Market Expects Recession Cry To Be Met With Fed Put

By Simon White, Bloomberg Markets Live reporter and strategist

Is it possible to believe things will get worse and better at the same time? US equity markets appear to have embraced this apparent cognitive dissonance, pricing in a recession, and then anticipating a rescue in the form of the Fed put not far behind.

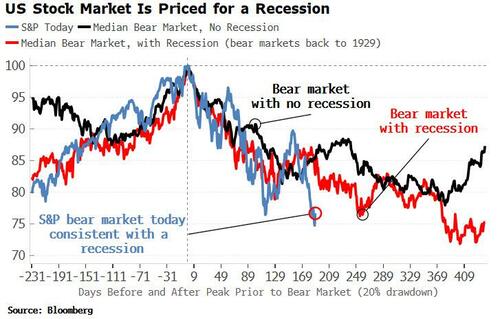

This year’s bear market is one of the worst since 1929. The S&P made new lows for 2022 last week, taking the index 25% off its highs before bouncing.

The US has so far avoided a recession, but not all bear markets coincide with one (1987 is the canonical example). Splitting out those bears that coincided with recessions and those that didn’t, a clear pattern emerges: bear-market recessions last longer and experience deeper falls. This year’s equity downturn is fully consistent, historically speaking, with one that will eventually incur a recession.

You would normally expect that falling equities would increase the likelihood that still lower prices will occur. Yet the price of far out-of-the-money put options on the S&P has been dropping relative to options that are less out of the money. In essence, the relative demand for “crash” insurance in US equities has been falling.

There is still demand for downside protection, as the put-call ratio has been rising, but the decline in demand for crash insurance implies investors are buying protection closer to the money. The equity market is anticipating that the recession it expects will be met with a Fed pivot, making steeper falls less likely. In other words, the market believes the Fed put is getting closer.

It’s no great surprise equity markets like loose monetary policy, but even so I’m surprised at how clear the relationship could be seen in the chart below. Higher rate-hike expectations are associated with greater expectations of a crash, and vice-versa. Simply put, the greater the expected size of the Fed pivot, the nearer the market expects we are to the Fed put.

The sharp rise in rate-cut expectations for next year seen over the last few months has coincided with a sharp fall in demand for crash insurance. When the Fed’s got your back, there’s no need to spend too much on your own safety net.

Why has the rates market priced in such a large Fed pivot for next year? Early signs of a weakening in the US jobs market gained attention this week, but already the market was front-running a fairly imminent and steep fall in inflation.

The recession the equity market is pricing is therefore a red herring. What the Fed really needs to see in order to meet expectations for a pivot is a drop in inflation, whether or not this happens to coincide with a recession.

Here the prognosis is good. Multiple leading indicators, from supply-chain pressures and commodity prices to profit margins and inflation expectations, all point to a pronounced, cyclical fall in inflation in the near future. But just because we see a drop in inflation does not mean the bear market is over, even if much deeper falls in prices are avoided.

For that, we need to see a unequivocal upturn in excess liquidity – the difference between real money growth and economic growth, and the best medium-term leading indicator of equity performance. Currently money growth is falling, inflation is high and economic growth is still positive, and so excess liquidity is low.

But when inflation and growth start to fall in the coming months, and the Fed responds to this by stopping tightening or easing, excess liquidity will surge. It will be time to embrace cognitive dissonance once more as, although sentiment will be terrible at this point, the stage will be set for the end of a bear market most will be happy to forget.

Tyler Durden

Thu, 10/06/2022 – 12:24