above the figure.

Action that comes to the benefit of peers across the board with GBP the primary beneficiary, Cable to a 1.1218 peak, but closely followed by other activity FX.

EUR/USD is more contained given a hefty amount of OpEx around today’s NY Cut, with participants also cognisant of worrying German data.

After yesterday’s relative outperformance, the CHF and NZD are the relative laggards and are currently unchanged on the session.

CNB Minutes (Sep): Mora and Holub voted for a 75bp hike, other members regarded rates as commensurate with the current situation. Consensus that inflation was probably close to peaking.

HKMA purchases HKD 1.57bln from the market as the HKD hits the weak end of its trading range.

Fixed Income

Core benchmarks dipped to lows amid the morning’s German data release, with Import Prices lifting again, though have gained some poise since in quiet trade.

Currently, Bunds are towards the mid-point of a ~70tick range with similarly settled action in USTs and Gilts before US data & Fed speak.

As such, yields are elevated but off highs of 3.85%, 2.16% & 4.22% for US, German and UK 10yrs respectively.

Commodities

WTI and Brent are off highs but still holding onto gains of around USD 0.50/bbl and are at the top-end of the week’s USD 86.35/bbl – 95.00/bbl parameter in Brent Dec’22.

For today, the main potential catalyst is the EU’s informal meeting of heads of state. A gathering which is focused on “Russia’s war in Ukraine, energy and the economic situation.”

US Secretary of State Blinken said the US will not do anything that infringes upon its interests and is reviewing a number of response options when asked about ties with Saudi Arabia and OPEC+ cuts, according to Reuters.

US Republican Senator Grassley will seek to add the NOPEC bill to the defence policy bill, according to Reuters.

OPEC Sec Gen says oil production capacity freed up by the latest production reductions could allow nations to intervene in the event of any crises in the oil market, according to Al Arabiya.

Spot gold is little changed overall having derived some very brief upside from the DXY’s move below 112.00; however, the metal remains capped by the 50-DMA.

US Event Calendar

08:30: Sept. Change in Nonfarm Payrolls, est. 255,000, prior 315,000

Change in Private Payrolls, est. 275,000, prior 308,000

Change in Manufact. Payrolls, est. 20,000, prior 22,000

Unemployment Rate, est. 3.7%, prior 3.7%

Underemployment Rate, prior 7.0%

Labor Force Participation Rate, est. 62.4%, prior 62.4%

Average Hourly Earnings YoY, est. 5.0%, prior 5.2%; Average Hourly Earnings MoM, est. 0.3%, prior 0.3%

Average Weekly Hours All Emplo, est. 34.5, prior 34.5

10:00: Aug. Wholesale Trade Sales MoM, est. 0.5%, prior -1.4%;

Wholesale Inventories MoM, est. 1.3%, prior 1.3%

15:00: Aug. Consumer Credit, est. $25b, prior $23.8b

Fed speakers

10:00: Fed’s Williams Speaks in Moderated Q&A

11:00: Fed’s Kashkari Discusses Agriculture, Food and Inflation

12:00: Fed’s Bostic Discusses Inequality

DB’s Jim Reid concludes the overnight wrap

In these stressful markets I’ve kept my personal anecdotes to a minimum but I have a few butterflies this morning as I have a big 36 hole golf matchplay final on Sunday. After 2 major knee operations in the last 12 months, 4 back injections in the last 18, a long period with a trapped nerve in my shoulder, a numb hand and countless rounds of physio, I’ve eventually played the best golf of my life this year and have got down to a 2.6 handicap. I have to give my opponent 16 shots over 36 holes though so it’s going to be hard. A couple of weeks later I’m also in a scratch final with no shots given. However the problem is my opponent is off +1. My current mid-life crisis obsession (after piano, cycling, etc. previously) is to get down to scratch. I suspect I’ll fail as I don’t hit it far enough. However I’m doing weights and speed training which is why I keep getting injured. My wife despairs at my obsessiveness most of the time but it keeps me going!!

We’re all going to be obsessing about payrolls today and then US CPI next week. Clearly the latter has more potential to shape trading over the next few weeks but the former is always a big event. In terms of what to expect from today’s jobs report, our US economists are forecasting that nonfarm payrolls grew by +275k in September. That’s slightly above the +250k consensus print, but if realised that would still be the slowest pace of monthly job growth since April 2021. However versus long-term average that would still be a hefty print even if you adjust for population. Our economists think that’ll be enough to push the unemployment rate down a tenth to 3.6%, especially given the three-tenths rise in the participation rate in August. When it comes to the Fed, both futures and our US economists see a +75bps move as the likely outcome at the next meeting, and a strong report today would cement those expectations, not least given the recent chatter that the Fed might slow down their pace of hikes earlier than anticipated.

Today’s print comes as the mood has soured again over the last 48 hours even if the prior 48 hours were spectacular enough to leave us notably stronger for the week still for risk even if bonds have given up their gains.

Yesterday saw a fresh selloff in stocks and bonds alongside further dollar strength after multiple Fed speakers pushed back on speculation that they’re about to ease up on hiking rates. That wasn’t helped by the news on the inflation side either, with oil prices reaching a one-month high, whilst commodities more broadly advanced for a 4th day running.

Going through some of these themes we’ll start with the Fed, since yesterday saw an array of speakers who reiterated hawkish talking points from the get-go. In particular, Minneapolis Fed President Kashkari said that “Until I see some evidence that underlying inflation has solidly peaked and is hopefully headed back down, I’m not ready to declare a pause. I think we’re quite a ways away from a pause.” So that adds to the previous day’s FOMC members who similarly pushed back on an imminent reversal. Later in the session, we heard from Presidents Evans and Mester, Governors Cook and Waller. They all held the line, pushing back on any pivot pricing. Notably, President Evans, another reformed dove, said rates would be near 4.5-4.75% by the spring of next year, with the market pricing terminal rates at the lower end of that range at 4.55% as of March.

