US Gasoline Demand Unexpectedly Soars To Highest In Five Years As Inventories Crater

Two months ago, amid some major discrepancies in key points, the energy market was swept with speculation that the Biden admin – in this case the Department of Energy – was publishing “very crooked numbers“ to artificially represent gasoline demand as much lower than it really was in order to depress the price of oil (considering the lengths to which the Soros administration has gone to keep gas prices low ahead of the midterms, even threatening OPEC+ that it had committed a “hostile act” for daring to put its own interest ahead of the Democrats’ chances of winning the midterms). What made the manipulated “data” even more absurd is that gasoline demand had somehow collapsed below levels hit in 2020 when the US economy was largely shut down by covid.

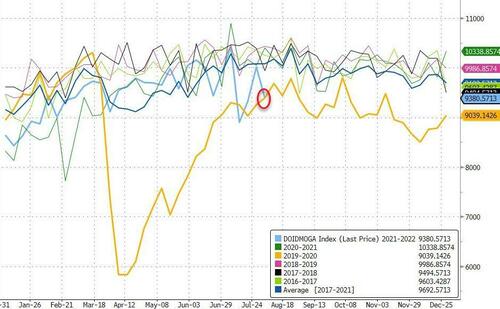

And so, after we raised a big stink, and after the DOE was caught revising its weekly number substantially higher on at least two occasions, things are back to normal, and according to the latest DOE data, US gasoline demand is magically roaring back just as the US economy is actually sliding into a recession and just as OPEC+ moves to cut global oil supplies. As shown below, according to the latest EIA release, weekly gasoline supplied – a proxy for demand – hit the highest level this year, surging not only past the five-year average but also the highest level in the past five years…

… while gasoline inventories plunged to the lowest since November 2014, according to the EIA.

Worse, petroleum inventories fell by -16 million bbl in the week to September 30 (reductions in crude (-8 million), gasoline (-5 million), distillate fuel oil (-3 million) and jet fuel (-1 million)). Including the SPR, total inventories have depleted by 480 million bbl since the start of July 2020 and are now at the lowest seasonal level since 2004:

While we are delighted to have gotten to the bottom of yet another government data “intervention” coverup, it goes without saying that surging demand in a time when supply is collapsing is a scenario that could intensify the Soros administration’s worries over pump prices heading into November elections.

Tyler Durden

Thu, 10/06/2022 – 14:46