Against that backdrop, investors continued to price out the chances of a Fed pivot next year, with Fed funds futures for December 2023 up +13.4bps on the day to 4.33%, their biggest one-day increase since the September FOMC itself. Now that’s still beneath the 4.6% that the FOMC had in their dot plot for end-2023 a couple of weeks back, and the 4.50% the market priced in 8 days ago, but the moves over the last couple of days do suggest they’re having some success in pushing back on the rate cut speculation. The impact of that worked its way through to Treasury yields, with the 10yr yield up +7.1bps to 3.82%, having been led by a +6.8bps rise in the real yield to 1.61%. That’s still some room below the late September intraday peak of 4.02%, but quite a bounce from Tuesday’s intraday low of 3.56%. That range is all within seven days, such is the recent volatility in bond markets. This morning in Asia, yields on the 10yr are just a tad lower as we go to press.

It’s worth keeping an eye on long-end Gilts as they continue to unwind some of the once in a lifetime sized rally from 5% last week after the BoE stepped in. 30yr yields closed at 4.29% having been as low as 3.62% on Monday. Anecdotal evidence points to the LDI saga still impacting that end of the curve.

The hawkish Fed rhetoric impacted on equities as well, with the S&P 500 (-1.02%) and the STOXX 600 (-1.25%) each seeing a noticeable pullback. The NASDAQ proved more resilient falling only -0.68%. In addition, the VIX index of volatility picked up again following a run of 4 consecutive declines, moving up +1.97pts to finish above 30 again at 30.52.

One factor that won’t be welcomed by policymakers is the latest rise in commodity prices, with Brent crude (+1.12%) and WTI (+0.79%) oil prices rising for a 4th day running, which follows the decision by the OPEC+ group to cut their production levels the previous day. In response, US President Biden said that his reaction was “Disappointment. And we’re looking at what alternatives we may have”. In the meantime, there was a modest downtick in European natural gas futures (-3.91%) to €167 per megawatt-hour. Speaking of which, our research colleagues in Frankfurt published their latest gas supply monitor yesterday (link here), in which they update their scenarios for this winter to reflect the latest developments. They also preview what to expect from the informal meeting of EU leaders taking place in Prague today.

Staying on Europe, sovereign bonds lost ground across the continent in line with the US moves, with yields on 10yr bunds (+5.4bps), OATs (+4.4bps) and BTPs (+4.7bps) all moving higher. That follows a similar dose of scepticism from investors about whether the ECB might pivot alongside the Fed, and the deposit rate priced in by overnight index swaps for June 2023 moved up more than 15bps for the second straight day, increasing +15.5bps yesterday to 2.89%. Those moves also came as we got the accounts from the ECB’s September meeting when they hiked by 75bps, which indicated that “some members” had preferred to only hike by 50bps, although “all members joined a consensus to raise the three key ECB interest rates by 75 basis points”. There was also a view that policy rates were still “significantly below the neutral rate”, even with the latest rate hike”, and it said that chief economist Lane had “stressed that price pressures were extraordinarily high and likely to persist for an extended period.”

Back in the UK, there were fresh signs that the recent market turmoil was impacting the mortgage market, after Moneyfacts reported that the average 5yr fixed mortgage rate was now above 6%. That puts it at its highest level since February 2010, and follows the previous day’s news that the 2yr fixed rate had also passed the 6% milestone. Furthermore, there were some warnings on the energy front, with National Grid saying that there was one scenario (although not its base case) that could see 3-hour power cuts if there wasn’t enough gas supply. The more negative newsflow occurred as sterling continued to lose ground against the US Dollar again, with a further -1.45% fall that brings its declines over the last two sessions to -2.76%. And gilts struggled as well, and not just at the long-end as discussed earlier, with 10yr yields up +13.3bps on the day to 4.15%.

Asian equity markets are also declining this morning with the Hang Seng (-1.13%) leading losses, pulling back from a strong rebound earlier this week with the Nikkei (-0.59%) also trading in negative territory. Meanwhile, the Kospi (+0.06%) is swinging between gains and losses with the index heavyweight Samsung Electronics downbeat 3Q preliminary earnings forecast weighing on sentiment. Elsewhere, markets in China are closed for the National Day holiday.

Looking forward, stock futures in the US are fluctuating with contracts tied to the S&P 500 (+0.03%) and NASDAQ 100 (+0.04%) just above flat ahead of the big day.

Early morning data showed that Japan’s real wages (-1.7% y/y) fell in August for the fifth consecutive month, following a revised -1.8% fall in July. At the same time, household spending (+5.1% y/y) increased in August (v/s +6.7% expected) following a +3.4% gain in July as the economy continued to recover from COVID-19 restrictions albeit with rising prices probably preventing further gains.

Ahead of today’s US jobs report, the weekly initial jobless claims for the week ending October 1 came in at 219k (vs. 204k expected), although there was a -3k downward revision to the previous week, without any apparent impact from the recent hurricane, which our US econ team believes will show up in next week’s data. Elsewhere, German factory orders contracted by more than expected in August, falling -2.4% (vs. -0.7% expected), but there was a sharp upward revision to the previous month, as the data now showed a +1.9% expansion (vs. -1.1% previously).

To the day ahead now, and the highlight will likely be the aforementioned US jobs report for September. Otherwise, data releases include German industrial production and Italian retail sales for August. From central banks, we’ll hear from the Fed’s Williams, Kashkari and Bostic, as well as BoE Deputy Governor Ramsden. Finally, EU leaders will be meeting in Prague.

Tyler Durden

Fri, 10/07/2022 – 07:49